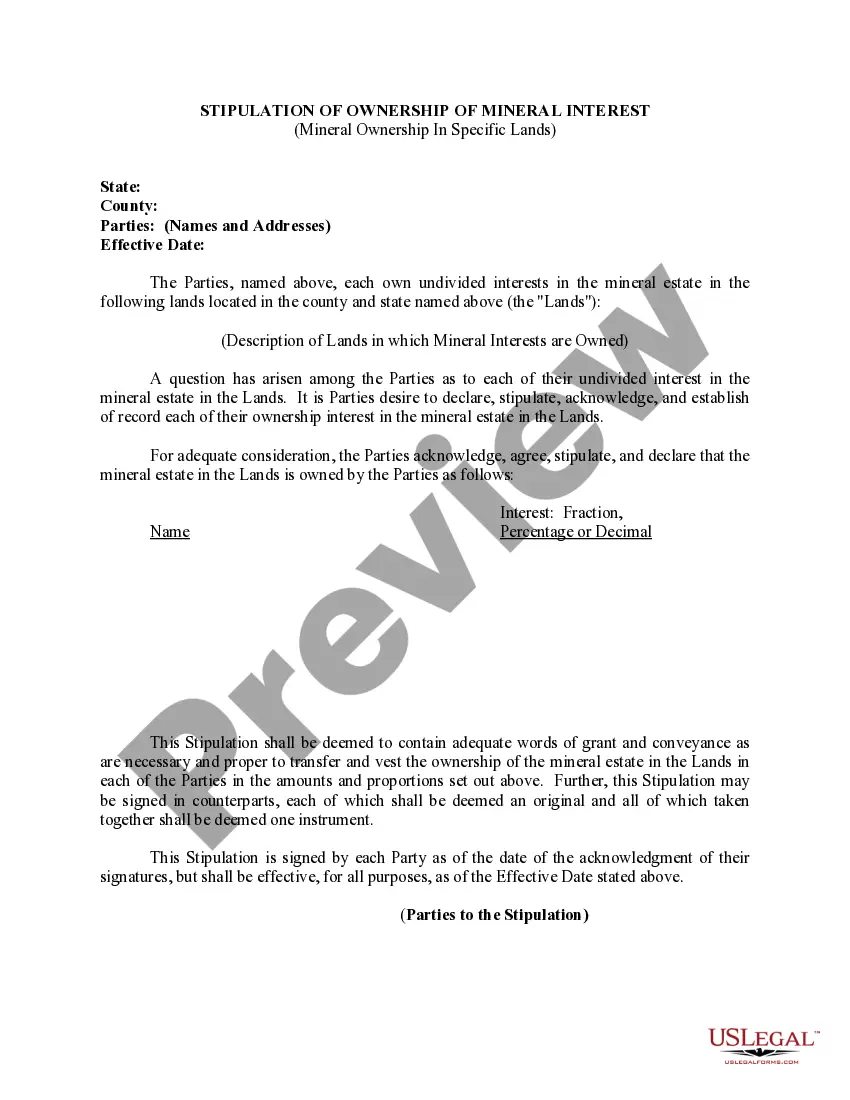

Wayne Michigan Stipulation of Ownership of Mineral Interest in Specific Lands is a legal document that establishes the ownership and rights related to mineral interests in particular plots of land located within Wayne County, Michigan. This stipulation is commonly used in the process of buying, selling, or leasing mineral rights in Wayne County. When it comes to stipulations of ownership of mineral interests, there are different types within Wayne Michigan. These may include: 1. Fee Simple Ownership: This stipulation indicates an individual or entity's complete ownership of both the surface and mineral rights in a specific piece of land. Fee simple ownership grants the owner the authority to lease or sell the mineral rights as desired. 2. Mineral Rights Only: This type of stipulation refers to the ownership of only the subsurface mineral rights, excluding any surface rights. The individual or entity holding these mineral rights lacks control over the surface usage but has the liberty to explore, extract, or lease the minerals present. 3. Leased Mineral Interests: A Wayne Michigan stipulation may pertain to the temporary transfer of mineral rights through a lease agreement. In this arrangement, the mineral rights' owner (the lessor) grants permission to another party (the lessee) to explore, drill, or produce minerals from a specific property for a predetermined period. The stipulation will outline the terms, conditions, and financial obligations associated with the lease. 4. Surface Rights Reserved: This stipulation pertains to the separation of surface and mineral rights, with the previous owner choosing to retain all or a portion of the surface rights while selling the mineral rights to a separate party. These arrangements allow for shared ownership, with the stipulation of responsibilities and limitations for both parties. It is important to note that Wayne Michigan stipulations of ownership of mineral interest in specific lands are governed by state laws and regulations. These stipulations are enforced to ensure clear understanding and protection of the rights and interests of all parties involved. In conclusion, Wayne Michigan Stipulation of Ownership of Mineral Interest in Specific Lands refers to various legal agreements governing the ownership, transfer, and usage of mineral rights in the county. Understanding the specific stipulations and their implications is crucial for individuals or entities involved in the exploration, leasing, or sale of mineral rights in Wayne County, Michigan.

Wayne Michigan Stipulation of Ownership of Mineral Interest in Specific Lands

Description

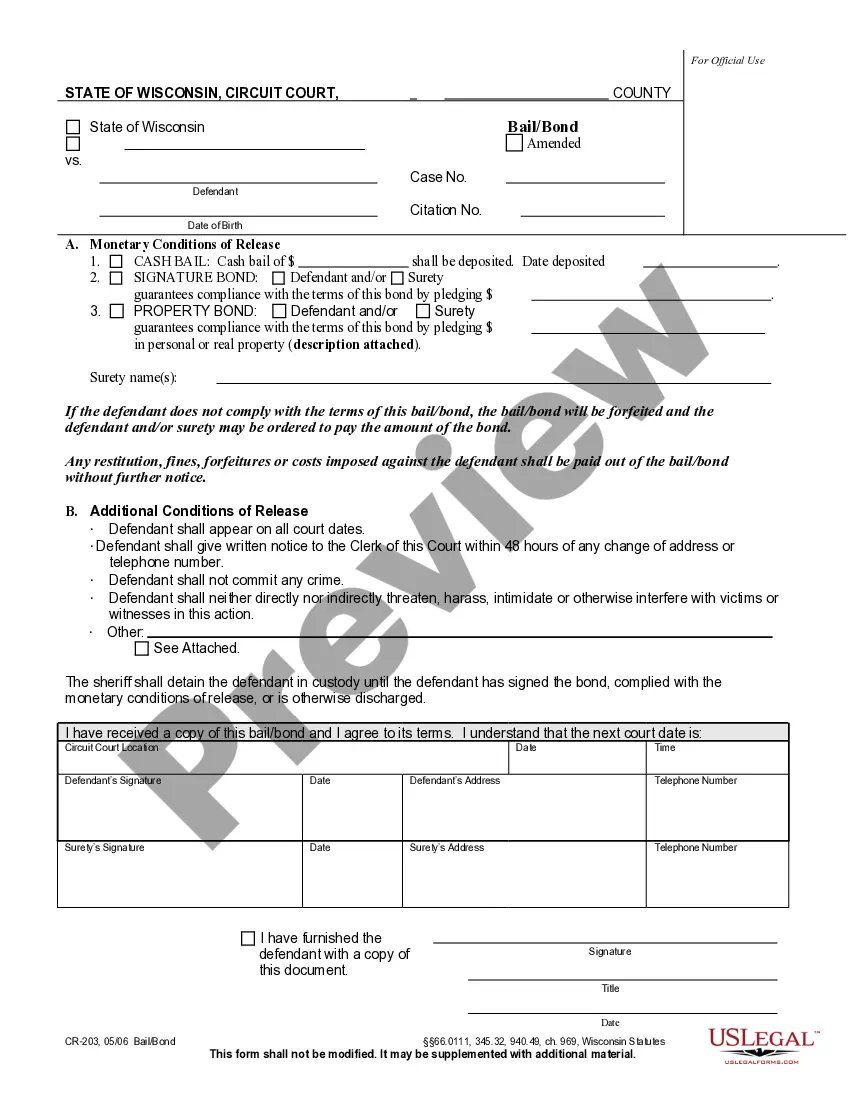

How to fill out Stipulation Of Ownership Of Mineral Interest In Specific Lands?

Completing documentation for business or personal needs is invariably a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it's crucial to take into account all federal and state regulations of the relevant area.

Nevertheless, smaller counties and even municipalities also possess legislative regulations that you must regard.

The advantage of the US Legal Forms library is that all the documents you have ever accessed remain retrievable - you can access them in your profile within the My documents tab at any moment. Enroll in the platform and swiftly obtain validated legal templates for any scenario with merely a few clicks!

- All these particulars render it challenging and time-intensive to produce Wayne Stipulation of Title of Mineral Rights in Certain Lands without professional assistance.

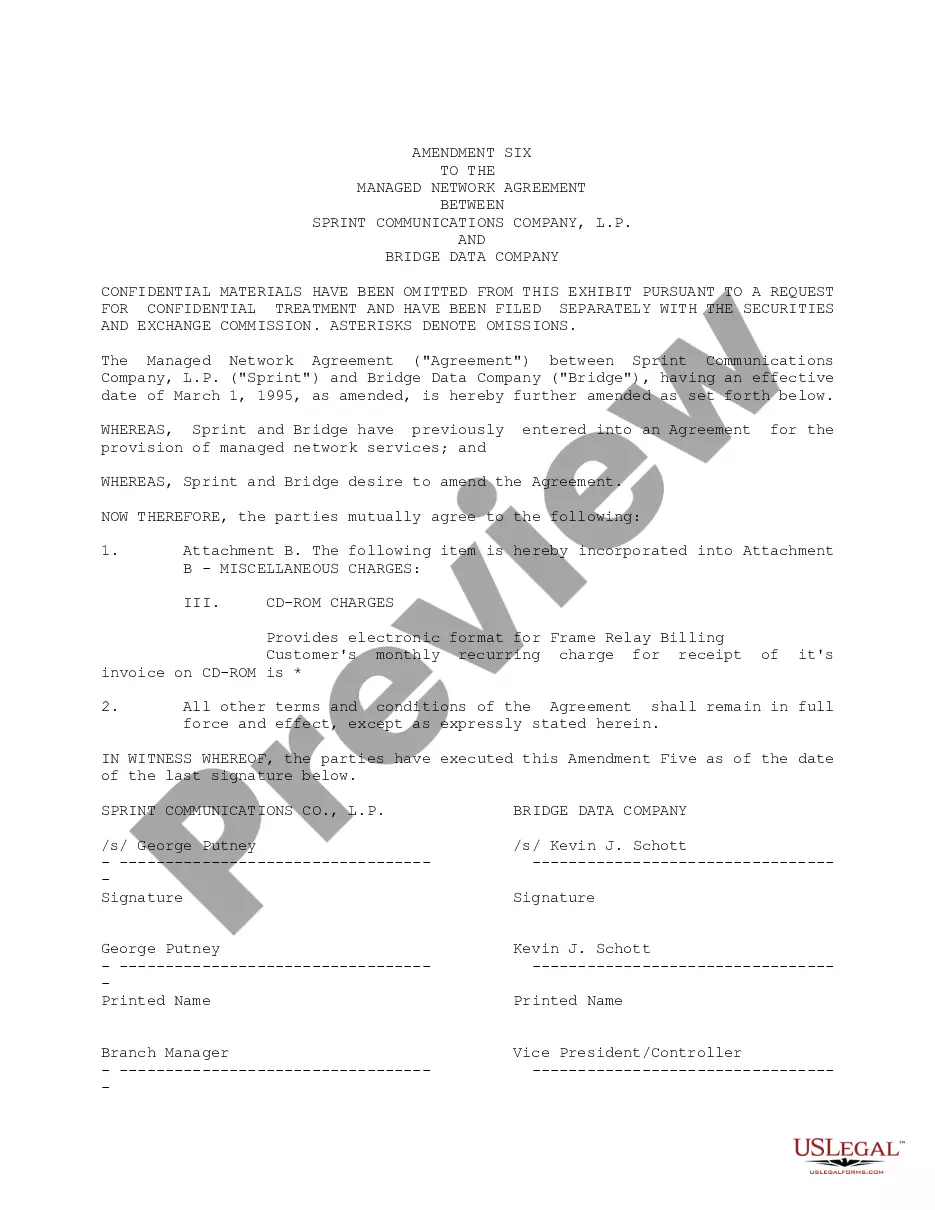

- It is feasible to avert unnecessary expenditures on attorneys crafting your documents and generate a legally binding Wayne Stipulation of Title of Mineral Rights in Certain Lands independently, utilizing the US Legal Forms online repository.

- This is the most comprehensive online directory of state-specific legal documents that are professionally verified, ensuring their authenticity when selecting a template for your county.

- Previous subscribers only need to Log In to their accounts to acquire the required form.

- Should you still lack a subscription, adhere to the step-by-step instructions below to obtain the Wayne Stipulation of Title of Mineral Rights in Certain Lands.

- Review the page you've accessed and confirm whether it contains the sample you seek.

- To do this, utilize the form description and preview if these functionalities are available.

Form popularity

FAQ

The purpose of a division order is to protect the company paying the royalty (payor) from double liability. If you sign a division order and it turns out that you should have been paid a larger interest than shown on the division order, the company is protected as long as it paid according to the division order.

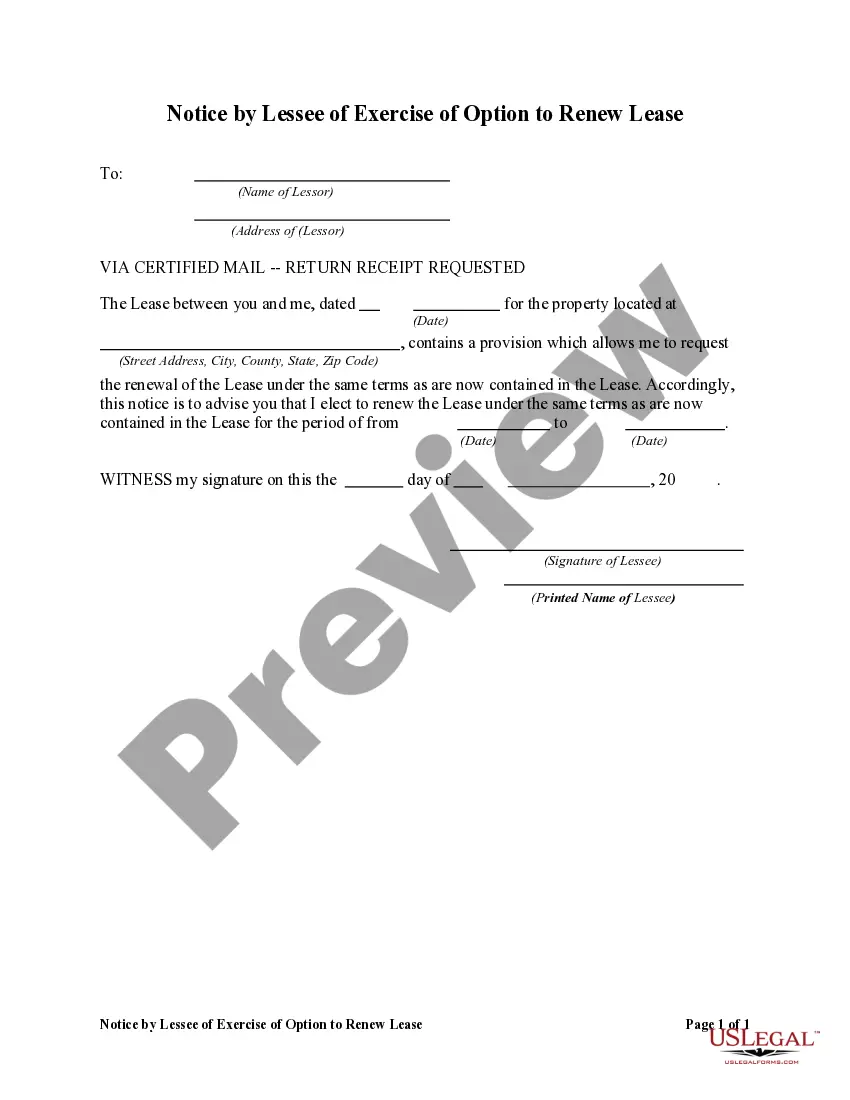

Remember, the property and the mineral rights are two separate entities. You may have inherited the mineral rights, but you need to know who owns the property if you want to drill. The opposite scenario is to check who owns the mineral rights on the property you inherited.

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed.

However, several steps need to be taken to claim mineral rights in Ohio, they include; After confirming your ownership with a lawyer, you should draw up a deed of transfer of the dormant mineral in your name and file it with your local county records office as the new mineral owner according to the state laws.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that all minerals are included.

Mineral rights are ownership claims against the natural resources located beneath a plot of land. In the United States, mineral rights are separate from surface rights. 1feff Mineral rights are often "severed" from surface rights in states such as Texas, Oklahoma, Pennsylvania, Louisiana, Colorado, and New Mexico.

Under Michigan law, mineral rights are severable from other property rights.

The ownership of the mineral rights in a parcel can usually be determined by examining the deed abstract for the property.

Surface property owners can pursue the purchase of the mineral rights beneath their land with whomever owns the mineral rights. The mineral right owner is not required to sell them, but such sales do occur.