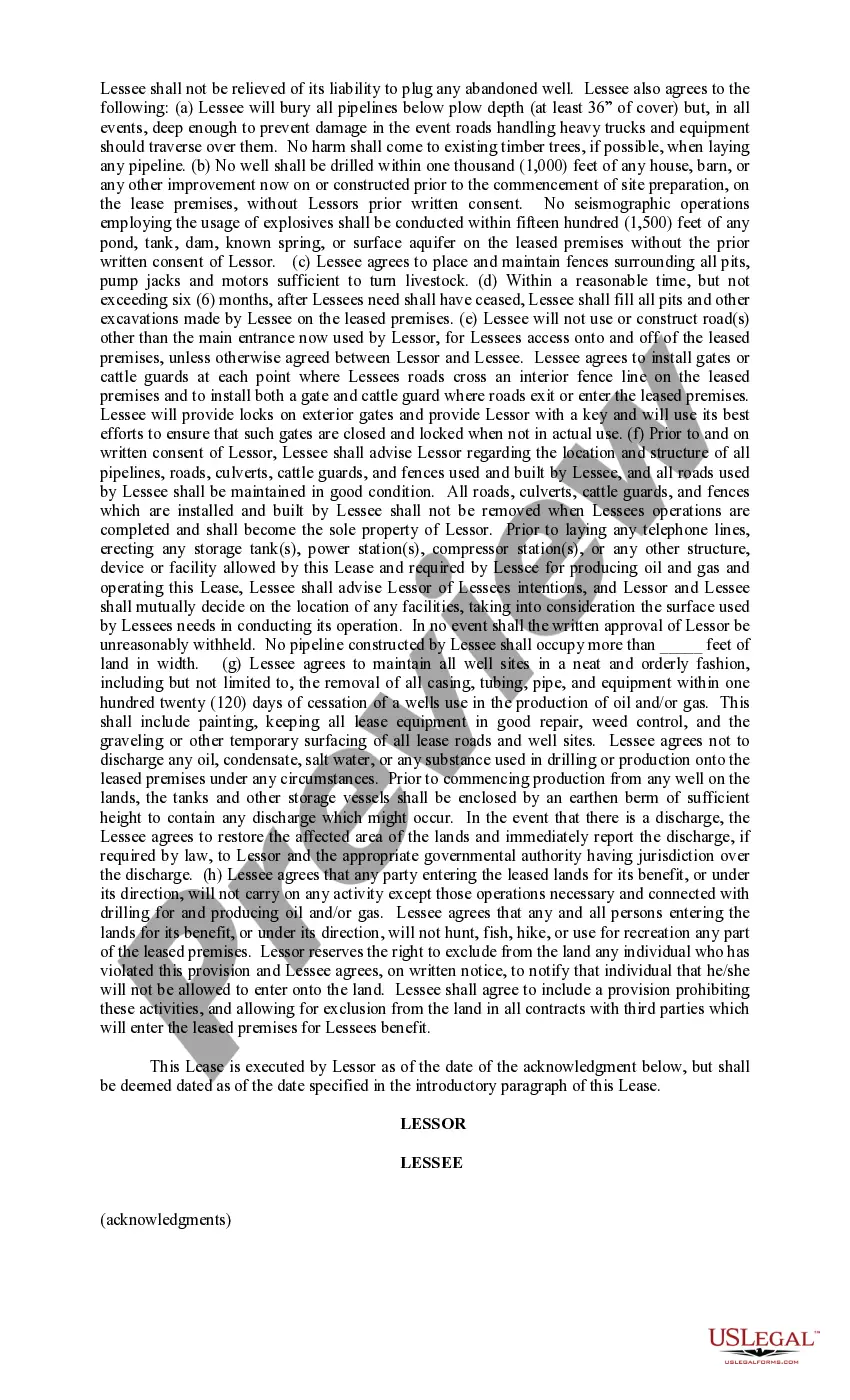

The lease form contains many detailed provisions not found in a standard oil and gas lease form. Due to its length, a summary would not adequately describe each of the terms. It is suggested that if you consider adopting the form for regular use, that you print the form and closely read and review it. The lease form is formatted in 8-1/2 x 14 (legal size).

Hennepin County, located in the state of Minnesota, has specific legal forms designed for lessors or landlords to use when leasing their property. One such form is the Hennepin Minnesota Lessor's Form. This form is a legally binding document that outlines the terms and conditions of the lease agreement between the lessor and the lessee. The Hennepin Minnesota Lessor's Form covers various aspects of the leasing process, including the property details, lease duration, rent payment terms, security deposit, and other important provisions. It serves as a comprehensive agreement that protects both parties' rights and helps ensure a smooth landlord-tenant relationship throughout the lease term. One type of Hennepin Minnesota Lessor's Form is the Residential Lessor's Form. This form is specifically used for leasing residential properties such as apartments, houses, or condominiums. It includes clauses and agreements tailored to the unique needs and regulations governing residential leases in Hennepin County. Another type of Hennepin Minnesota Lessor's Form is the Commercial Lessor's Form. This form is designed for leasing commercial properties, such as offices, retail spaces, or warehouses. It includes provisions specific to commercial leases, such as permitted uses, maintenance responsibilities, and options for renewing or terminating the lease. Whether it's a residential or commercial property, using the Hennepin Minnesota Lessor's Form provides a standardized and legally compliant document that protects the rights and interests of both lessor and lessee. It helps minimize disputes and ensures transparency in the leasing process. In conclusion, the Hennepin Minnesota Lessor's Form is a crucial document for lessors in Hennepin County. It exists in different variations, such as the Residential Lessor's Form and Commercial Lessor's Form, depending on the type of property being leased. By utilizing this form, lessors can establish a fair and comprehensive lease agreement that benefits both parties involved.