Cook Illinois Exhibit C Accounting Procedure Joint Operations refers to a specific accounting process followed by Cook Illinois Corporation, a renowned transportation company based in Illinois, United States. This particular accounting procedure is specifically designed for joint operations, where two or more entities collaborate to carry out transportation projects or ventures. This detailed description will provide insights into the key aspects of this accounting procedure and shed light on its significance in ensuring efficient financial management and transparency for joint operations. Keywords: Cook Illinois, Exhibit C, Accounting Procedure, Joint Operations, transportation company, Illinois, United States, financial management, transparency, collaboration. Cook Illinois Exhibit C Accounting Procedure Joint Operations primarily focuses on the financial aspects of joint operations, which involve two or more entities combining their resources, expertise, and financial investments to undertake transportation projects. It sets forth guidelines, rules, and regulations that govern the accounting practices within joint operations to ensure accuracy, consistency, and compliance with accounting standards. Within the Cook Illinois Exhibit C Accounting Procedure Joint Operations framework, several key aspects are addressed: 1. Revenue and Expense Recognition: This accounting procedure defines how revenues and expenses related to joint operations should be recognized, recorded, and reported. It outlines the appropriate criteria for recognizing revenue and the allocation of expenses incurred jointly by the participating entities. 2. Cost Allocation: Joint operations often involve shared costs, such as fuel expenses, maintenance costs, or labor expenses. The accounting procedure establishes methods and principles for allocating these costs fairly and accurately among the involved entities, ensuring transparency and equitable sharing. 3. Financial Reporting: The procedure emphasizes the importance of detailed and timely financial reporting for joint operations. It outlines the necessary financial statements and schedules that need to be prepared, including income statements, balance sheets, cash flow statements, and analysis of key performance indicators. 4. Intercompany Transactions: Joint operations may involve financial transactions between the participating entities. The accounting procedure specifies the appropriate accounting treatment for such intercompany transactions, including loans, leases, or the exchange of assets, to ensure proper recording and elimination of any duplicated entries. 5. Audit and Control: The procedure highlights the significance of regular audits and internal control mechanisms within joint operations. It lays down measures to be undertaken to perform internal and external audits, ensuring that the financial statements and processes comply with accounting standards and legal requirements. Types of Cook Illinois Exhibit C Accounting Procedure Joint Operations: 1. Joint Venture Accounting Procedure: This type of accounting procedure is specifically designed for joint ventures undertaken by Cook Illinois Corporation, where it collaborates with other entities to share risks, profits, and losses related to a particular transportation project or venture. 2. Partnership Accounting Procedure: Cook Illinois may engage in joint operations in partnership with other transportation companies or entities. The partnership accounting procedure within Exhibit C enables the accurate and transparent recording of financial transactions and the equitable sharing of profits or losses among the partners. In summary, Cook Illinois Exhibit C Accounting Procedure Joint Operations is a comprehensive accounting framework designed to ensure accurate financial management, transparency, and compliance within joint transportation projects. By addressing crucial aspects such as revenue recognition, cost allocation, financial reporting, intercompany transactions, and audit control, this procedure enhances financial accountability and facilitates smooth collaboration between entities involved in joint operations.

Cook Illinois Exhibit C Accounting Procedure Joint Operations

Description

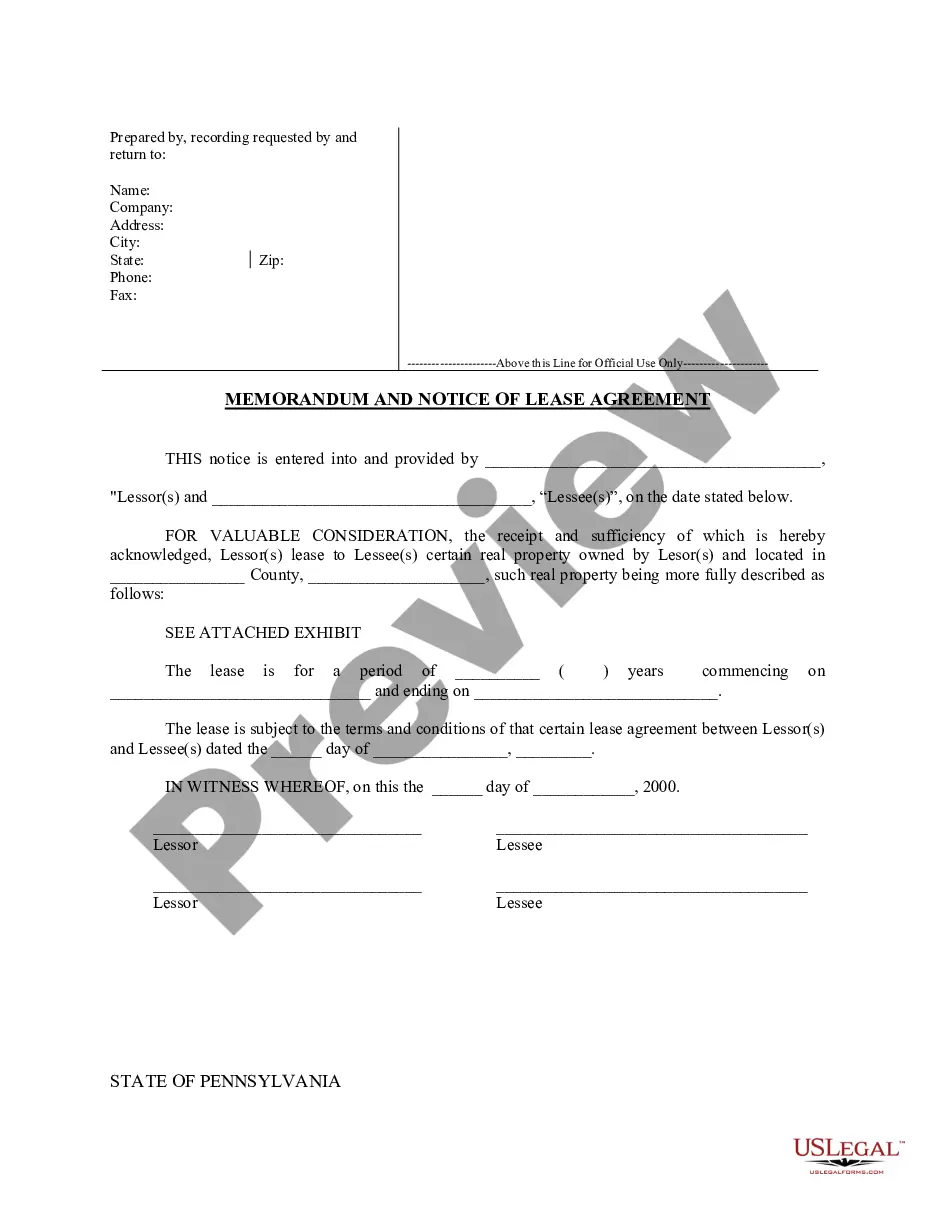

How to fill out Cook Illinois Exhibit C Accounting Procedure Joint Operations?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Cook Exhibit C Accounting Procedure Joint Operations, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Cook Exhibit C Accounting Procedure Joint Operations from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Cook Exhibit C Accounting Procedure Joint Operations:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!