Cook Illinois Revocable Trust Agreement is a legal document created when both husband and wife serve as settlers of the trust. This agreement allows them to establish a trust for the management and distribution of their assets during their lifetime and after their death. The trust can be modified or revoked at any time as long as both spouses are alive and in agreement. Under the Cook Illinois Revocable Trust Agreement, there are different types that cater to specific needs and circumstances of the settlers. These variations include: 1. Joint Revocable Trust: This type of trust agreement is most common among married couples who want to create a single trust to hold their combined assets. It allows both spouses to have equal control and management over the trust assets. 2. Spousal Lifetime Access Trust (SLAT): A SLAT is a unique type of revocable trust agreement where one spouse is the settler, and the other spouse, as the beneficiary, can access the assets during their lifetime. This trust helps to minimize estate taxes and protect assets. 3. Qualified Terminable Interest Property (TIP) Trust: A TIP trust ensures that the surviving spouse receives income from the trust assets during their lifetime. It provides flexibility in estate planning and allows the settlers to control the ultimate distribution of assets to other beneficiaries after the second spouse's death. 4. Marital Deduction Trust: This trust type is designed to take advantage of certain tax benefits available to married couples. It allows both spouses to gift assets to each other, while also reducing the taxable estate value. 5. Common Law Trust: This trust variation is suitable for couples in common law marriages or domestic partnerships. It provides similar benefits to a joint revocable trust, allowing both partners to have control over the trust assets. In summary, Cook Illinois Revocable Trust Agreement when settlers are husband and wife is a legal arrangement that enables couples to create a trust to manage and distribute their assets. The various types of agreements, such as joint revocable trusts, Slats, TIP trusts, marital deduction trusts, and common law trusts, cater to different needs and goals within the realm of estate planning and asset protection.

Cook Illinois Revocable Trust Agreement when Settlors Are Husband and Wife

Description

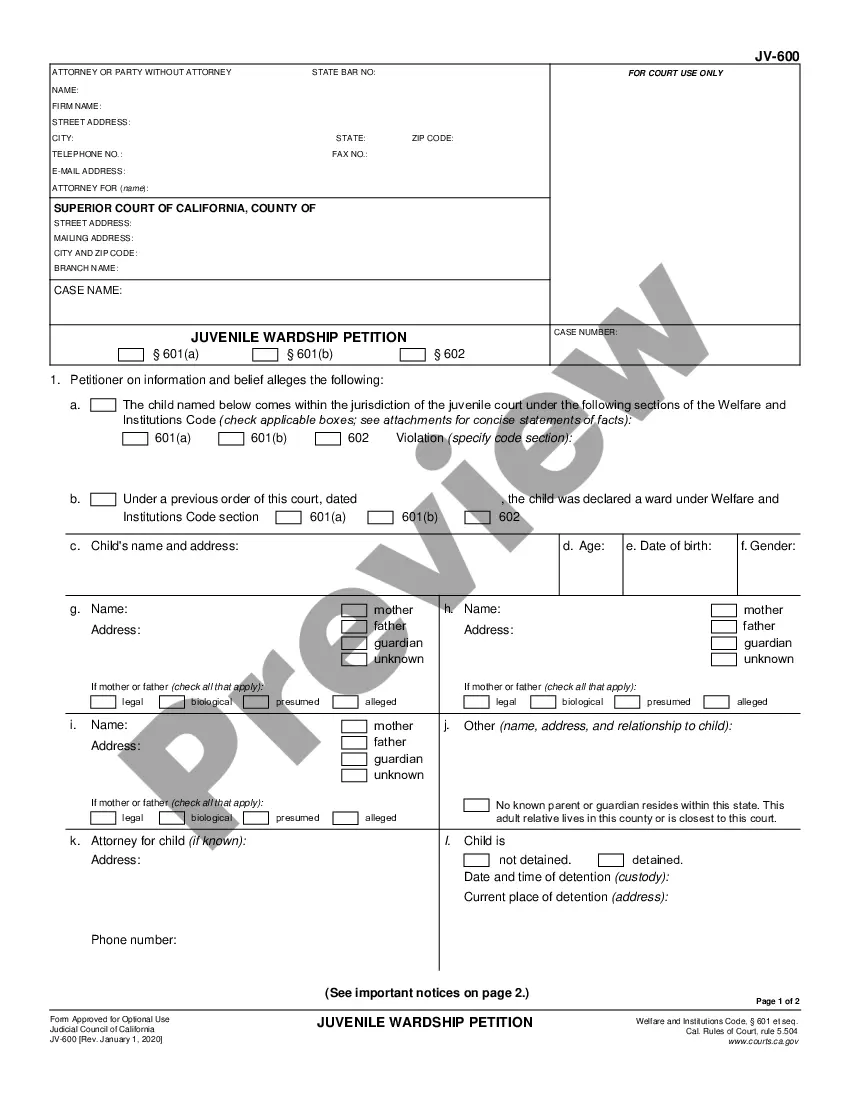

How to fill out Cook Illinois Revocable Trust Agreement When Settlors Are Husband And Wife?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Cook Revocable Trust Agreement when Settlors Are Husband and Wife is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Cook Revocable Trust Agreement when Settlors Are Husband and Wife. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Revocable Trust Agreement when Settlors Are Husband and Wife in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!