A Montgomery Maryland Subordination Agreement, also known as a Deed of Trust, is a legal document commonly used in real estate transactions to establish the priority of multiple mortgages or liens on a property. This agreement clarifies the order in which these debts must be repaid in the event of foreclosure or sale of the property. In Montgomery County, Maryland, different types of Subordination Agreements (Deeds of Trust) exist, each designed to cater to specific circumstances. These can include: 1. Purchase Money Subordination Agreement: This type of agreement is often used when a buyer requires financing from a lender to purchase a property. The purchase moneylender will hold the first lien on the property, while any additional liens, such as home equity loans, will hold subordinate positions. 2. Refinance Subordination Agreement: In situations where a homeowner decides to refinance their existing mortgage, a refinancing subordination agreement may be necessary. This agreement allows the new lender to obtain a first lien position, while the original mortgage holder will move to a subordinate position. 3. Commercial Subordination Agreement: Commercial properties often involve complex financing arrangements that require multiple lenders. In such cases, a commercial subordination agreement is used to determine the priority of various liens and mortgages against the property. 4. Construction Loan Subordination Agreement: When a property undergoes construction or significant renovations, a construction loan is often obtained. A construction loan subordination agreement determines the priority of the construction loan against existing liens or mortgages on the property. Montgomery Maryland Subordination Agreements (Deeds of Trust) play a crucial role in protecting the rights of lenders and borrowers, ensuring a fair loan repayment process. These agreements provide legal clarity by outlining the precise order in which debts should be settled, which is especially important in cases of foreclosure or property sale. It is essential to consult with a knowledgeable real estate attorney or mortgage professional to draft and understand these agreements accurately, as their provisions can significantly impact the rights and obligations of all parties involved.

Montgomery Maryland Subordination Agreement (Deed of Trust)

Description

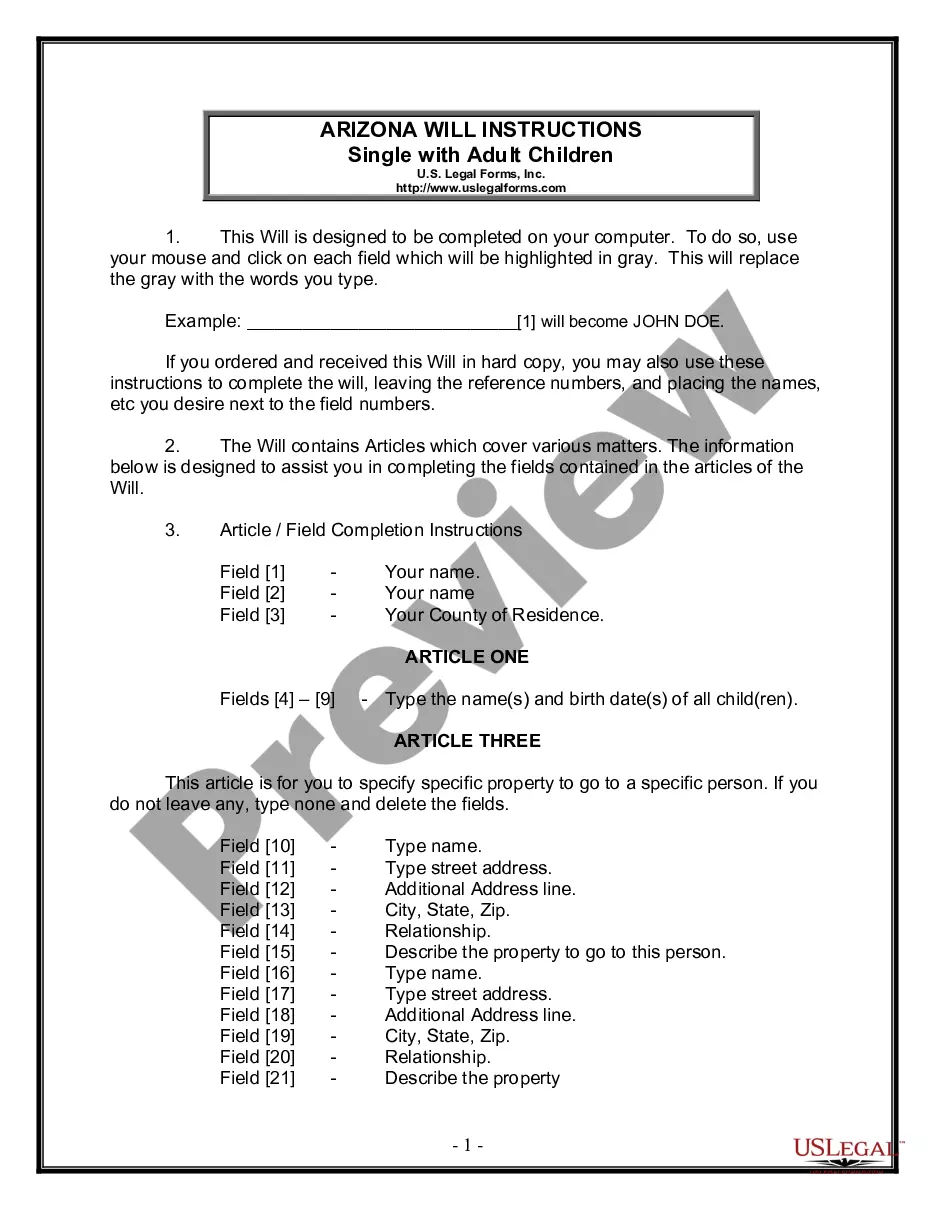

How to fill out Montgomery Maryland Subordination Agreement (Deed Of Trust)?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Montgomery Subordination Agreement (Deed of Trust).

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Montgomery Subordination Agreement (Deed of Trust) will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Montgomery Subordination Agreement (Deed of Trust):

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Montgomery Subordination Agreement (Deed of Trust) on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

A subordination clause is a clause in an agreement which states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.

The lender might require a subordination agreement to protect its interests should the borrower place additional liens against the property, such as if she were to take out a second mortgage. The "junior" or second debt is referred to as a subordinated debt.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.