A Nassau New York Quitclaim Deed for Mineral/Royalty Interest is a legal document that transfers ownership of mineral rights or royalty interests from one party to another in Nassau County, New York. This type of quitclaim deed is commonly used in real estate transactions involving mineral or royalty rights, ensuring a clear and binding transfer of ownership. In Nassau County, New York, there are primarily two types of quitclaim deeds related to mineral/royalty interests: individual/minority interest quitclaim deeds and entire interest quitclaim deeds. Individual/Minority Interest Quitclaim Deed: This type of quitclaim deed relates to the transfer of partial ownership of mineral rights or royalty interests. It allows a party to convey their specific percentage or fractional interest in the property to another individual or entity. The transfer of these interests does not affect the overall ownership structure of the property. Individuals or companies seeking to sell or assign a portion of their mineral/royalty interests can use this deed to complete the transfer in Nassau County, New York. Entire Interest Quitclaim Deed: Unlike the individual/minority interest quitclaim deed, this document transfers the entire ownership of mineral rights or royalty interests from the granter to the grantee. Through this deed, the granter relinquishes all rights, title, and interests associated with the property. This type of quitclaim deed is commonly used when one party wishes to transfer all of their ownership rights to another party in Nassau County, New York, without any restrictions or reservations. Both types of quitclaim deed for mineral/royalty interests provide a clear legal transfer of ownership. It is essential for all parties involved to seek proper legal advice and ensure that the deed complies with Nassau County and New York State laws. When drafting or reviewing a Nassau New York Quitclaim Deed for Mineral/Royalty Interest, make sure to include relevant keywords such as: Nassau County, New York, quitclaim deed, mineral rights, royalty interests, transfer of ownership, partial ownership, entire interest, granter, grantee, legal document, real estate transaction, fractional interest, title, restrictions, reservations, clear transfer, and compliance with laws.

Nassau New York Quitclaim Deed for Mineral / Royalty Interest

Description

How to fill out Nassau New York Quitclaim Deed For Mineral / Royalty Interest?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the Nassau Quitclaim Deed for Mineral / Royalty Interest.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Nassau Quitclaim Deed for Mineral / Royalty Interest will be available for further use in the My Forms tab of your profile.

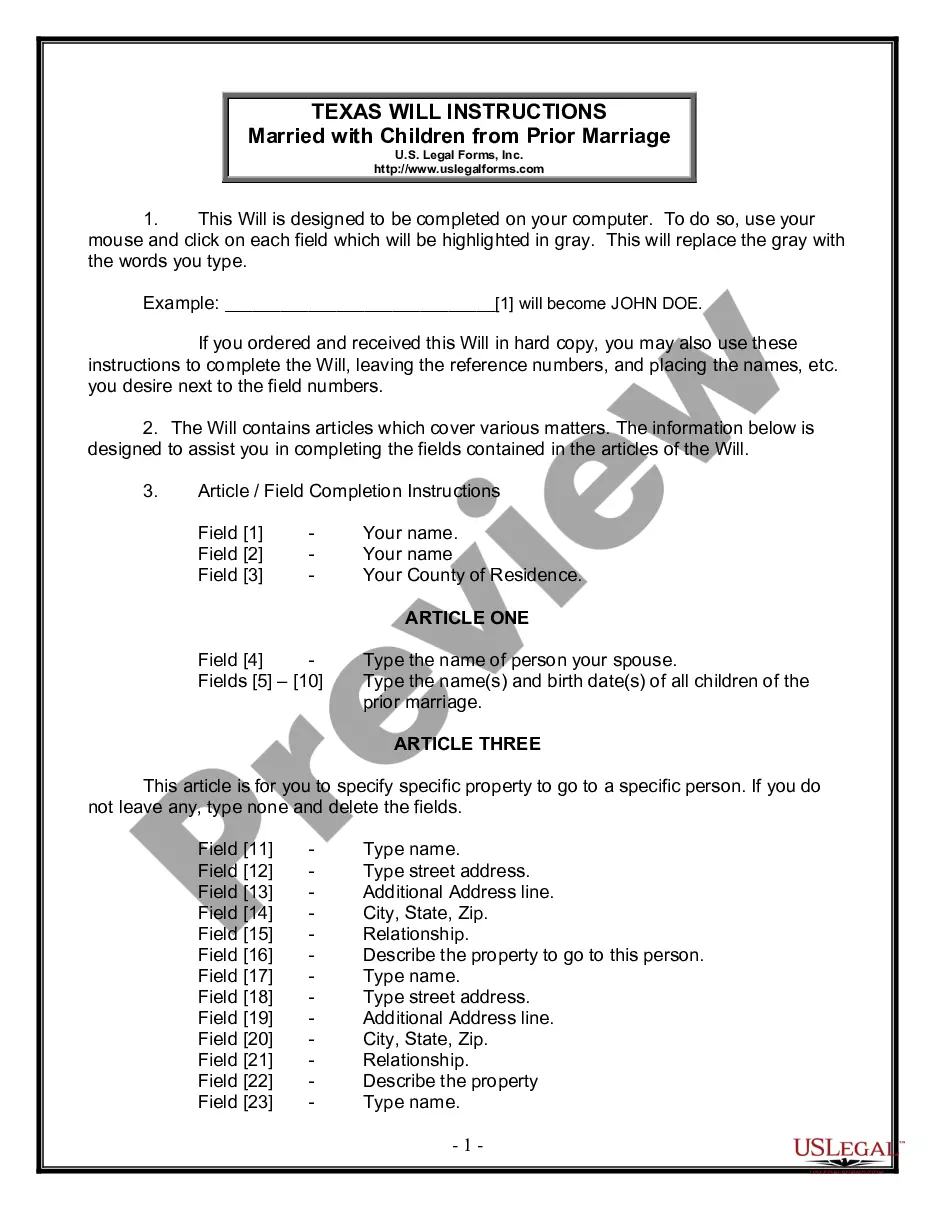

If you are using US Legal Forms for the first time, follow this simple guideline to get the Nassau Quitclaim Deed for Mineral / Royalty Interest:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Nassau Quitclaim Deed for Mineral / Royalty Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

If you want to get your money, state officials will ask for evidence supporting your right to the unclaimed oil or gas rights located in your search. You may need to show evidence of inheritance or complete an Affidavit of Heirship (AOH) if you are claiming royalty payments on an inherited property.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

You can collect a lump sum by selling oil royalty interests to meet your financial needs. Medicaid: Some royalty interest owners need to sell royalties due to medicaid. In some states you may not be eligible for Medicaid depending on the amount of your oil royalty income.

A royalty interest is an interest retained in the output of a property when the owner of mineral rights enters into a lease agreement. A royalty interest entitles the mineral rights owner to receive a portion of the minerals produced or a portion of the gross revenue from sold production.

They generally range from 1225 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership.

A royalty interest carved or reserved from the mineral estate is an interest in land, but has no right of use and possession and no right to explore for or produce the mineral estate. Its sole right is to receive royalties once production is established, no more.

What Is A Royalty Deed? A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).