Phoenix Arizona Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment) A Partial Assignment of Oil and Gas Lease refers to an agreement in the energy industry where a lessee transfers a portion of their interest or rights under an existing oil and gas lease to another party. In the case of Phoenix, Arizona, this type of assignment is particularly relevant due to the city's proximity to various oil and gas fields and its involvement in the energy sector. Keywords: Phoenix Arizona, Partial Assignment, Oil and Gas Lease, Producing Lease, Reservation of Production Payment. Types of Phoenix Arizona Partial Assignment of Oil and Gas Lease: 1. Assignment of Working Interest: This type of partial assignment involves the transfer of a percentage or fraction of the lessee's working interest in an oil and gas lease located in the Phoenix, Arizona area. The working interest entitles the assignee to a share of the profits generated from the production of hydrocarbons. 2. Assignment of Royalty Interest: With this type of partial assignment, the assignee acquires a portion of the lessor's royalty interest in an oil and gas lease within Phoenix, Arizona. The royalty interest grants the assignee a percentage of the revenue generated from the production and sale of oil and gas without bearing the burden of exploration and extraction costs. 3. Assignment of Overriding Royalty Interest: In this partial assignment, the assignee receives a percentage of the revenue generated from an oil and gas lease located in Phoenix, Arizona, but only from production after certain costs, such as operating expenses, have been deducted. Unlike a royalty interest, this assignment is derived from the lessee's working interest rather than the lessor's interest. 4. Assignment of Net Profits Interest: This form of partial assignment allows the assignee to receive a share of the net profits generated from an oil and gas lease in Phoenix, Arizona. The assignee receives a percentage of the income derived from the lease, after deducting operating expenses, royalties, and other costs. 5. Assignment of Production Payment: This type of partial assignment involves an assignee receiving payments from the lessee based on a predetermined formula or share of the oil and gas production from the assigned lease within Phoenix, Arizona. These payments are typically made until a specified amount or a predetermined period is reached. It's crucial to note that the specific terms, conditions, and arrangements of a Phoenix Arizona Partial Assignment of Oil and Gas Lease may vary depending on the parties involved and the negotiated agreement. Detailed legal documentation and consultation with industry professionals are essential before entering into any such transactions.

Phoenix Arizona Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment)

Description

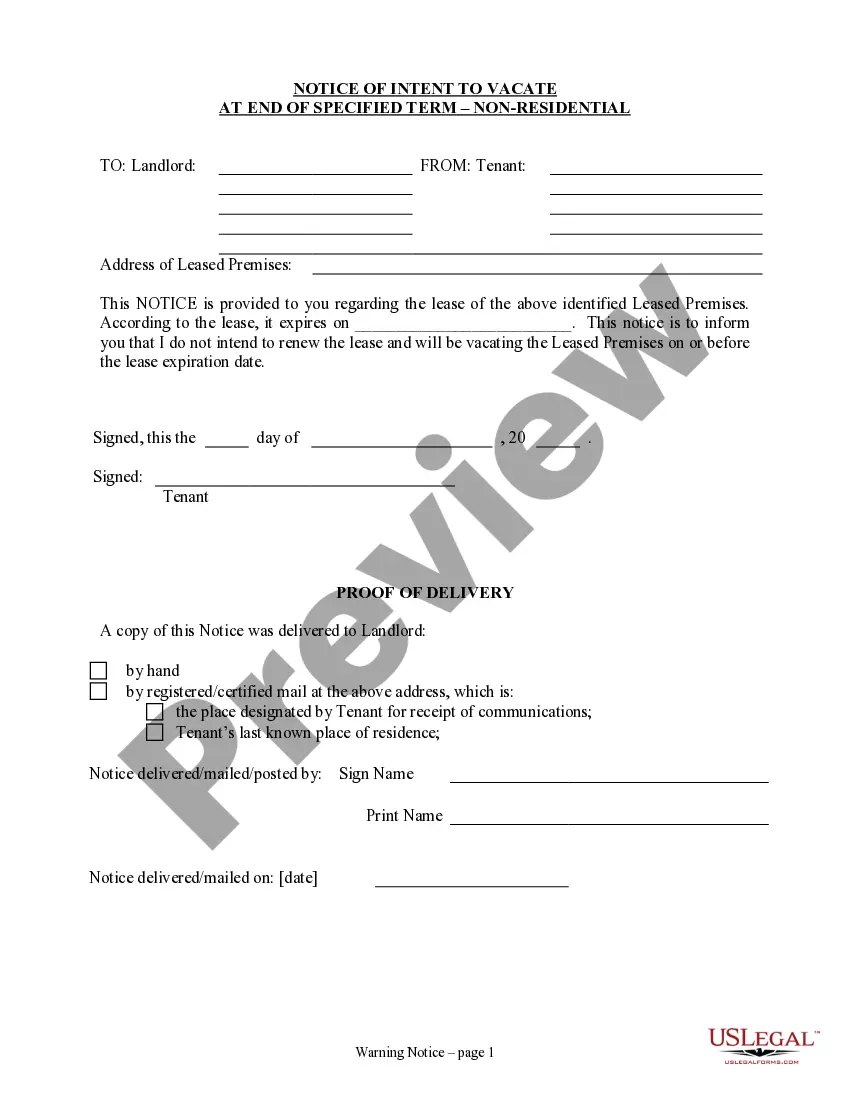

How to fill out Phoenix Arizona Partial Assignment Of Oil And Gas Lease (Producing Lease. Reservation Of Production Payment)?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Phoenix Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment), it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Consequently, if you need the recent version of the Phoenix Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment), you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment):

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Phoenix Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment) and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!