The lease form contains many detailed provisions not found in a standard oil and gas lease form. Due to its length, a summary would not adequately describe each of the terms. It is suggested that if you consider adopting the form for regular use, that you print the form and closely read and review it. The lease form is formatted in 8-1/2 x 14 (legal size).

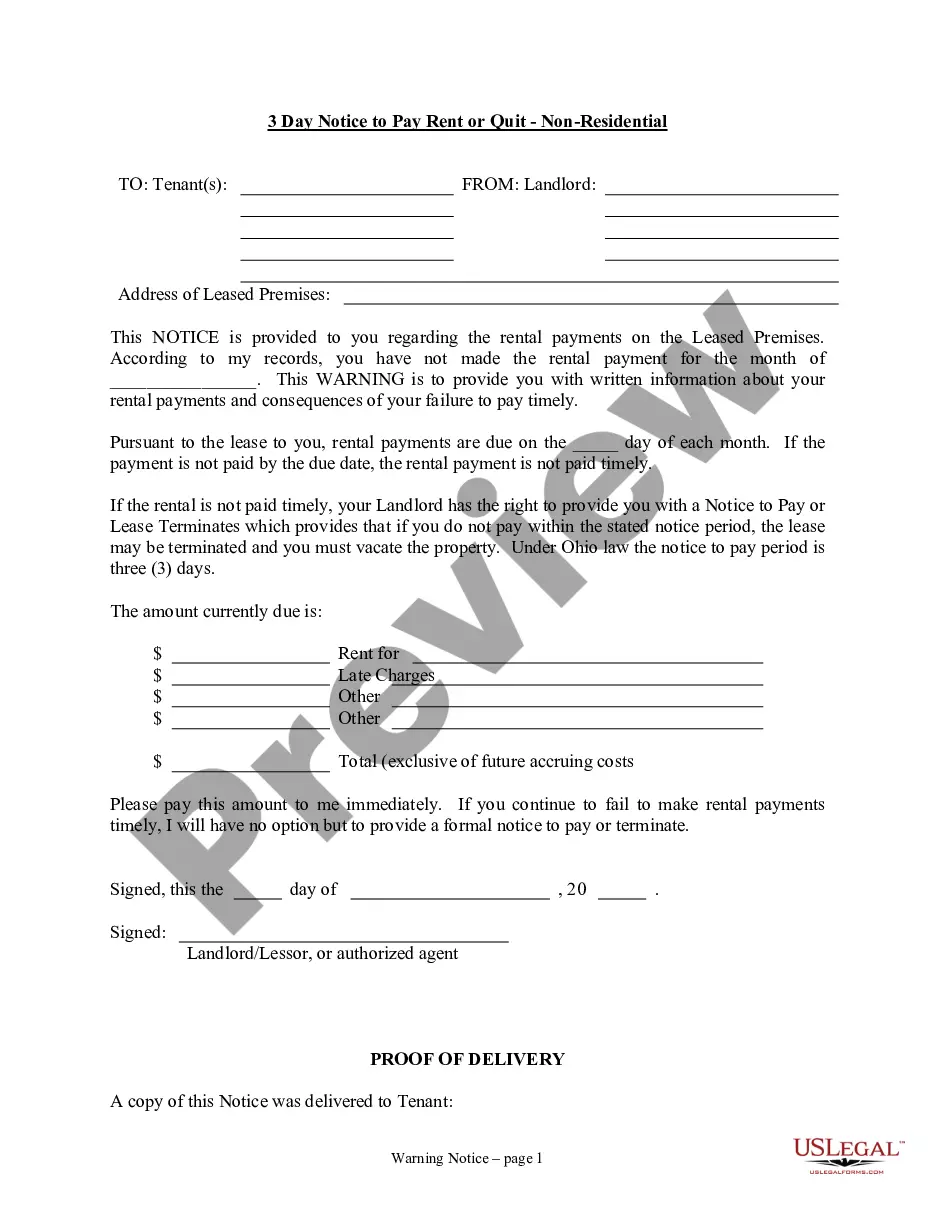

Nassau New York Lessor's Form is a legal document used by landlords or lessors in Nassau County, New York. This form serves as a contractual agreement stipulating the terms and conditions between the lessor and lessee (tenant) for the rental or lease of residential or commercial properties. The Nassau New York Lessor's Form outlines key details including the duration of the lease, rent amount and payment schedule, security deposit requirements, maintenance responsibilities, property usage restrictions, and any additional provisions specific to the property or the lessor's requirements. Several types of Nassau New York Lessor's Forms exist depending on the nature of the lease or rental agreement. These may include: 1. Residential Lessor's Form: This form is used for leasing residential properties such as apartments, houses, condos, or townhouses in Nassau County, New York. It encompasses terms and conditions tailored for residential lease agreements, including regulations regarding pets, rental insurance, and tenant rights. 2. Commercial Lessor's Form: Designed for leasing commercial properties like offices, retail spaces, or warehouses, the Commercial Lessor's Form includes provisions specific to commercial tenancies. This form may cover aspects such as permitted uses, signage regulations, subletting, maintenance of common areas, and compliance with zoning laws. 3. Short-Term Lessor's Form: This type of Lessor's Form is utilized for temporary or short-term rentals, typically for durations less than a year. It is commonly used for vacation rentals, short-stay accommodations, or month-to-month rentals. The Short-Term Lessor's Form may contain provisions regarding cleaning fees, booking deposits, and cancellation policies. 4. Agricultural Lessor's Form: This specific form caters to lease agreements related to agricultural properties, farms, or rural land use. It may include provisions related to crop cultivation, livestock raising, equipment storage, water usage, and land maintenance responsibilities. Nassau New York Lessor's Forms are crucial in establishing clear expectations and protecting the rights and interests of both lessors and lessees. It is advised to seek legal counsel or utilize pre-approved Nassau County templates when drafting or signing this document to ensure compliance with local laws and regulations.