Middlesex Massachusetts Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment)

Description

How to fill out Middlesex Massachusetts Partial Assignment Of Oil And Gas Lease (Producing Lease. Reservation Of Production Payment)?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Middlesex Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment) meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Apart from the Middlesex Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment), here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Middlesex Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment):

- Examine the content of the page you’re on.

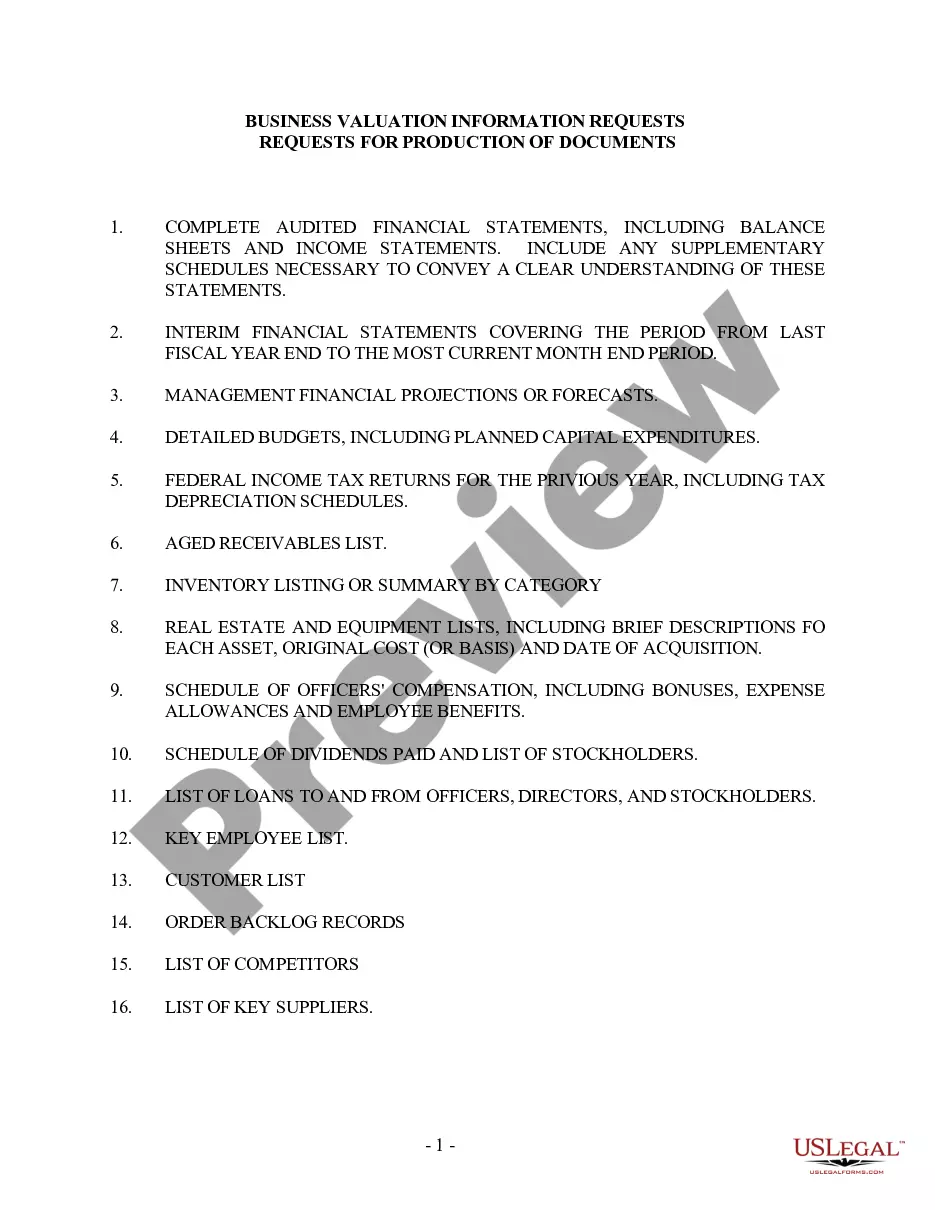

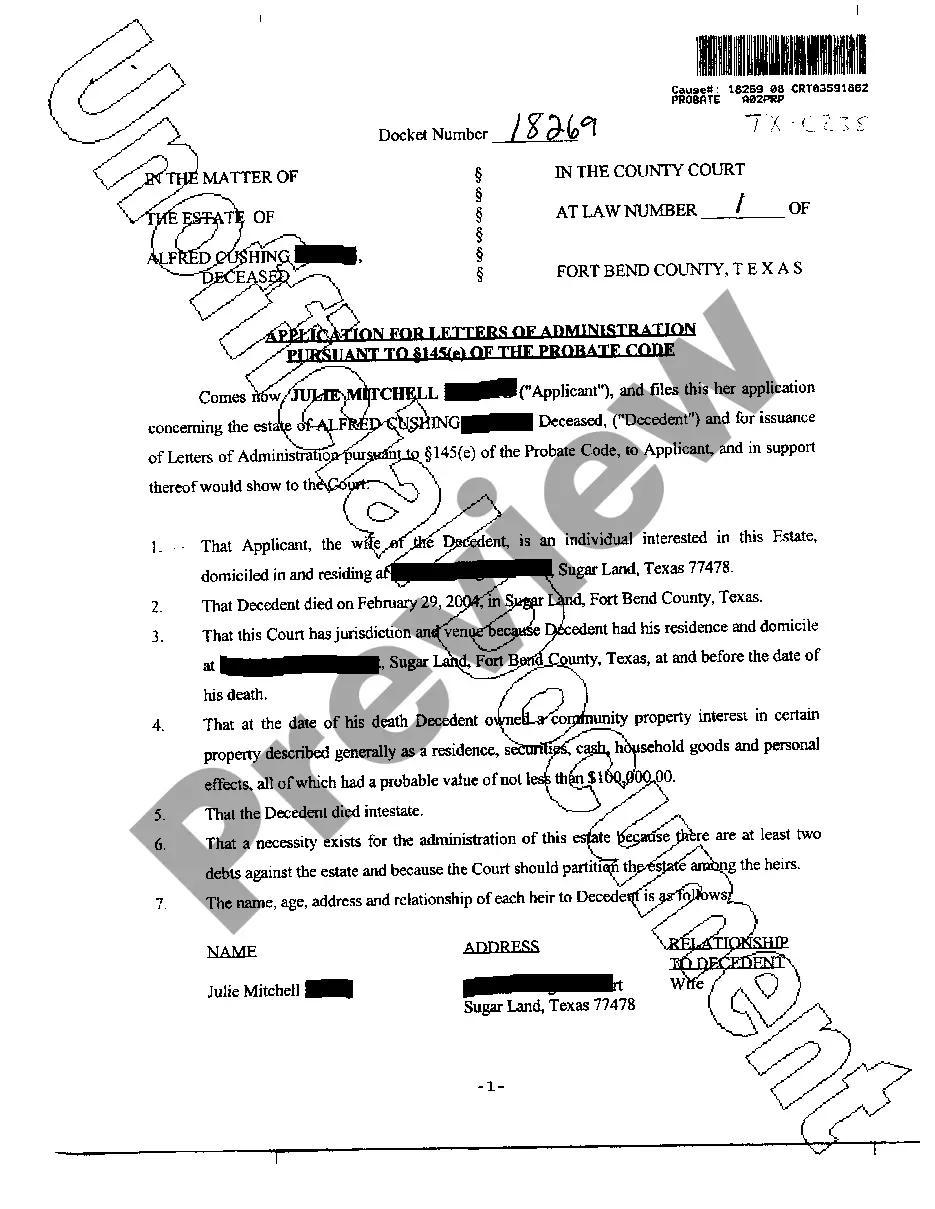

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Middlesex Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment).

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

An Assignment of an Oil, Gas and Mineral Lease is a document in which the original Lessee, and or their successors, assign either all or part of their working interest and/or net revenue interest that they own in that lease. This is leasehold interest. You can also assign or reserve interest in wellbores.

In terms of the oil and gas industry, ratification of a lease is the term for requesting acceptance of an existing lease agreement, with or without changes, from landowners who have purchased parcels to which the original leaseholder gave permission to drill and produce. Leases can last for decades.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

1031 Exchange: another term for Like-Kind Exchange. 8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

In times of a low natural gas prices and reduced drilling, Lease Amendments, Modifications and Ratifications may become common. Gas companies may attempt to revive or restore a expired lease by presenting the royalty owner with a Lease Modification and Amendment.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

(a) (1) Any lease of oil or natural gas rights or any other conveyance of any kind separating such rights from the freehold estate of land shall expire at the end of ten (10) years from the date executed, unless, at the end of such ten (10) years, natural gas or oil is being produced from such land for commercial

The assignment serves three basic functions. First, it is the operative document that assigns rights and delegates duties between the assignor and the assignee. 22/ Second, it allocates liabilities between the assignor and assignee and may create obligations in addition to those imposed by the oil and gas lease.