A Maricopa Arizona Subordination Agreement, also known as a Deed of Trust, is a legal document that determines the priority of liens on a property. It is commonly used in real estate transactions when multiple loans or debts are secured by the same property. The agreement allows one lender to subordinate their interest to another, meaning they agree to have their lien or claim on the property take a lower priority than the other creditor. In Maricopa Arizona, there are various types of Subordination Agreements (Deeds of Trust) that may be relevant in different situations: 1. First Lien Subordination Agreement: This type of agreement occurs when a property has an existing first lien (mortgage or other debt) and the borrower wants to obtain a second loan or additional financing secured by the property. The first lien holder consent to subordinate their lien to the new lender, meaning that in the event of foreclosure or sale, the first lien holder will be repaid before the new lender. 2. Second Lien Subordination Agreement: In some cases, a property may already have two existing liens, and the borrower seeks to add a third. The second lien holder, in this case, enters into a subordination agreement with the new lender, agreeing to subordinate their lien to both the first lien and the third lien. This ensures that the first lien holder would be paid first, followed by the third lien holder. 3. Intercreditor Subordination Agreement: This type of subordination agreement is used when there are different types of lenders involved, such as a traditional bank and a mezzanine lender. It sets out the priority of each lender's interest in case of default or foreclosure, and typically specifies the rights and obligations of each party. 4. Partial Subordination Agreement: This agreement is utilized when the borrower seeks to sell or refinance a portion of the property while keeping other portions encumbered by existing liens. It allows for certain parts of the property to be released from the liens, and the remaining portion to maintain its priority. Maricopa Arizona Subordination Agreements (Deeds of Trust) are crucial in determining the order in which creditors will be repaid in case of foreclosure or sale. These agreements protect the interests of both lenders and borrowers and provide clarity on rights and priorities. Proper legal advice and consultation from an attorney or qualified professional are essential when entering into any type of Subordination Agreement in Maricopa Arizona to ensure compliance with state laws and regulations.

Maricopa Arizona Subordination Agreement (Deed of Trust)

Description

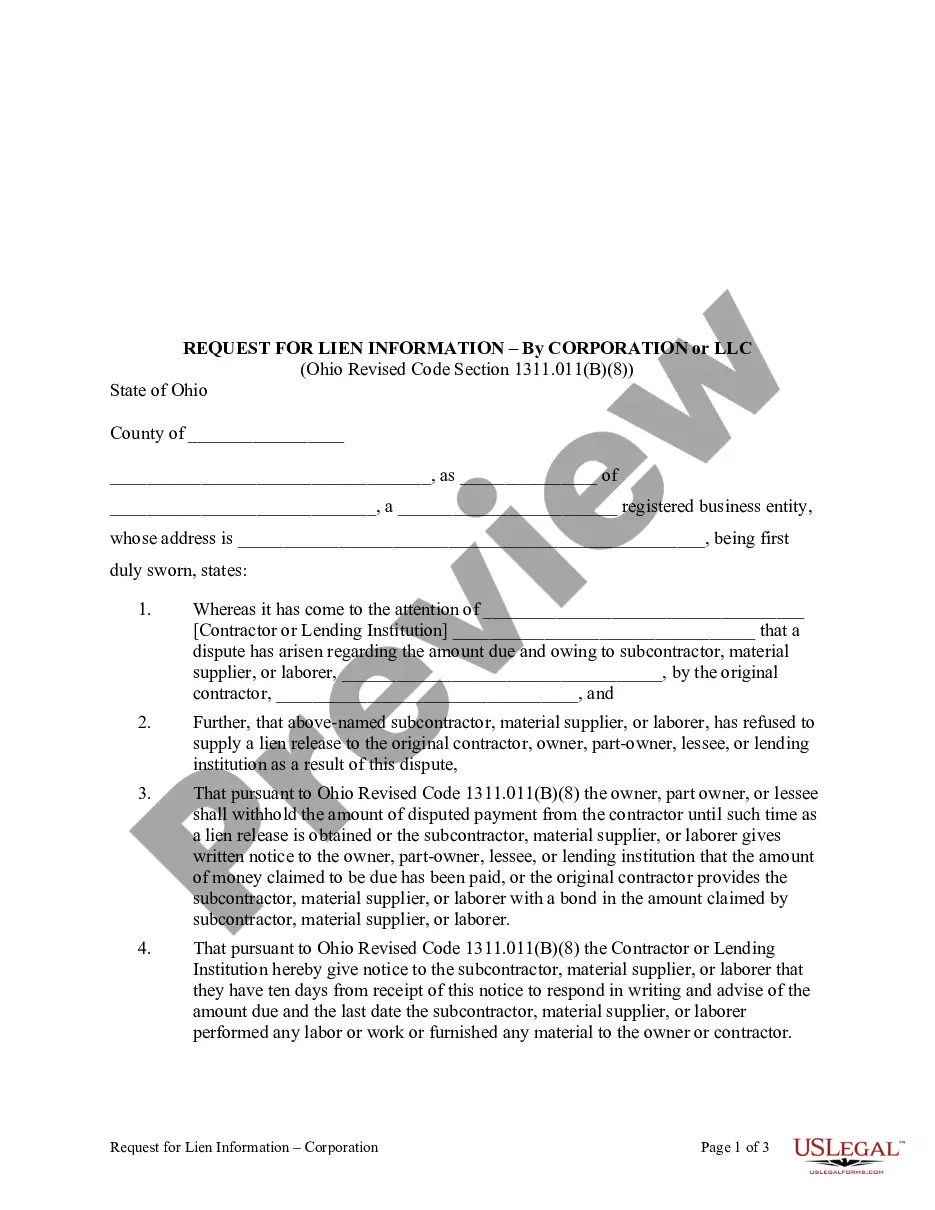

How to fill out Maricopa Arizona Subordination Agreement (Deed Of Trust)?

Do you need to quickly draft a legally-binding Maricopa Subordination Agreement (Deed of Trust) or maybe any other document to manage your own or business affairs? You can go with two options: contact a legal advisor to draft a valid document for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant document templates, including Maricopa Subordination Agreement (Deed of Trust) and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Maricopa Subordination Agreement (Deed of Trust) is adapted to your state's or county's laws.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the document isn’t what you were looking for by using the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Maricopa Subordination Agreement (Deed of Trust) template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!