Hennepin Minnesota Revocable Trust Agreement when Settlers Are Husband and Wife is a legal document that allows spouses to establish a trust in which they retain control and flexibility over their assets during their lifetime, while also providing for the orderly transfer of those assets upon their death. This type of trust agreement enables the settlers (the spouses who create the trust) to transfer their individual and joint assets into the trust. By doing so, they can effectively organize their assets, protect them from probate, and potentially minimize estate taxes. The agreement serves as a comprehensive estate planning tool that addresses various aspects of the couple's financial affairs. Here are few different types of Hennepin Minnesota Revocable Trust Agreements when Settlers Are Husband and Wife: 1. Living Revocable Trust: This is the most common type of trust agreement for married couples. It allows the settlers to transfer their assets into the trust, remain in control as trustees, and make changes or revoke the trust terms during their lifetime. 2. A-B Trust: Also known as "marital and bypass trusts," this structure aims to take advantage of each spouse's estate tax exemption. Upon the first spouse's death, the trust divides into two separate trusts: the "A" trust (marital trust), which is typically funded up to the estate tax exemption amount and benefits the surviving spouse, and the "B" trust (bypass trust), which shelters assets from estate taxes upon the surviving spouse's death. 3. Qualified Terminable Interest Property (TIP) Trust: This trust is designed to provide for the surviving spouse while ensuring control over the ultimate disposition of assets. It allows one spouse to provide for the surviving spouse while still dictating how the remaining assets will be distributed among other beneficiaries, such as children from previous marriages. 4. Joint Revocable Living Trust: In this type of trust, both spouses act as co-settlors and co-trustees. They pool their assets and jointly manage them during their lifetime. Upon the death of one spouse, the surviving spouse continues to manage the trust assets. 5. Survivor's Trust: This trust is established for the surviving spouse's benefit after the death of the first spouse. It allows the surviving spouse to continue utilizing and managing the assets held within the trust while ensuring efficient administration and transfer of the assets upon their subsequent death. It's important for couples in Hennepin County, Minnesota, to consult with a qualified estate planning attorney to determine the specific type of trust agreement that suits their needs and achieves their estate planning objectives.

Hennepin Minnesota Revocable Trust Agreement when Settlors Are Husband and Wife

Description

How to fill out Hennepin Minnesota Revocable Trust Agreement When Settlors Are Husband And Wife?

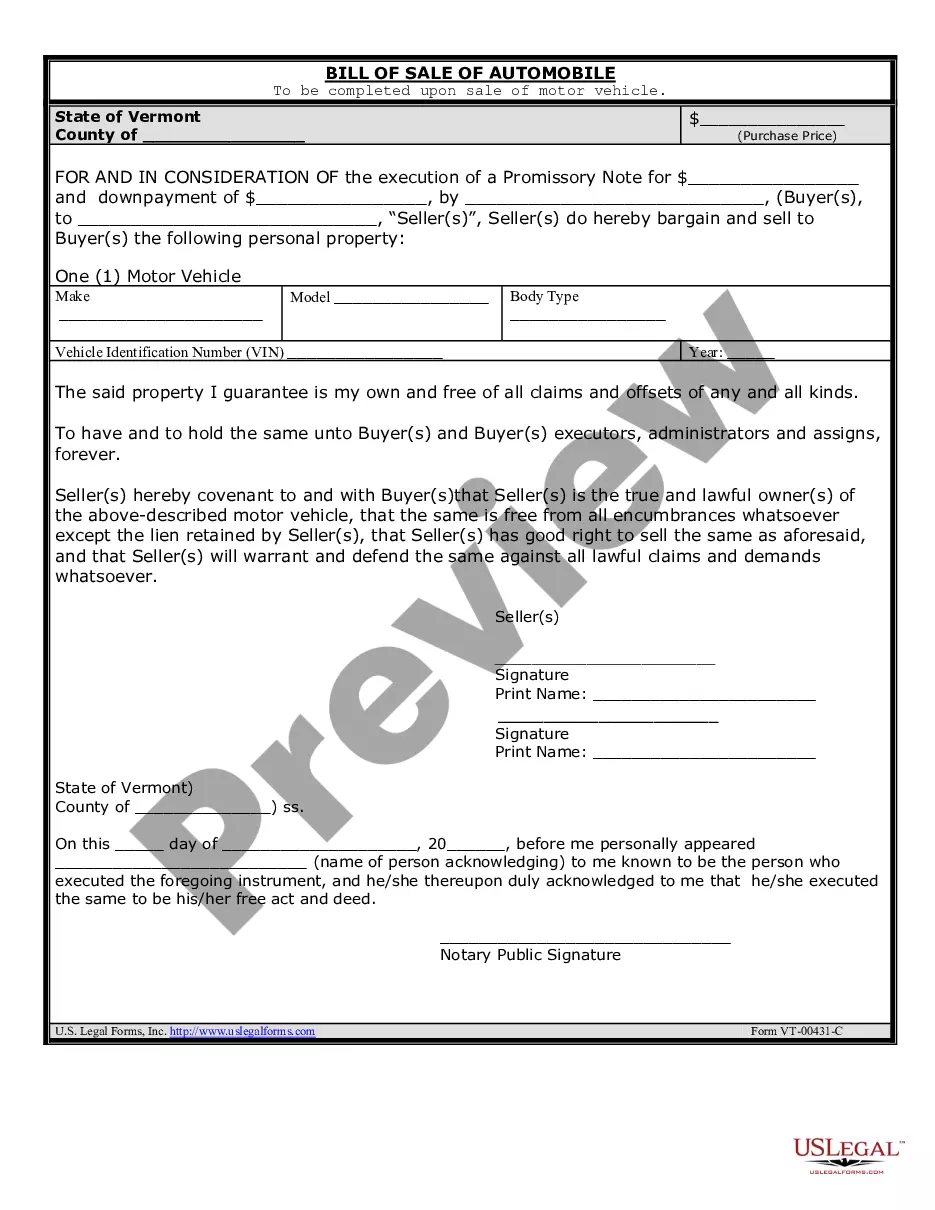

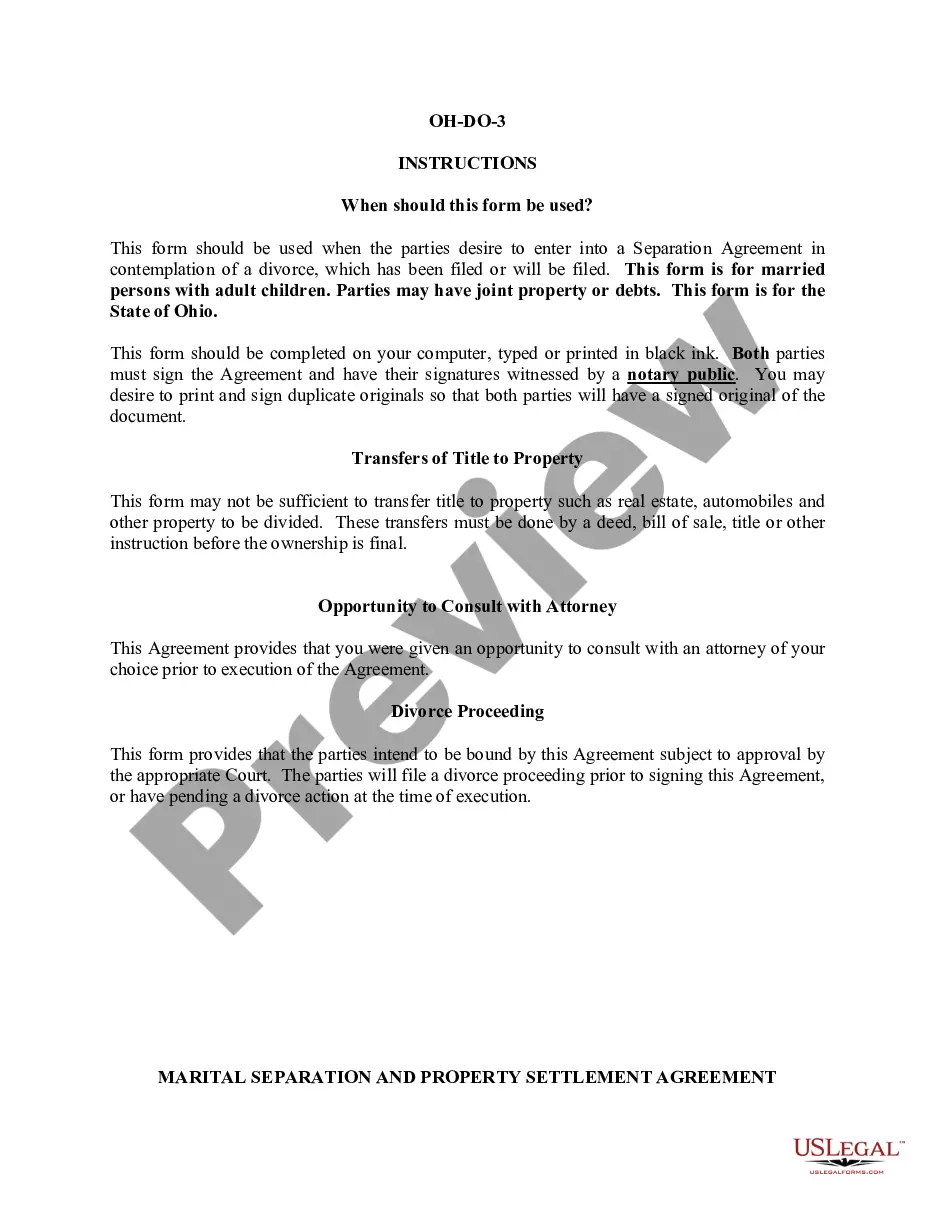

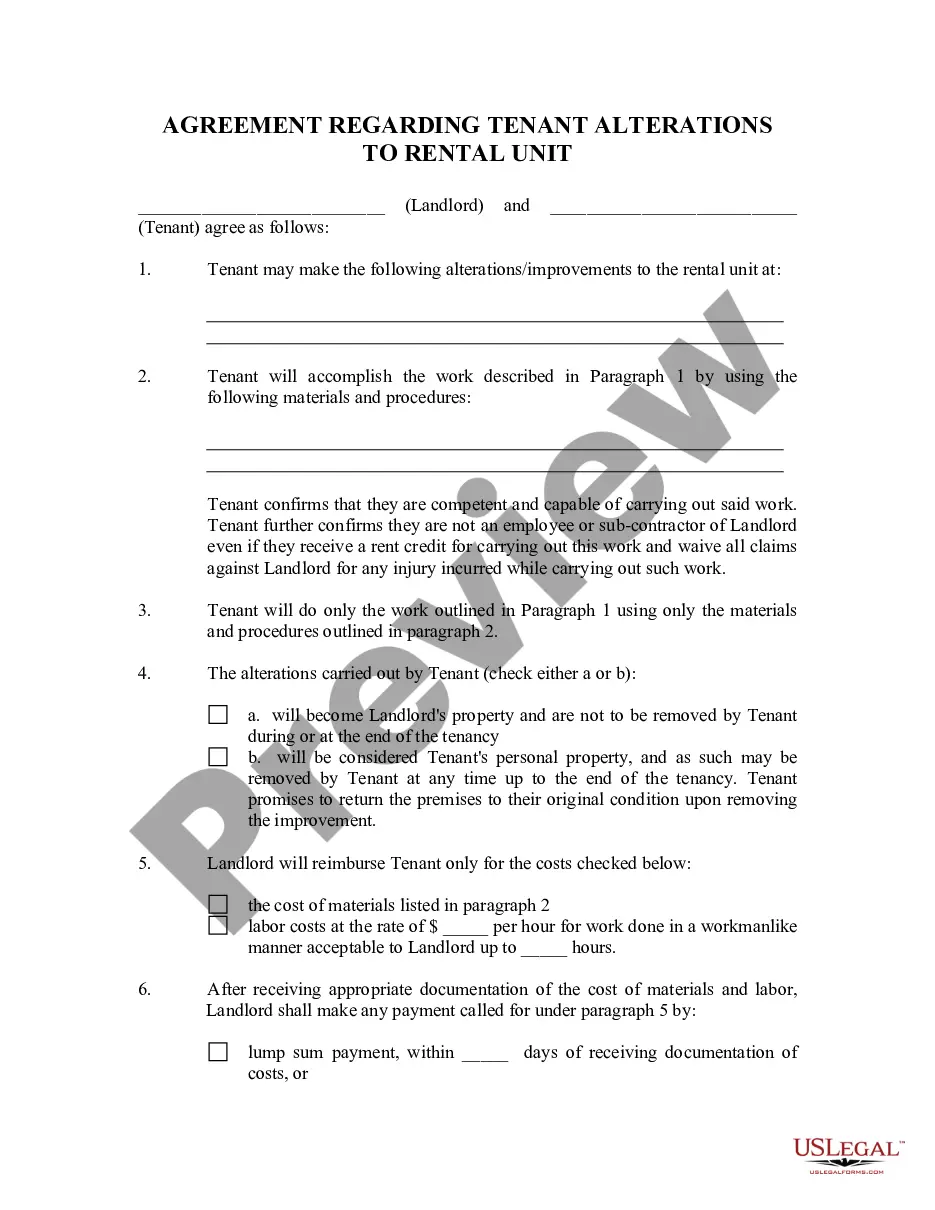

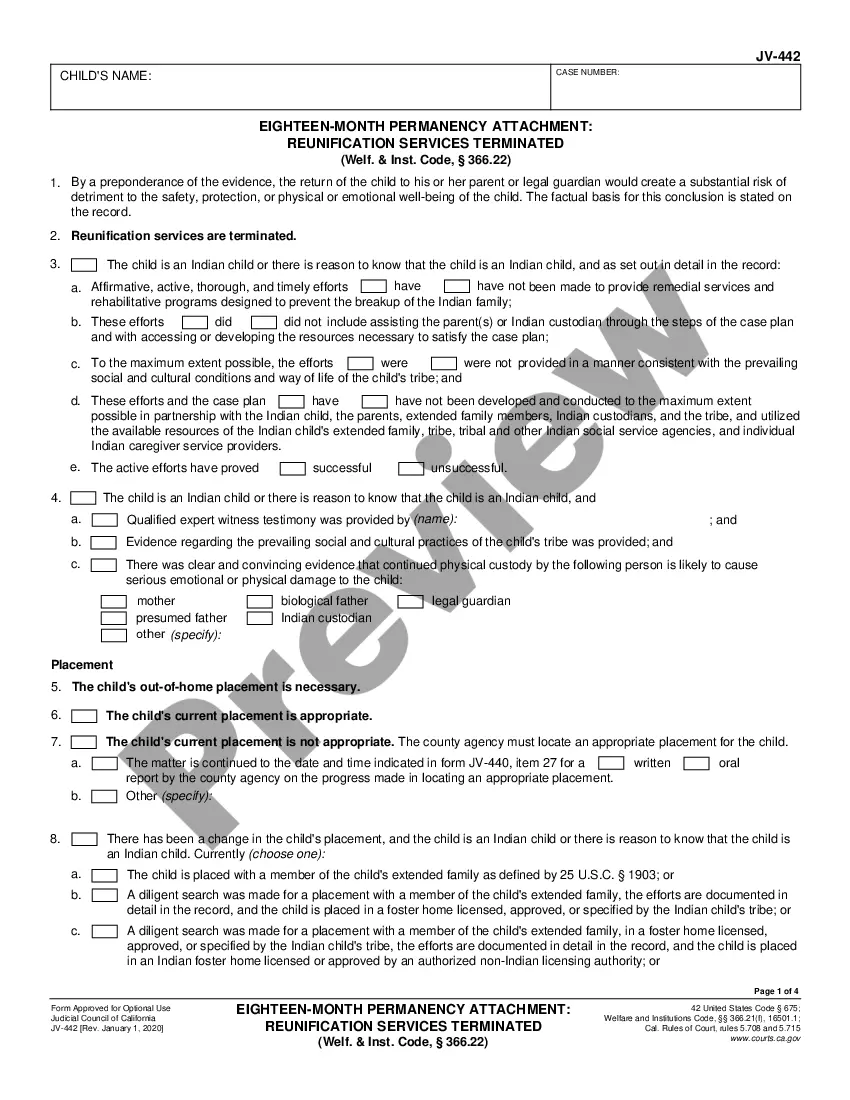

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Hennepin Revocable Trust Agreement when Settlors Are Husband and Wife, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the recent version of the Hennepin Revocable Trust Agreement when Settlors Are Husband and Wife, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Revocable Trust Agreement when Settlors Are Husband and Wife:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Hennepin Revocable Trust Agreement when Settlors Are Husband and Wife and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

You can be trustee of your own living trust. If you are married, your spouse can be trustee with you. Most married couples who own assets together, especially those who have been married for some time, are usually co-trustees.

In a simple living trust, a couple can share the control and benefits of the trust while they are living. Once one spouse dies, the other spouse will have total control over the trust. After one spouse's death, the survivor can alter the beneficiaries if they wish.

A single living trust involves just one individual, while a joint living trust usually involves a married couple. Joint living trusts are commonly used to transfer assets between spouses upon one spouse's death.

The person setting up the trust (the settlor) will automatically be one of the trustees. If it's a joint investment, both people will be joint settlors and both will be trustees. The settlor can appoint other trustees either from the outset or later. After the settlor's death the trustees can appoint further trustees.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

The deceased spouse's assets are either put completely into a Family Trust, or split between a Family Trust and a Marital Trust. The Family Trust will no longer be considered part of the surviving spouse's estate upon death.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

It is possible for a trust to have multiple grantors. If more than one person funded the trust, then they will each be treated as grantors in proportion to the value of the cash or property that they each provided to fund the trust.

That said, revocable trusts can have multiple settlors. These are typically spouses or domestic partners, especially in community property states. They can be funded with the property of its respective settlors. These revocable trusts are often called joint trusts or family trusts.