A Harris Texas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainder man, is a legal document used to transfer ownership of a property based on the terms specified in a will. This type of deed allows the life tenant to hold possession of the property for their lifetime, while the remainder man owns the property after the death of the life tenant. The Harris Texas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainder man, clarifies the rights and responsibilities of both parties involved in the transaction. The life tenant, usually the individual specified in the will, holds the right to use and enjoy the property during their lifetime. They are responsible for the property's maintenance, taxes, and other financial obligations. The remainder man, often a family member or a designated beneficiary, receives the property upon the life tenant's death. The remainder man's ownership interest is subject to the life estate during the life tenant's lifetime, meaning they cannot sell or transfer the property until the life tenant passes away. In Harris County, Texas, there are different types of quitclaim deeds that can be used to create a life estate interest under a will. These include: 1. Harris Texas Traditional Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainder man: This is the standard document used to transfer a life estate interest in Harris County. It outlines the rights and responsibilities of the life tenant and the remainder man as per the terms of the will. 2. Harris Texas Enhanced Life Estate Deed (also known as a Lady Bird Deed): This type of deed is increasingly popular and offers additional flexibility to the life tenant. It allows the life tenant to retain control over the property during their lifetime, including the ability to sell, mortgage, or convey the property without the remainder man's consent, while still naming the remainder man as the ultimate owner. 3. Harris Texas Joint Tenancy with Right of Survivorship Quitclaim Deed: This deed creates a life estate interest, where the property is jointly owned by the life tenant and the remainder man. Upon the life tenant's death, the remainder man automatically assumes full ownership of the property without the need for probate. It is important to consult with an attorney or a real estate professional familiar with Harris County laws to determine the most appropriate type of quitclaim deed of life estate interest in a particular situation. In conclusion, a Harris Texas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainder man, is a legal document that allows for the transfer of ownership of a property based on the terms specified in a will. There are different types of quitclaim deeds available in Harris County, each offering unique advantages and considerations for the life tenant and remainder man.

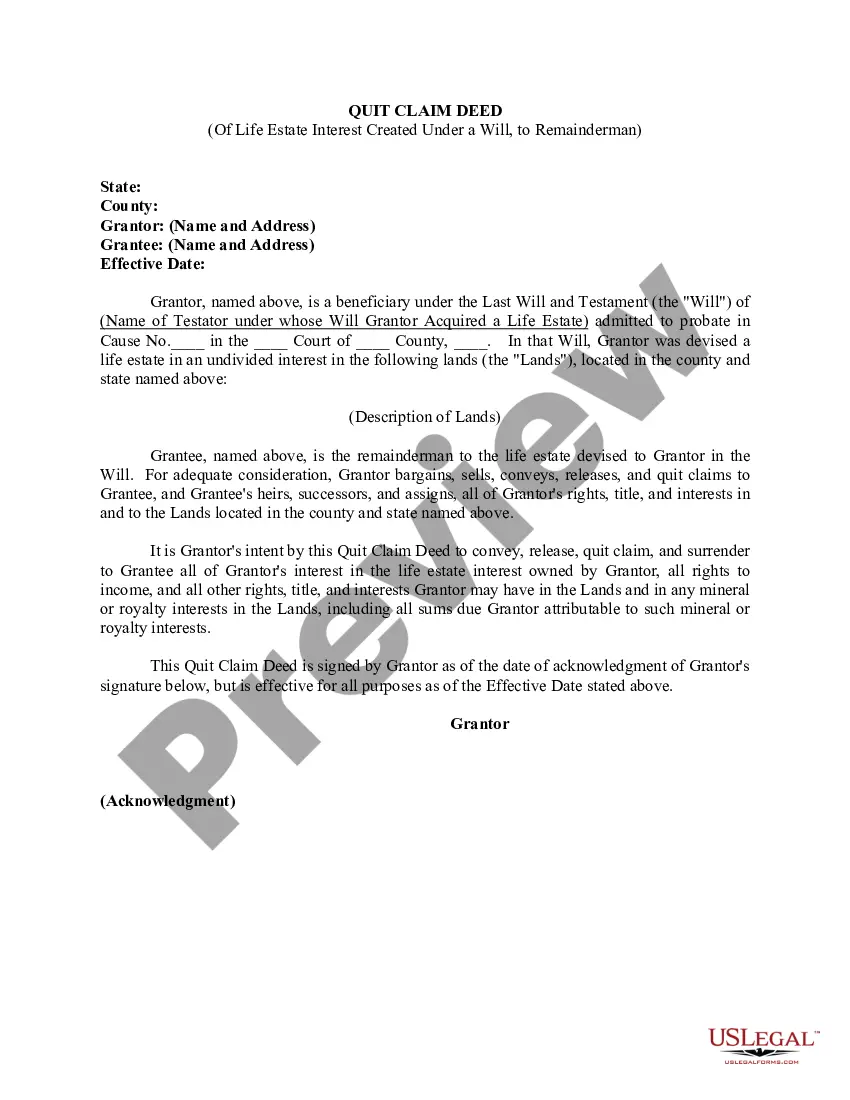

Harris Texas Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman

Description

How to fill out Harris Texas Quitclaim Deed Of Life Estate Interest Created Under A Will, To The Remainderman?

If you need to find a trustworthy legal form supplier to obtain the Harris Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it easy to get and execute different papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Harris Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Harris Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or execute the Harris Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman - all from the convenience of your home.

Join US Legal Forms now!