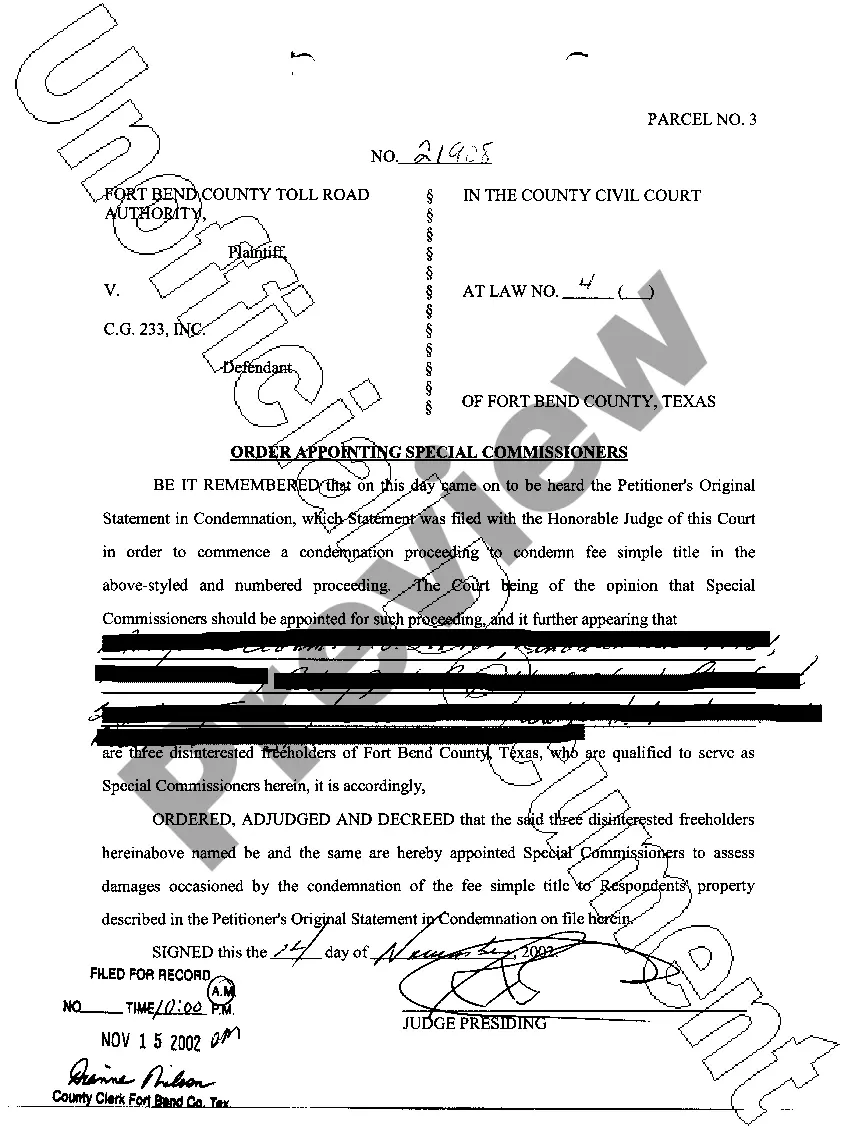

Chicago, Illinois Division Order: A Comprehensive Overview A Chicago, Illinois Division Order refers to a legal document that outlines the allocation and distribution of production revenues generated from oil, gas, or mineral extraction activities occurring within the city of Chicago, Illinois. The Division Order serves as a crucial contract between an oil or gas company and the owners of the mineral rights or royalty interest in a particular piece of land. Chicago, being a prominent urban center, may not have significant oil or gas exploration activities taking place within its city limits. However, Division Orders related to Chicago often pertain to interests in mineral rights or royalties of properties located on the outskirts of the city. The purpose of a Division Order is to establish the proper distribution of revenues to the rightful mineral owners and ensure transparency in the payment process. It typically includes vital information such as the legal description of the property, the percentage of ownership interest, and the payment terms. Types of Chicago, Illinois Division Orders: 1. Oil Division Order: This type of Division Order applies to properties where oil extraction activities occur. It regulates the distribution of oil revenues among the mineral rights owners based on their ownership interest percentages. 2. Gas Division Order: Gas Division Orders come into play when natural gas extraction activities take place within the vicinity of Chicago. Similar to an Oil Division Order, this document outlines the specific distribution of gas-related revenues to the relevant mineral rights owners. 3. Mineral Rights Division Order: If there is a possibility of multiple types of resources being extracted from a property near Chicago, an all-encompassing Mineral Rights Division Order may be drafted. This document covers the allocation of revenues generated from various resources, such as oil, gas, and minerals, according to the respective ownership interests. While the primary purpose of Division Orders remains consistent, the specific provisions and requirements may vary between different entities or companies. It is vital for mineral rights owners to review the terms and conditions of a Chicago, Illinois Division Order thoroughly and seek legal counsel if necessary to ensure their rights and entitlements are properly protected. Keywords: Chicago, Illinois, Division Order, legal document, allocation, distribution, production revenues, oil extraction, gas extraction, mineral extraction, mineral rights, royalty interest, ownership interest, payment terms, oil revenues, gas revenues, mineral revenues, transparency, legal description, mineral owners, resources, legal counsel.

Chicago Illinois Division Order

Description

How to fill out Chicago Illinois Division Order?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Chicago Division Order, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the current version of the Chicago Division Order, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Chicago Division Order:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Chicago Division Order and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The City does not impose an income tax on residents or workers in Chicago. All residents of Illinois, including Chicago residents, are subject to State and Federal income taxes.

Collecting and remitting, therefore, are two separate steps in the process of complying with sales tax laws. Collecting is the process of obtaining money from your customers to cover your tax obligations; remitting is when you pass that money on to the appropriate tax authorities.

The Illinois sales tax rate is currently 6.25%. The County sales tax rate is 1.75%. The Chicago sales tax rate is 1.25%.

You can pay this sales tax online through MyTax Illinois, the tax web portal for the Illinois Department of Revenue. As an Illinois resident, if you buy goods or services from a seller out of state who does not collect sales tax (such as an internet purchase), you're also required to pay state sales tax.

To file a City of Chicago tax return via our web site please visit . All you need is your IRIS (Integrated Revenue Information System) account number and your unique PIN to begin the filing process.

Effective January 1, 2021, the lease tax rate is 9% for all taxable transactions. In addition, Chicago will begin applying an economic nexus standard to remote vendors starting July 1, 2021. Chicago imposes lease tax on leases/rentals of all property, other than real property, in Chicago.

File online ? File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail ? You can use Form ST-1 and file and pay through the mail.

You can file Form ST-1, Sales and Use Tax and E911 Surcharge electronically using MyTax Illinois to report your sales and use tax liability. If you are reporting sales for more than one location or from a changing location, you must also submit Form ST-2, Multiple Site Form.

Corporations, other than S corporations, pay 7 percent (. 07) income tax. Small business corporations (S corporations) who file the federal Form 1120S, U.S. Income Tax Return for an S Corporation, do not pay income tax. Corporations, including S corporations, also pay replacement tax.

What is the sales tax rate in Chicago, Illinois? The minimum combined 2022 sales tax rate for Chicago, Illinois is 10.25%. This is the total of state, county and city sales tax rates. The Illinois sales tax rate is currently 6.25%.

Interesting Questions

More info

If you found this post through the social media share buttons on this post (especially the Facebook share button), you can make sure that we see it here with the button below

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.