Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. Known for its rich history, iconic landmarks, and bustling urban environment, Philadelphia is home to a diverse population and offers a wide range of cultural, educational, and recreational opportunities. A Philadelphia Pennsylvania Release of Judgment Lien refers to a legal document that releases an individual or entity from the burden of a judgment lien placed on their property or assets in Philadelphia. It allows individuals to clear their property titles and regain control over their assets. This release is typically issued by a court or an authorized entity after the judgment debtor satisfies the judgment amount or fulfills other specified conditions. There are two commonly known types of Philadelphia Pennsylvania Release of Judgment Lien: 1. Voluntary Release of Judgment Lien: This type of release occurs when the judgment creditor voluntarily agrees to release the lien on the judgment debtor's property or assets. It often happens when the judgment debtor fulfills their financial obligations by paying the judgment amount in full or by negotiating an alternative arrangement with the judgment creditor. 2. Court-Ordered Release of Judgment Lien: In some cases, the judgment debtor may petition the court to release the judgment lien based on specific legal grounds, such as evidence of incorrect judgment, improper filing, or expiration of the lien. The court evaluates the merits of the case and may order the release if it finds the judgment lien is unjust or no longer necessary. Releasing a judgment lien in Philadelphia Pennsylvania is a crucial step for individuals or entities seeking to restore their financial stability, regain control over their assets, and ensure a clear title to their property. Consulting with a qualified attorney or legal professional specializing in judgment liens can provide valuable guidance and ensure a smooth and successful release process.

Philadelphia Pennsylvania Release of Judgment Lien

Description

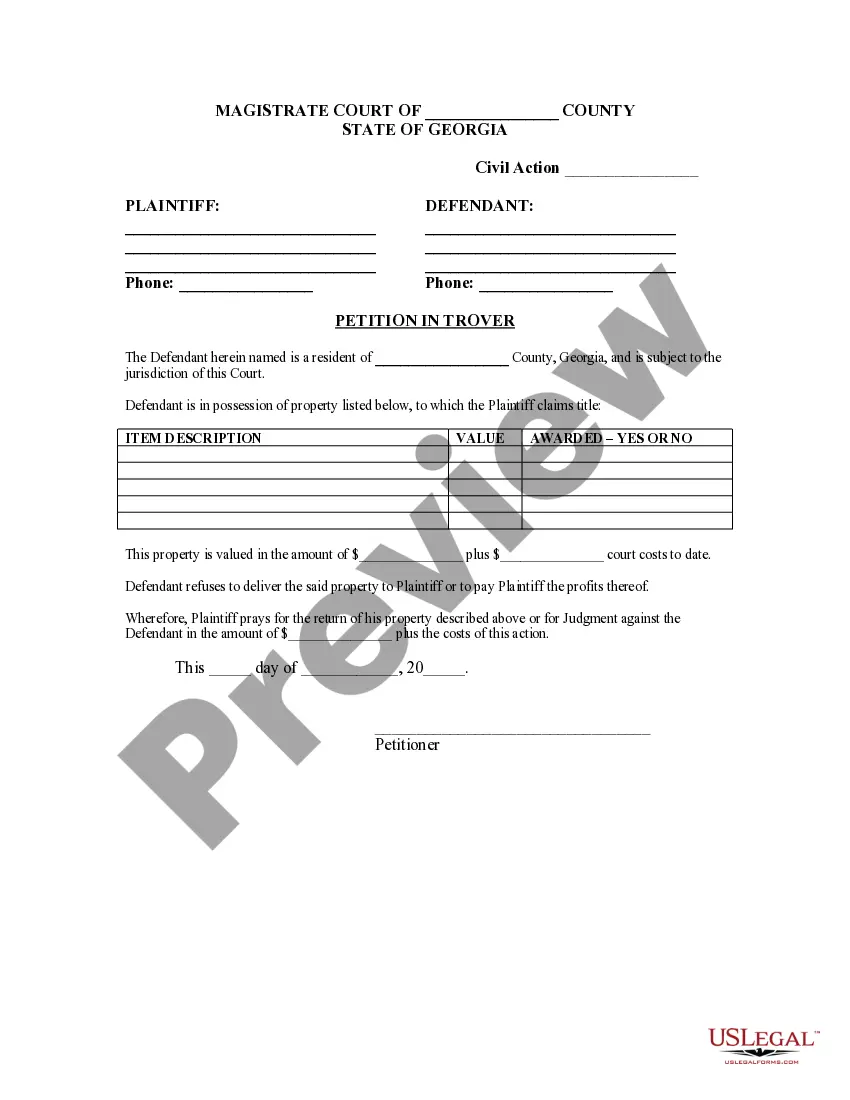

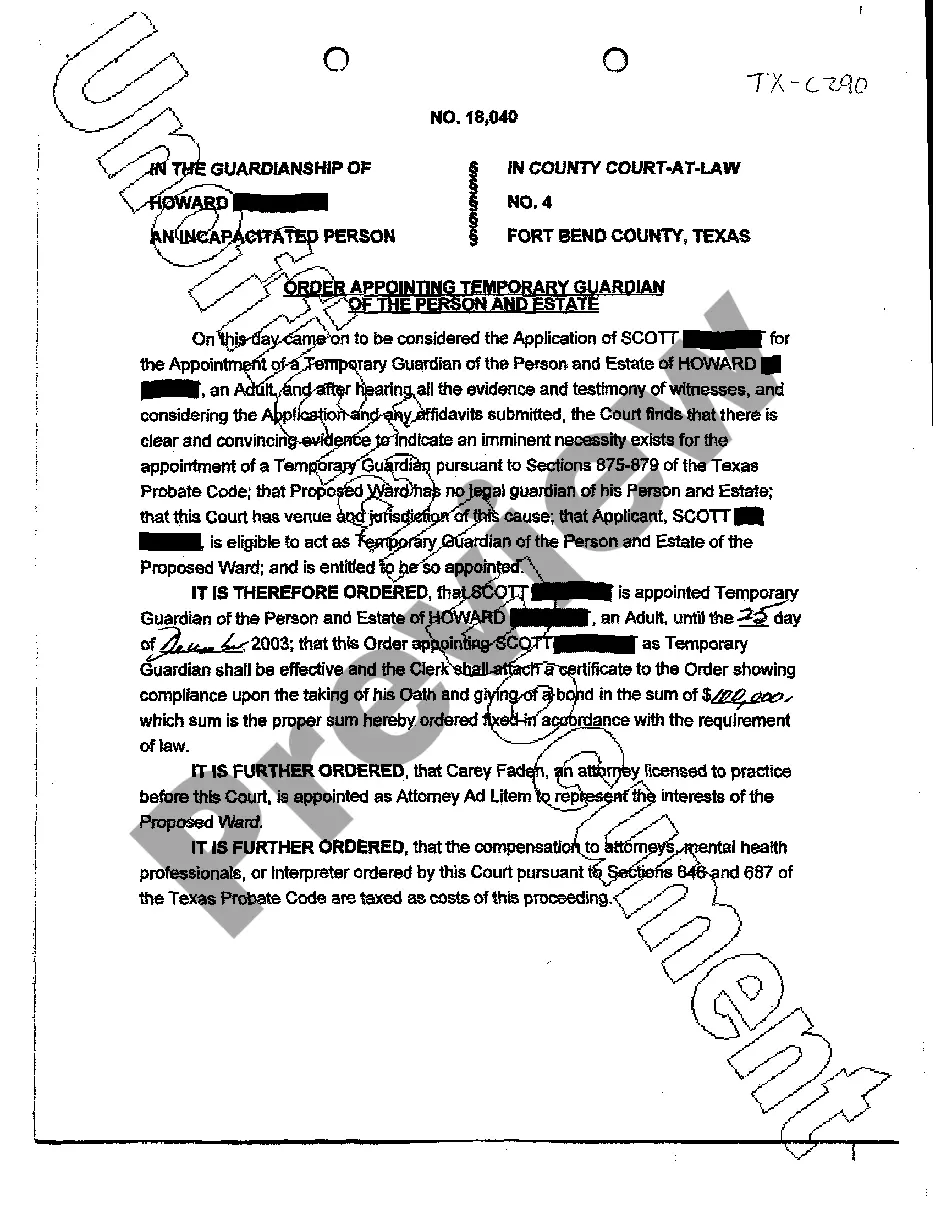

How to fill out Philadelphia Pennsylvania Release Of Judgment Lien?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Philadelphia Release of Judgment Lien, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Philadelphia Release of Judgment Lien from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Philadelphia Release of Judgment Lien:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The quickest way to check for liens in Pennsylvania is to visit the Pennsylvania Centre County official website and look up the lien records available there. In Pennsylvania, liens are public records uploaded on the assessor's website for public access.

What do I do after I pay a judgment? Contact the landlord's lawyer. Show proof that you paid the judgment and ask the lawyer to mark the judgment satisfied. Contact the landlord.File a Petition to Satisfy if the landlord will not sign an Order to Mark Judgment Satisfied.

The Department of Records at City Hall has information on utility liens. You can also search for execution actions involving utility liens at (under search court records click trial division search civil dockets, then search by person name or company name).

Philadox is an online document search system. Use it to: Search deeds and other property records from 1974 to the present. View document information and watermarked copies online.

The quickest way to check for liens in Pennsylvania is to visit the Pennsylvania Centre County official website and look up the lien records available there.

How long does a judgment lien last in Pennsylvania? A judgment lien in Pennsylvania will remain attached to the debtor's property (even if the property changes hands) for five years.

First both the landowner and the municipality can do nothing in which case as a practical matter, the lien continues forever until the property deed is transferred because although the lien continues for 20 years, the lien can easily be revived.

To complete a title search in Pennsylvania, you can hire someone to complete the search, visit the courthouse of the county where the property is located, or visit the county assessor.

Hours of operation: Monday through Friday, 8 a.m. to 4 p.m. You must be in Room 111 by p.m. to have your document recorded that day.

To find out if there's a lien on your property, you can contact the IRS Centralized Lien Unit at (800) 913-6050.