A Dallas Texas Quitclaim Deed of Life Estate Interest Created Under A Will is a legal document used to transfer ownership of a property upon the death of the owner, known as the life tenant, to the designated beneficiaries, also known as the remainder man. This type of deed is designed to ensure a smooth and seamless transition of property rights according to the wishes outlined in the deceased's will. In this type of deed, the life tenant retains the right to use and occupy the property during their lifetime or for a specific period stated in the will. After the life tenant's passing, ownership is automatically transferred to the remainder man, who then becomes the sole and absolute owner of the property. There are a few variations of the Dallas Texas Quitclaim Deed of Life Estate Interest Created Under A Will, depending on the specific circumstances or conditions outlined in the will. These variations may include: 1. Traditional Life Estate: This is the most common type of life estate arrangement where the life tenant has full rights to use and enjoy the property for the duration of their lifetime. Once the life tenant passes away, the remainder man assumes full ownership rights. 2. Term of Years Life Estate: In this case, the life tenant is granted a specific period of time during which they can use or occupy the property. After the designated period expires, ownership is transferred to the remainder man. 3. Life Estate with Power of Sale: This variation allows the life tenant to sell or convey the property during their lifetime if they choose to do so. However, the remainder man will still receive the proceeds from any such sale upon the life tenant's death. 4. Contingent Remainder: This type of quitclaim deed is employed when the transfer of ownership to the remainder man depends on a certain condition. For instance, the remainder man may only gain ownership if they reach a specific age or achieve a certain milestone. When drafting a Dallas Texas Quitclaim Deed of Life Estate Interest Created Under A Will, it is crucial to consult with an experienced estate attorney who can provide appropriate guidance and ensure compliance with local laws and regulations.

Dallas Texas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman

Description

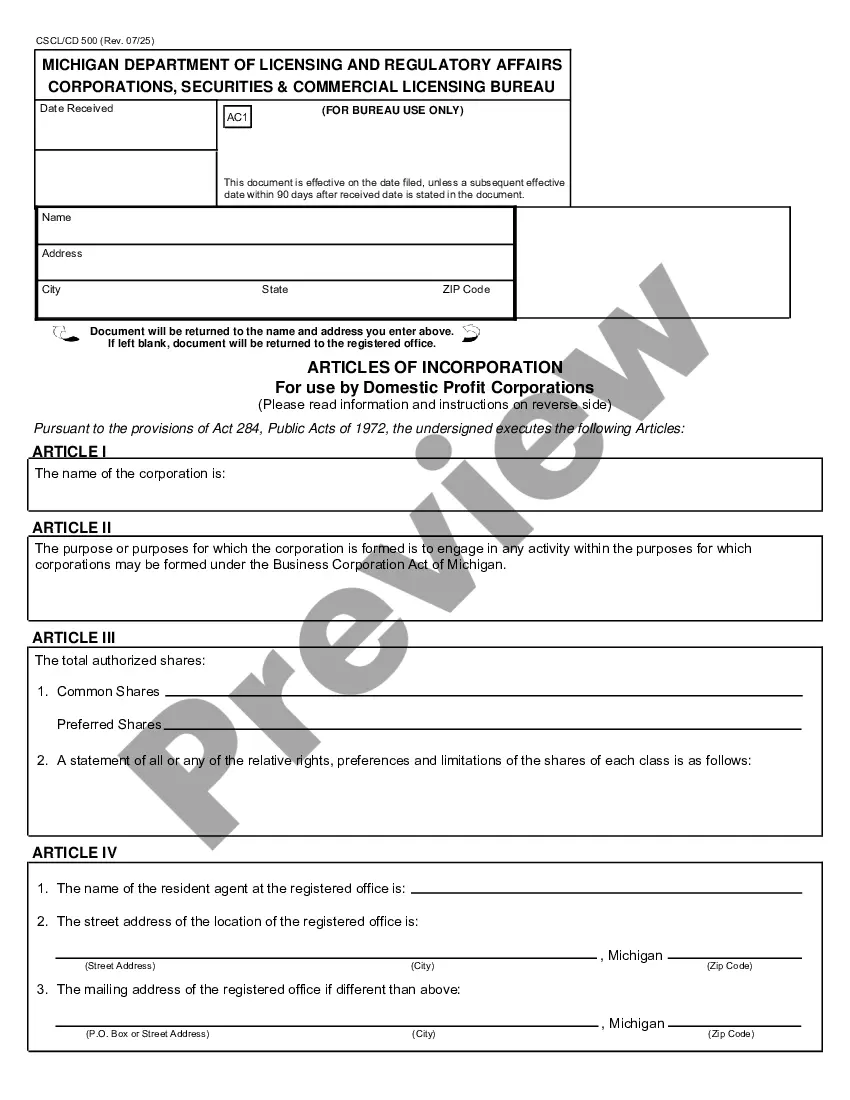

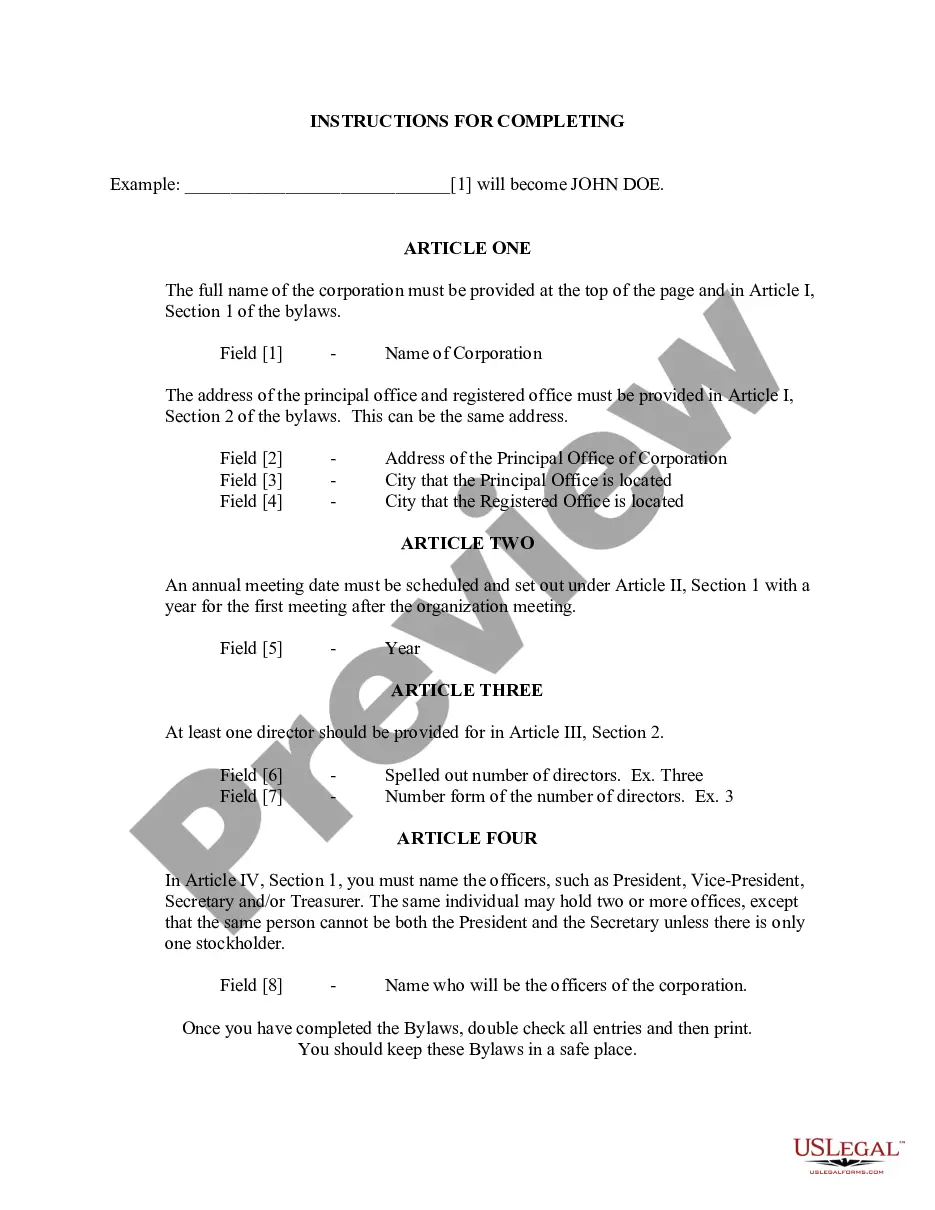

How to fill out Dallas Texas Quitclaim Deed Of Life Estate Interest Created Under A Will, To The Remainderman?

Draftwing documents, like Dallas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman, to take care of your legal affairs is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Dallas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading Dallas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman:

- Make sure that your form is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Dallas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!