San Diego, California, is a vibrant city located on the Southern California coast known for its beautiful beaches, year-round pleasant climate, and diverse cultural attractions. Offering a mix of stunning natural landscapes and urban settings, San Diego provides a unique and exciting experience for both residents and visitors. A San Diego California Release of Judgment Lien — By Creditor refers to a legal document filed by a creditor to release a judgment lien placed upon a debtor's property in San Diego. This release typically occurs when the debtor has fulfilled their financial obligations or negotiated a settlement, resulting in the removal of the judgment lien. There are several types of San Diego California Release of Judgment Lien — By Creditor, including: 1. Voluntary Release of Judgment Lien: This occurs when the creditor willingly releases the judgment lien due to the debtor's payment or settlement of the debt. By filing this release, the creditor acknowledges that the debt has been satisfied, and the judgment lien is no longer valid. 2. Court-Ordered Release of Judgment Lien: Sometimes, a court may order the release of a judgment lien upon the debtor's request or based on specific legal circumstances. For example, if the judgment was obtained through a mistake or fraud, the court may order the release of the lien. 3. Expiration of Judgment Lien: A judgment lien in San Diego will automatically expire after a certain period if not renewed or enforced. The duration of the lien can vary based on local laws, but typically it may last between five and ten years. Once the judgment lien expires, it is considered released without the need for further action from the creditor. 4. Satisfaction of Judgment: When the debtor satisfies the judgment in full or according to agreed-upon terms, the creditor can file a Satisfaction of Judgment. This document acknowledges the fulfillment of the debt and releases the judgment lien from the debtor's property. In summary, a San Diego California Release of Judgment Lien — By Creditor is an essential legal document used to release a judgment lien placed on a debtor's property in San Diego. Various types of releases, such as voluntary releases, court-ordered releases, expiration of judgment liens, and satisfaction of judgments, can occur, depending on the circumstances of the debt settlement. It is crucial for both creditors and debtors in San Diego to understand the release of judgment lien process to ensure smooth resolution of their financial obligations.

San Diego California Release of Judgment Lien - By Creditor

Description

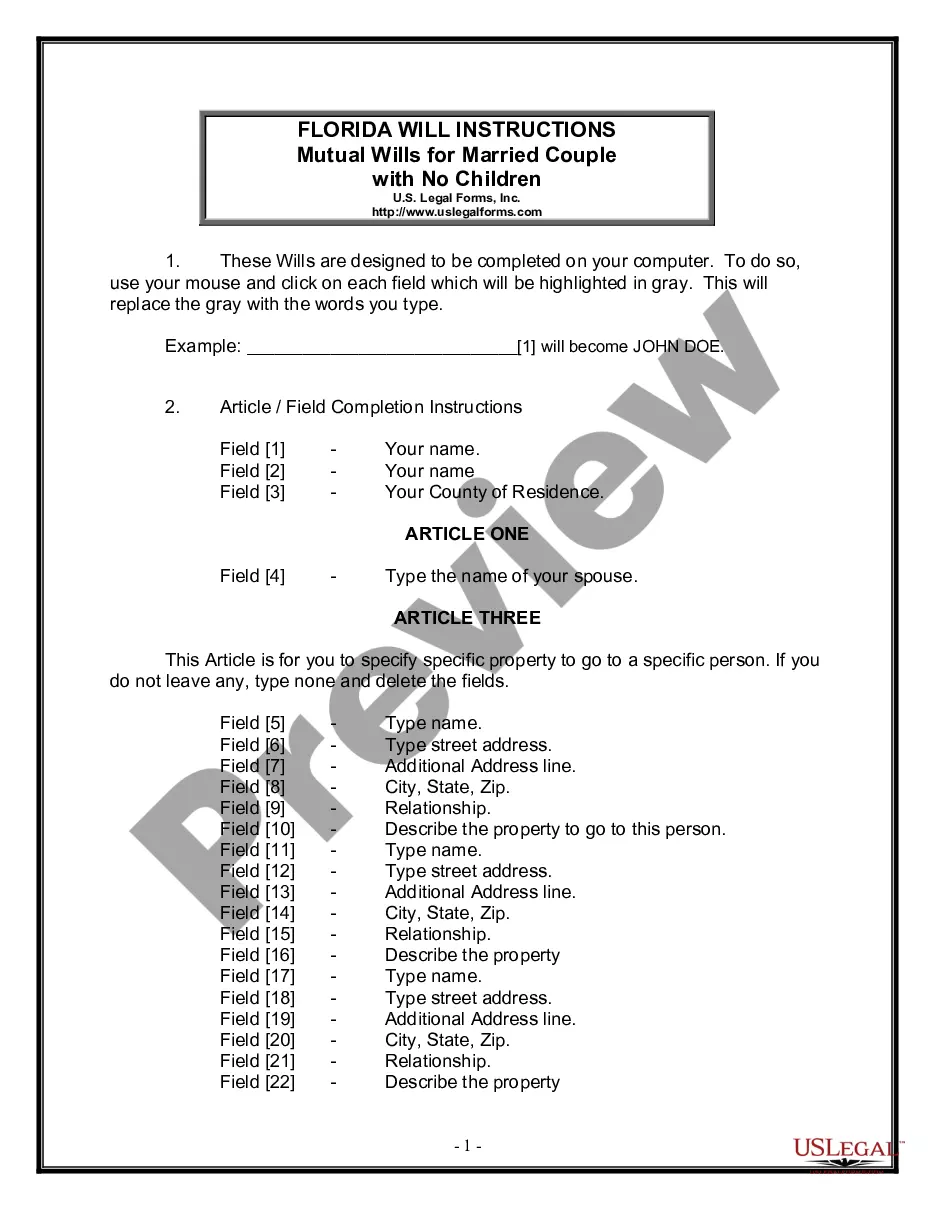

How to fill out San Diego California Release Of Judgment Lien - By Creditor?

Are you looking to quickly draft a legally-binding San Diego Release of Judgment Lien - By Creditor or probably any other form to take control of your personal or business matters? You can go with two options: hire a legal advisor to draft a valid paper for you or create it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you get professionally written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including San Diego Release of Judgment Lien - By Creditor and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the San Diego Release of Judgment Lien - By Creditor is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Diego Release of Judgment Lien - By Creditor template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the paperwork we offer are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

What is the duration of the judgment lien? California Code of Civil Procedure is clear unless satisfied or released, the judgment lien continues until 10 years from the date of entry of the judgment, after which it may be renewed.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

The MC 012 is used to keep a running total of all costs, credits/payments, and interest accrued after. the final Entry of Judgment. Number 1. a) I claim the following costs after Judgment incurred within the last two years. 1) Complete if you filed an Abstract of Judgment (Form EJ-001).

The debtor must get a discharge or release of the abstract of judgment to remove the lien from the home. Contact the judgment creditor shown on the abstract. Arrange to pay the debt in full or negotiate payments. Ask the creditor for a discharge if paying in full.

If the judgment is not renewed, it will not be enforceable any longer and you will not be able to get your money. Once a judgment has been renewed, it cannot be renewed again until at least 5 years later. But make sure it is renewed at least every 10 years or it will expire.

To remove a lien you have to pay the judgment and get the judgment creditor to complete a notarized Acknowledgment of Satisfaction of Judgment (EJ-100). Either party can eFile the form to the court. Then the judgment creditor or you have to record a certified copy of this form in the county where the property is.

Step 1: Complete the Form. The Judicial Council form commonly used in this procedure is:Step 2: Make Copies. Make photocopies of your unsigned Acknowledgment of Satisfaction of Judgment (EJ-100). Step 3: Notarize Your Forms.Step 4: Have your Acknowledgement Served.Step 5: Filing.

Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.