Maricopa Arizona Revocable Trust Agreement plays a crucial role when it comes to estate planning for couples. This legal document enables the transfer of assets to beneficiaries in a seamless and efficient manner. When Settlers Are Husband and Wife, the Maricopa Arizona Revocable Trust Agreement offers several types to suit individual needs. Let's delve deeper into these different types and understand their benefits. 1. Joint Revocable Trust Agreement: The Joint Revocable Trust Agreement is designed to handle the assets and property jointly owned by married couples. It allows them to establish a comprehensive plan for managing and distributing their assets. This agreement provides flexibility to add or remove assets, make changes as per their wishes, and effectively avoid probate while ensuring that their wishes are carried out after their passing. 2. A-B Revocable Trust Agreement: The A-B Revocable Trust Agreement, also known as the "A Trust" and "B Trust," allows couples to maximize their estate tax exemptions. Under this arrangement, upon the first spouse's passing, the trust divides into two separate trusts: the "A Trust" (Survivor's Trust) and the "B Trust" (Decedent's Trust). The "A Trust" generally remains revocable, providing the surviving spouse with access to the assets, income, and principal. The "B Trust," however, becomes irrevocable and allows for estate tax planning, preserving the deceased spouse's exemption. 3. Pour-over Will Revocable Trust Agreement: Maricopa Arizona also offers a Pour-over Will Revocable Trust Agreement for couples who desire to use both a will and trust for their estate planning. This agreement ensures any assets not included in the trust during the Settlers' lifetimes will be transferred into the trust upon their passing, hence the term "pour-over." It acts as a safety net, preventing any assets from being unintentionally left outside the trust. 4. Irrevocable Life Insurance Trust (IIT): While not a revocable trust agreement, an Irrevocable Life Insurance Trust is worth mentioning, as it can be a valuable addition to a couple's estate planning strategy. This trust is specifically designed to own life insurance policies, keeping them out of the settler's estate and thereby minimizing estate taxes upon their passing. In conclusion, the Maricopa Arizona Revocable Trust Agreement, when Settlers Are Husband and Wife, offers various options for couples aiming to protect and distribute their assets efficiently. Whether choosing a Joint Revocable Trust Agreement, A-B Revocable Trust Agreement, Pour-over Will Revocable Trust Agreement, or considering an Irrevocable Life Insurance Trust, seeking guidance from an experienced estate planning attorney is essential to ensure the trust aligns with the couple's goals while adhering to relevant laws and regulations.

Maricopa Arizona Revocable Trust Agreement when Settlors Are Husband and Wife

Description

How to fill out Maricopa Arizona Revocable Trust Agreement When Settlors Are Husband And Wife?

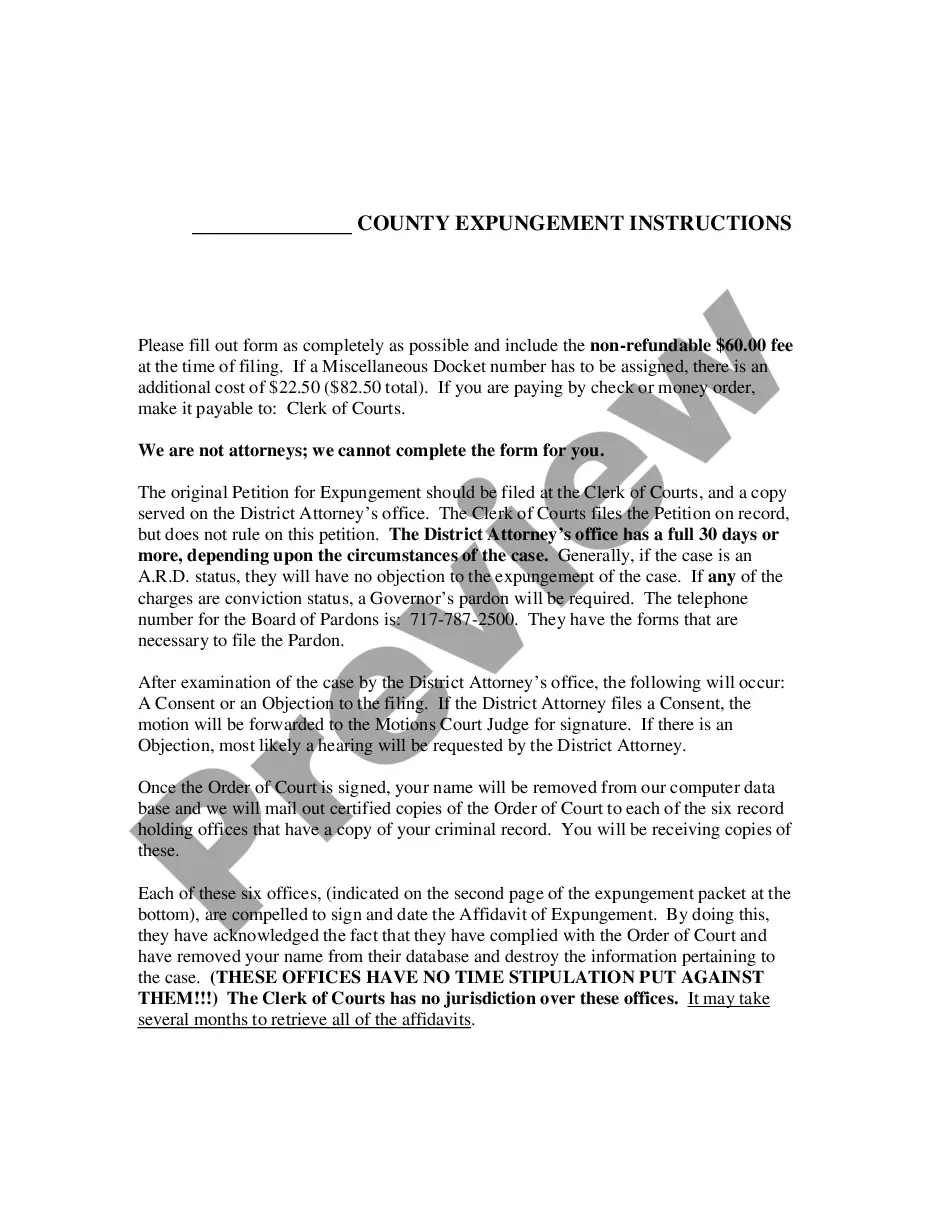

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Maricopa Revocable Trust Agreement when Settlors Are Husband and Wife, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Maricopa Revocable Trust Agreement when Settlors Are Husband and Wife from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Maricopa Revocable Trust Agreement when Settlors Are Husband and Wife:

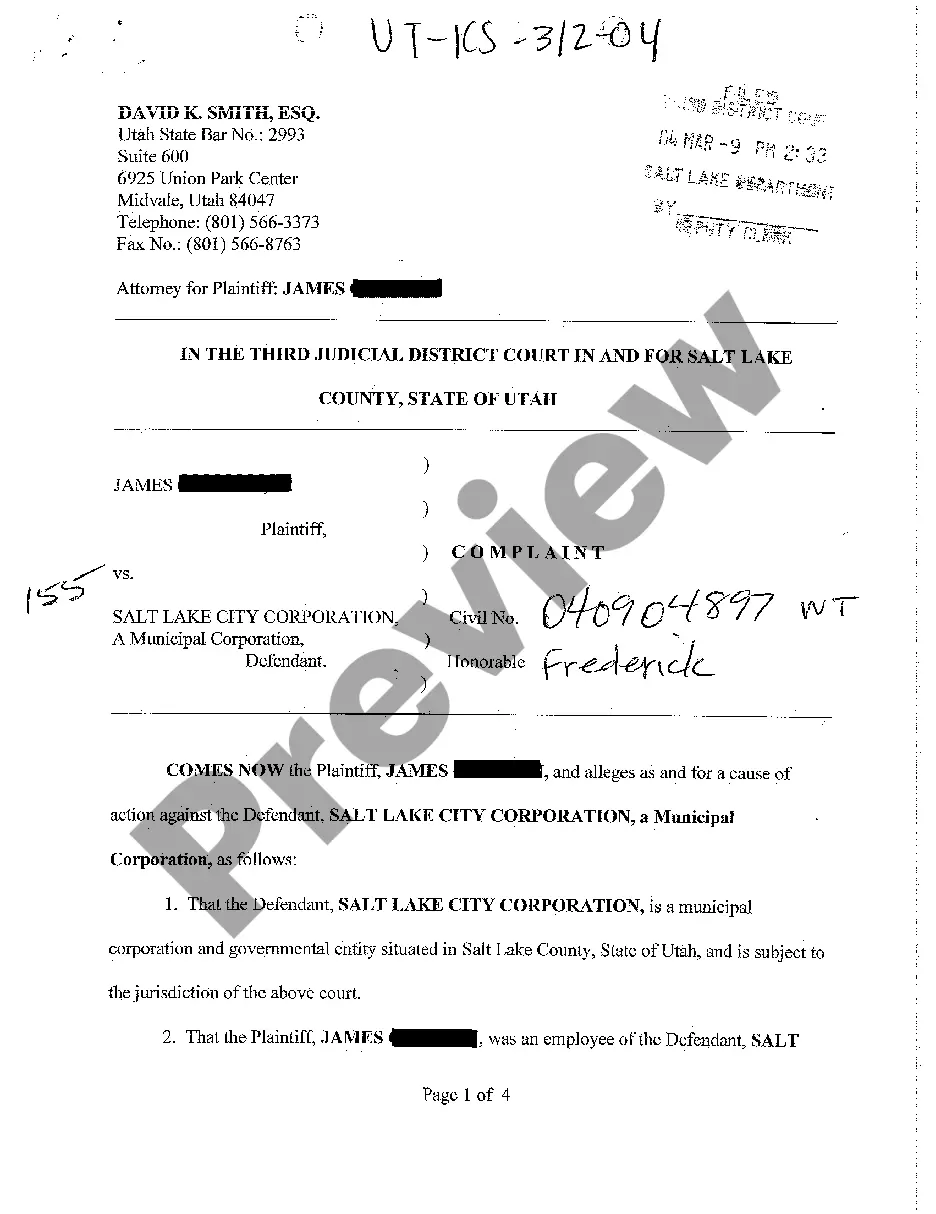

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The deceased spouse's assets are either put completely into a Family Trust, or split between a Family Trust and a Marital Trust. The Family Trust will no longer be considered part of the surviving spouse's estate upon death.

Once the grantor dies, the terms written into a revocable trust cannot be modified in any way, nor can anyone add or remove assets.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

You and your spouse can serve together as co-grantors since you both created the trust. The trustee is responsible for holding and managing the trust assets. You and your spouse can also serve as co-trustees. You must put assets into the trust to make the trust a legal document.

A revocable trust becomes irrevocable at the death of the person that created the trust. Typically, this person is the trustor, the trustee, and the initial beneficiary, and the trust is typically written so once that person dies, the trust becomes irrevocable.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.