Dallas Texas Exhibit C Accounting Procedure Joint Operations is a comprehensive financial framework specifically designed to facilitate joint operations among multiple parties in Dallas, Texas. This accounting procedure ensures proper management, recording, and reporting of finances related to joint ventures, mergers, acquisitions, and collaborations within the Dallas business community. Key Features: 1. Partnership Accounting: Dallas Texas Exhibit C Accounting Procedure Joint Operations enables accurate tracking and reporting of financial activities in joint ventures or partnerships. It ensures transparency and accountability among participating entities, allowing them to collaboratively manage finances. 2. Cost Allocation: This accounting procedure systematically allocates costs incurred in joint operations, including shared expenses, investments, research and development costs, and marketing expenditures. It ensures fair distribution based on predefined agreements, enhancing trust and reducing disputes among involved parties. 3. Revenue Recognition: The accounting procedure outlines precise guidelines for recognizing and recording revenues generated from joint operations. It ensures consistent application of revenue recognition principles to avoid conflicts and promote financial integrity. 4. Intercompany Transactions: Dallas Texas Exhibit C Accounting Procedure Joint Operations appropriately records intercompany transactions, ensuring accurate consolidation and eliminating double counting of revenues, expenses, and assets among partnering entities. This facilitates transparency and proper reporting while avoiding errors and misstatements. 5. Reporting and Analysis: It outlines the reporting requirements for joint operations, including financial statements, profit sharing schedules, and performance analysis. This ensures regular evaluation of the joint operation's financial health and assists in making informed business decisions. Types of Dallas Texas Exhibit C Accounting Procedure Joint Operations: 1. Joint Ventures: This type of joint operation involves two or more companies joining forces to pursue a specific business objective. The accounting procedure ensures precise recording and reporting of financial transactions between the participating entities. 2. Mergers and Acquisitions: In cases where companies merge or one company acquires another, the accounting procedure provides guidelines for consolidating financial statements and reconciling intercompany transactions during the transitional period. 3. Collaborative Research and Development: For joint research and development projects, this accounting procedure ensures proper cost allocation, revenue recognition, and reporting of financial results. It helps track the investments made by each party and the resulting benefits in a unified and transparent manner. In conclusion, the Dallas Texas Exhibit C Accounting Procedure Joint Operations is a crucial financial mechanism that facilitates efficient management and reporting of joint ventures, mergers, acquisitions, and collaborative endeavors in Dallas, Texas. Its implementation enhances transparency, trust, and accurate financial statement representation among involved parties, promoting mutual success and growth in the dynamic Dallas business landscape.

Dallas Texas Exhibit C Accounting Procedure Joint Operations

Description

How to fill out Dallas Texas Exhibit C Accounting Procedure Joint Operations?

Drafting papers for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Dallas Exhibit C Accounting Procedure Joint Operations without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Dallas Exhibit C Accounting Procedure Joint Operations on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Dallas Exhibit C Accounting Procedure Joint Operations:

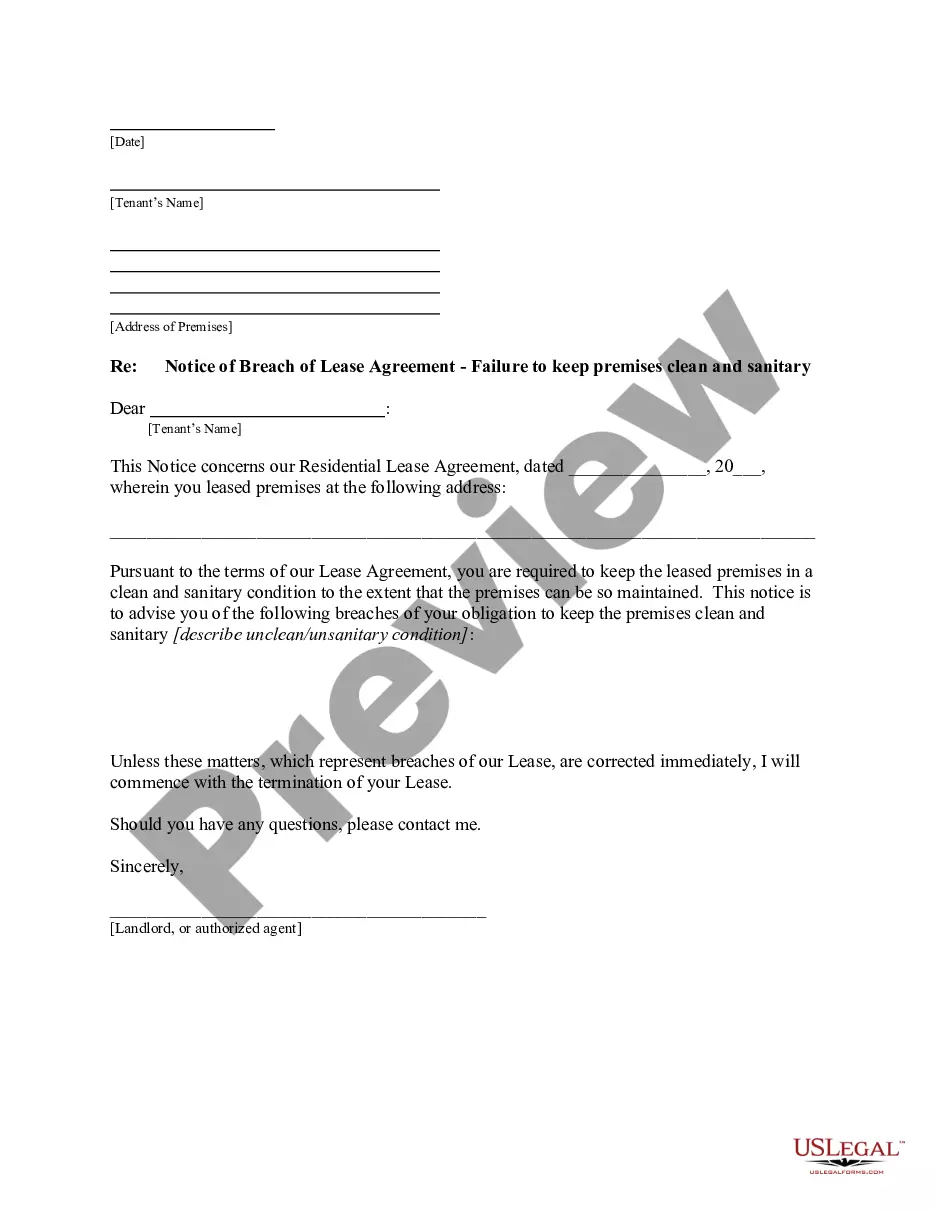

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!