Middlesex Massachusetts Subordination Agreement, also known as a Deed of Trust, is a legal document used in real estate transactions to establish the priority of liens or interests in a property. This agreement is commonly used when a borrower wishes to refinance their mortgage or obtain a new loan, but there are existing liens on the property that need to be subordinated to the new mortgage. The Middlesex Massachusetts Subordination Agreement outlines the agreement between the parties involved, usually the current lender or lien holder, the borrower, and the new lender. It states that the existing lien holder agrees to subordinate their lien or interest to the new loan, allowing the new lender to have a higher priority lien. Keywords: Middlesex Massachusetts Subordination Agreement, Middlesex Massachusetts Deed of Trust, liens, interests, real estate transactions, refinancing, mortgage, borrower, lender, lien holder, subordination, priority. There are different types of Middlesex Massachusetts Subordination Agreements, named based on their purpose or the parties involved: 1. First Lien Subordination Agreement: This type of agreement is used when there is an existing lien on the property, and the borrower wants to obtain a new loan or mortgage that will take priority over the existing lien. The first lien holder agrees to subordinate their lien to the new loan. 2. Second Lien Subordination Agreement: In this scenario, the borrower has an existing first mortgage or lien on the property and wants to take out a second mortgage. The second lien holder agrees to subordinate their lien to the first mortgage, allowing the first mortgage to maintain its priority status. 3. Intercreditor Subordination Agreement: This agreement is used when there are multiple lenders involved in a real estate transaction, such as a primary lender and a mezzanine lender. This agreement establishes the priority of each lender's lien and outlines the terms of their subordination to each other. Keywords: First Lien Subordination Agreement, Second Lien Subordination Agreement, Intercreditor Subordination Agreement, mezzanine lender, multiple lenders, priority status.

Middlesex Massachusetts Subordination Agreement (Deed of Trust)

Description

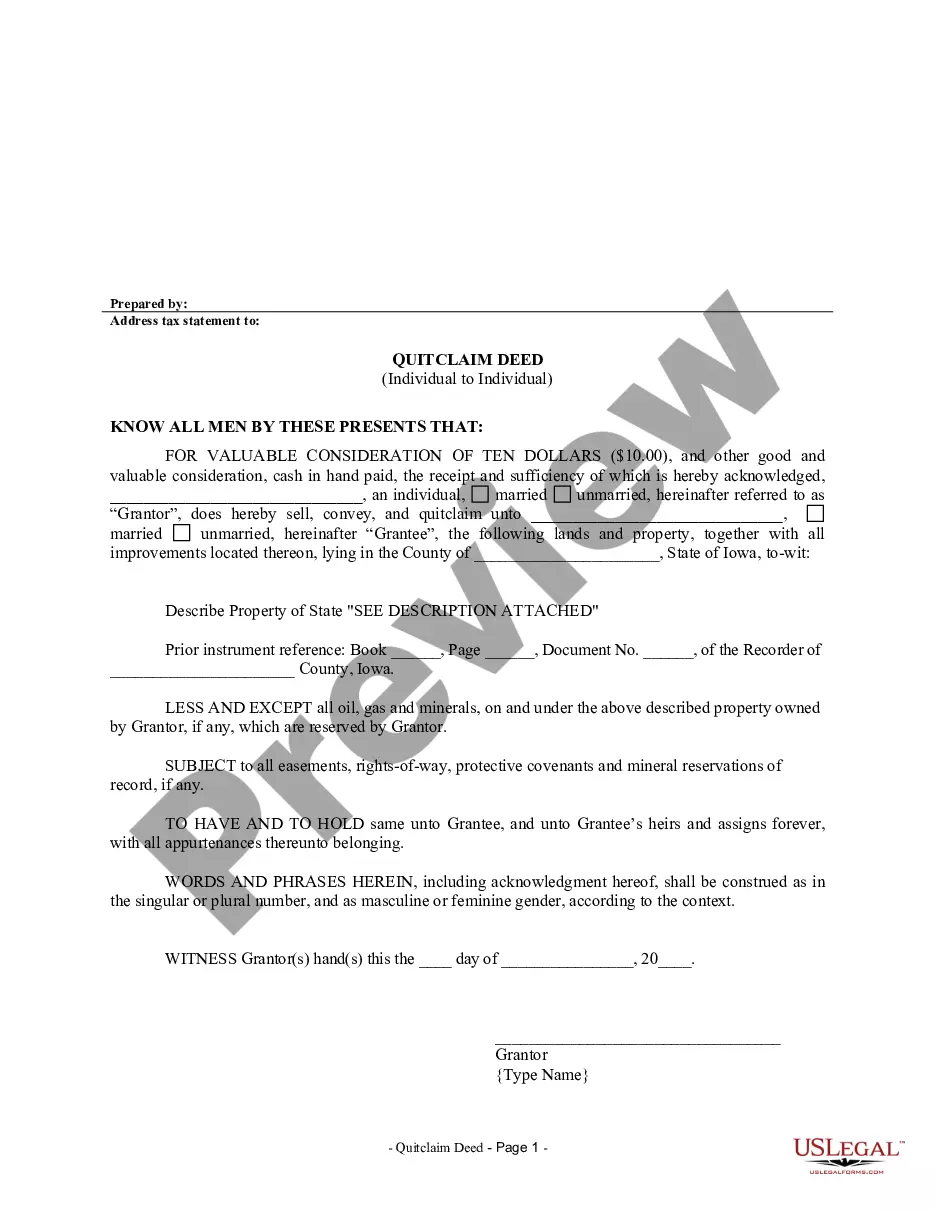

How to fill out Middlesex Massachusetts Subordination Agreement (Deed Of Trust)?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life sphere, finding a Middlesex Subordination Agreement (Deed of Trust) meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Aside from the Middlesex Subordination Agreement (Deed of Trust), here you can get any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Middlesex Subordination Agreement (Deed of Trust):

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Middlesex Subordination Agreement (Deed of Trust).

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

A subordination agreement is a legal document that establishes one debt or claim as ranking behind another in priority for repayment. The priority of debt repayment can become very important if a company or individual defaults on their debt repayment obligations and declares bankruptcy.

The lender might require a subordination agreement to protect its interests should the borrower place additional liens against the property, such as if she were to take out a second mortgage. The "junior" or second debt is referred to as a subordinated debt.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Put simply, a subordination agreement is a legal agreement which establishes one debt as ranking behind another debt in the priority for collecting repayment from a debtor.

Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.