Chicago, Illinois Escrow Agreement and Instructions serve as legal documents that outline the key terms, conditions, and procedures involved in a secure financial arrangement between two parties. This agreement outlines the responsibilities and obligations of each party, protecting their interests throughout the escrow process. Keywords: Chicago Escrow Agreement, Illinois Escrow Instructions, types of Chicago Escrow Agreements. One type of Chicago, Illinois Escrow Agreement is the Real Estate Escrow Agreement. This agreement is commonly used during real estate transactions to ensure a smooth transfer of property between the buyer and seller. The agreement specifies details such as the purchase price, timeline, and conditions for the release of funds. Another type is the Commercial Escrow Agreement, primarily used in business transactions. This agreement safeguards the financial interests of buyers and sellers involved in commercial deals, such as mergers, acquisitions, or the purchase of a business. It outlines the terms and conditions specific to the transaction and provides a clear instruction set for handling funds and documents. Additionally, Chicago, Illinois Escrow Instructions dictate the steps and guidelines for handling escrow funds, documents, and any other assets involved. These instructions outline the specific requirements for the escrow agent, who acts as a neutral third party responsible for managing the escrow process. The instructions provide details on the delivery of funds, documents, and ensure compliance with legal and contractual obligations. Furthermore, Chicago, Illinois Escrow Agreements and Instructions often include provisions for Dispute Escrow Agreements. These are used to handle disputes that may arise during the escrow process, establishing a transparent and fair mechanism for resolving disagreements between the parties involved. These agreements stipulate the steps to follow and outline how the dispute resolution process will operate. In conclusion, Chicago, Illinois Escrow Agreements and Instructions encompass various types, including Real Estate Escrow Agreements, Commercial Escrow Agreements, and Dispute Escrow Agreements. They serve as crucial legal documents that protect the interests of both parties involved in a transaction, ensuring a reliable and secure handling of funds and documents.

Chicago Illinois Escrow Agreement and Instructions

Description

How to fill out Chicago Illinois Escrow Agreement And Instructions?

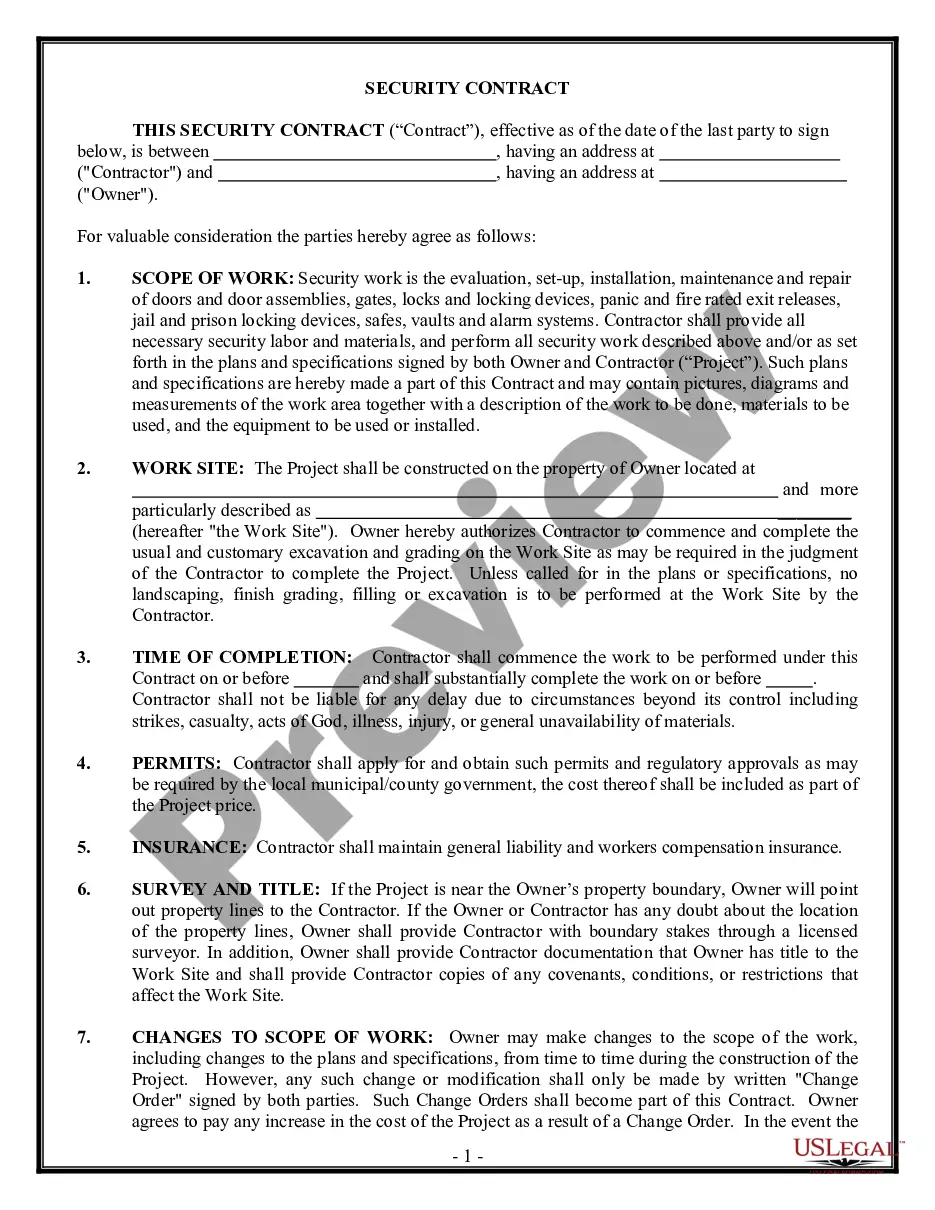

Do you need to quickly draft a legally-binding Chicago Escrow Agreement and Instructions or maybe any other document to manage your personal or business affairs? You can select one of the two options: hire a professional to write a valid paper for you or create it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant document templates, including Chicago Escrow Agreement and Instructions and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, double-check if the Chicago Escrow Agreement and Instructions is tailored to your state's or county's regulations.

- In case the form comes with a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were seeking by using the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Chicago Escrow Agreement and Instructions template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the paperwork we provide are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

When Is Earnest Money Due? Earnest money is usually due within three days of a signed and accepted offer. The earnest money check can be wired to an escrow account, or delivered to the seller's agent. It's important to get that money to the seller as soon as your offer has been accepted.

The principals to the escrow (buyer, seller, lender or borrower) or the real estate agents, if any, will provide the escrow officer with the information necessary for the escrow officer to prepare ?escrow instructions.? Generally, a party holding real estate escrow funds requires the buyer and seller sign an escrow

An escrow closing instruction letter provides the escrow agent with explicit instructions for the closing of the particular transaction. The escrow agent generally receives and holds all of the closing documents in escrow pending receipt of the purchase price and satisfaction of any conditions for closing.

Typically, you'll pay the earnest money deposit within three days of your offer being accepted, although this varies. Sometimes, a buyer will include the money with the offer. You can pay by personal check, certified check, or wire transfer to the escrow account.

The first EM payment is usually due within 1 business day of both the buyers and sellers signing the contract. There is then a second earnest money payment due once we finish the inspection and contract negotiations which usually takes about 2 weeks once we go under contract.

The escrow officer takes instructions based on the terms of your Purchase Agreement and the lender's requirements. The escrow officer can hold inspection reports and bills for work performed as required by the purchase agreement. Other elements of the escrow include hazard insurance, and the grand deed from the seller.

Escrow instructions normally identify the escrow holder's contact information and escrow number, license number, important dates including the date escrow opened, as well as the date it is scheduled to close, the names of the parties to the escrow, the property address and legal description, purchase price and terms,

The escrow agreement is a contract entered by two or more parties under which an escrow agent is appointed to hold in escrow certain assets, documents, and/or money deposited by such parties until a contractual condition is fulfilled.

Joint-Order Escrow Account means an escrow account held by Escrow Holder, in which the Proceeds of the Claims will be deposited immediately following receipt thereof pursuant to Section 4.2 of this Agreement.

The escrow instructions define the events and conditions that must take place and the manner in which the escrow agent shall deliver or release to the beneficiary of the escrow the assets, documents, and/or money held in escrow. The escrow instructions are commonly contemplated by the escrow agreement.