Wayne Michigan Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest) is a legal document used in Wayne County, Michigan, to formalize the transfer of ownership of oil and gas leases by the current leasehold interest holder to a new party. This document is crucial in ensuring that the assignment is legal and binding. Keywords: Wayne Michigan, Ratification of Assignment, Oil and Gas Leases, Owner of Leasehold Interest, Wayne County, Michigan, transfer of ownership, legal document. Types of Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest) in Wayne Michigan: 1. Individual to Individual Assignment: This type involves the transfer of oil and gas leases from one individual owner of a leasehold interest to another individual. This often occurs when the original leaseholder wants to sell, transfer, or assign their lease rights and interests to another party. 2. Company to Individual Assignment: In certain cases, a company or corporation may hold a leasehold interest in oil and gas leases. When such a company decides to transfer its ownership to an individual, a ratification of the assignment is required to ensure legal compliance. 3. Company to Company Assignment: Another common scenario is the transfer of leasehold interest from one company to another. In this case, a ratification of assignment document helps to solidify the transaction, ensuring that the assignee company becomes the lawful owner of the oil and gas leases. 4. Individual to Company Assignment: This type involves the transfer of leasehold interest from an individual to a company. It often occurs when an individual decides to sell or assign their lease rights and interests to a corporate entity for various reasons like financial benefit, streamlining operations, or taking advantage of the company's extensive resources. 5. Multiple Assignees Assignment: Occasionally, there may be multiple individuals or entities involved in the assignment process. This can occur in cases of partnerships, joint ventures, or when multiple parties have an interest in the oil and gas leases. In such instances, a ratification of assignment document will outline the terms and conditions for the transfer of rights among all parties involved, making the arrangement legally binding. Overall, the Wayne Michigan Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest) is a vital document that ensures proper legal compliance and protects the interests of all parties involved in the transfer of ownership of oil and gas leases within Wayne County, Michigan. It helps facilitate smooth transactions and minimizes the potential for disputes or misunderstandings in the future.

Wayne Michigan Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest)

Description

How to fill out Wayne Michigan Ratification Of Assignment Of Oil And Gas Leases (By Owner Of Leasehold Interest)?

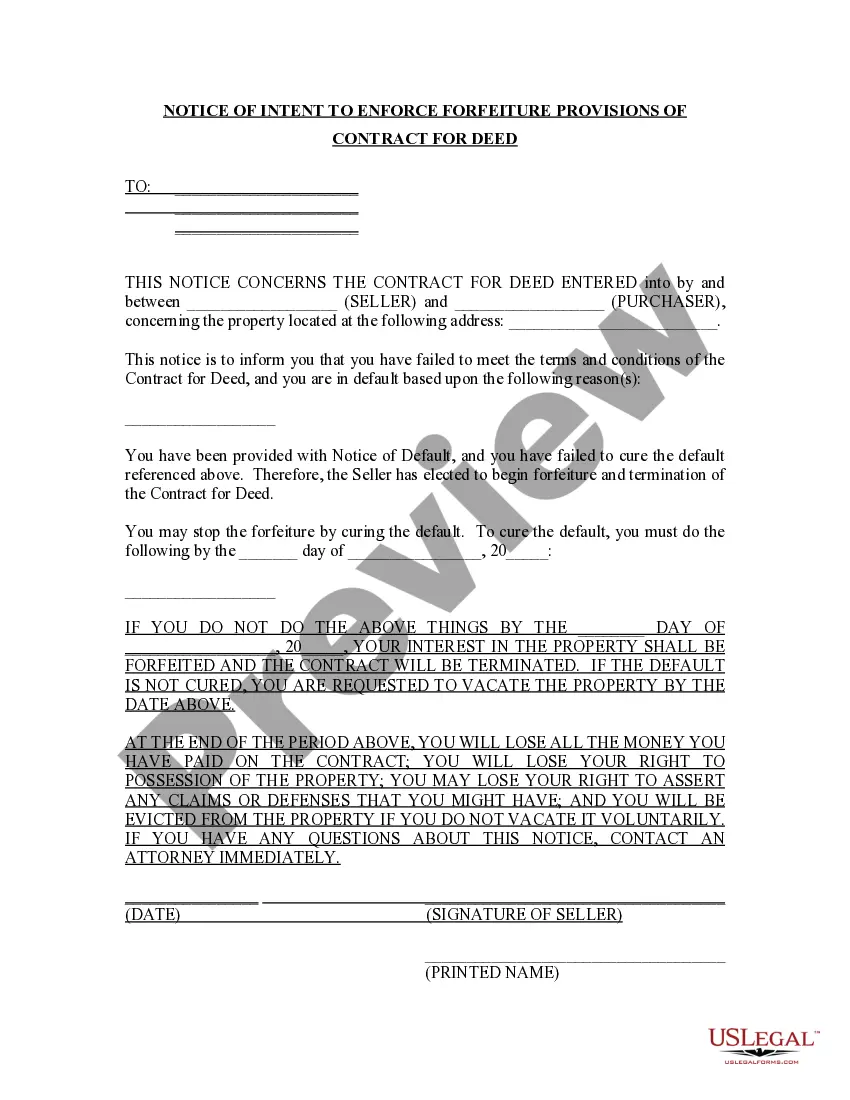

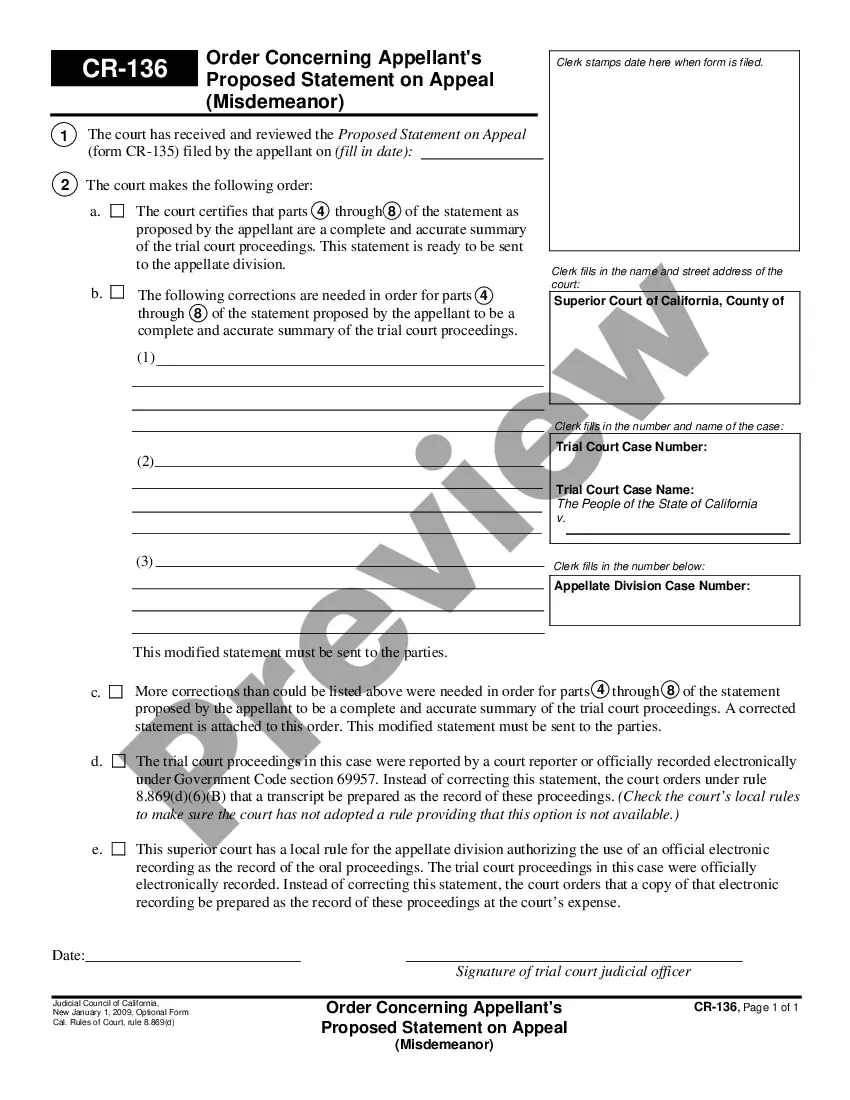

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, locating a Wayne Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest) suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Wayne Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest), here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Wayne Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest):

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Wayne Ratification of Assignment of Oil and Gas Leases (By Owner of Leasehold Interest).

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, according to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The royalty. It is typically expressed as a fraction or a percentage. For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Under Texas law, there is a rule of non-apportionment. It sets out that when the property is subdivided after the lease is already in place on the tract, the royalties are not apportioned but given to the royalty interest owner on whose property the well physically sits. Delay rentals however are apportioned.

The primary term of a federal oil and gas lease is 10 years. The term is extended as long as the lease has at least one well capable of production. Leases do not authorize ground disturbance.

The federal government charges oil and gas companies a royalty on hydrocarbon resources extracted from public lands. The standard Federal royalty payment was 12.5%, or a 1/8th royalty.

The annual rentals required under all oil and gas leases issued since December 22, 1987 is $1.50 per acre (or partial acre) for the first five lease years and $2.00 per acre (or partial acre) thereafter.

A Pugh Clause is meant to prevent a lessee from declaring all lands under an oil and gas lease as being held by production, even if production only occurs on a fraction of the property.

Generally, a pooling clause will allow the leased premises to be combined with other lands to form a drilling unit, wherein proceeds from production anywhere on the drilling unit are allocated according to the percentage of the acreage of each tract divided by the total acreage of the drilling unit.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.