King Washington Ratification of Royalty Commingling Agreement

Description

How to fill out King Washington Ratification Of Royalty Commingling Agreement?

Preparing documents for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate King Ratification of Royalty Commingling Agreement without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid King Ratification of Royalty Commingling Agreement by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the King Ratification of Royalty Commingling Agreement:

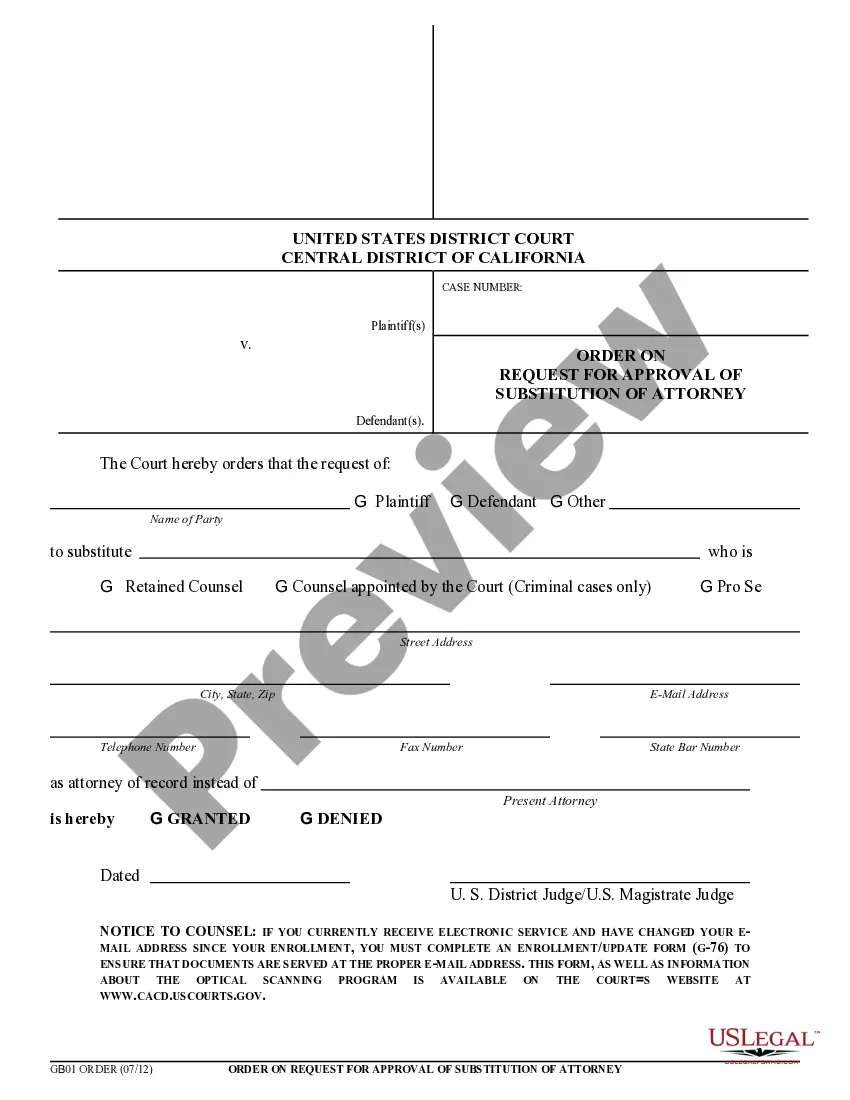

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

Since a NPRI is a real property interest, it is perpetual in nature and can be conveyed or assigned like any other piece of property.

In terms of the oil and gas industry, ratification of a lease is the term for requesting acceptance of an existing lease agreement, with or without changes, from landowners who have purchased parcels to which the original leaseholder gave permission to drill and produce. Leases can last for decades.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

ORRI means overriding royalty interest, or interest in oil and gas produced at the surface, free of the expense of Production, and in addition to the usual land owner's royalty reserved to the lessor in an oil and gas lease.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.