Orange Florida Subordination Agreement (Deed of Trust) is a legal document that determines the order in which multiple mortgages or liens on a property will be paid off in the event of a default or foreclosure. This agreement is commonly used in real estate transactions in Orange County, Florida, to establish the priority of claims against a property. A subordination agreement is typically entered into when a property owner wants to refinance their existing mortgage or take out a new loan while keeping the original mortgage intact. By signing this agreement, the property owner agrees to subordinate or lower the priority of their existing mortgage, allowing the new lender to have a higher claim on the property in case of default. Keywords: Orange Florida, Subordination Agreement, Deed of Trust, mortgages, liens, foreclosure, real estate transactions, priority, claims, property owner, refinance, existing mortgage, new loan, lender. Types of Orange Florida Subordination Agreement (Deed of Trust): 1. First Lien Subordination Agreement: This type of subordination agreement is used when the property owner has multiple liens or mortgages, and wants to establish a new first lien, which will have the highest priority in case of default. The existing liens or mortgages will be subordinated to the new first lien. 2. Second Lien Subordination Agreement: In situations where the property owner already has a first mortgage but wants to secure a second loan or mortgage, a second lien subordination agreement is used. This agreement establishes that the second lien or mortgage will have a subordinate position to the existing first lien but is still ahead of any subsequent claims. 3. Subordinate Financing Agreement: This type of subordination agreement is utilized when there is a need for additional financing, such as a home equity loan or line of credit. The existing mortgage holder agrees to subordinate their position to the new financing, allowing the borrower to access additional funds secured by the property. 4. Intercreditor Subordination Agreement: An intercreditor subordination agreement is employed when multiple lenders or lien holders are involved, usually in commercial real estate transactions. It establishes the hierarchy of claims and priorities among the different lenders, ensuring they are aware of their respective positions. By utilizing an Orange Florida Subordination Agreement (Deed of Trust), property owners, lenders, and lien holders can clarify their rights and priorities in a property, minimizing potential disputes and creating a clear framework for the resolution of any defaults or foreclosures.

Orange Florida Subordination Agreement (Deed of Trust)

Description

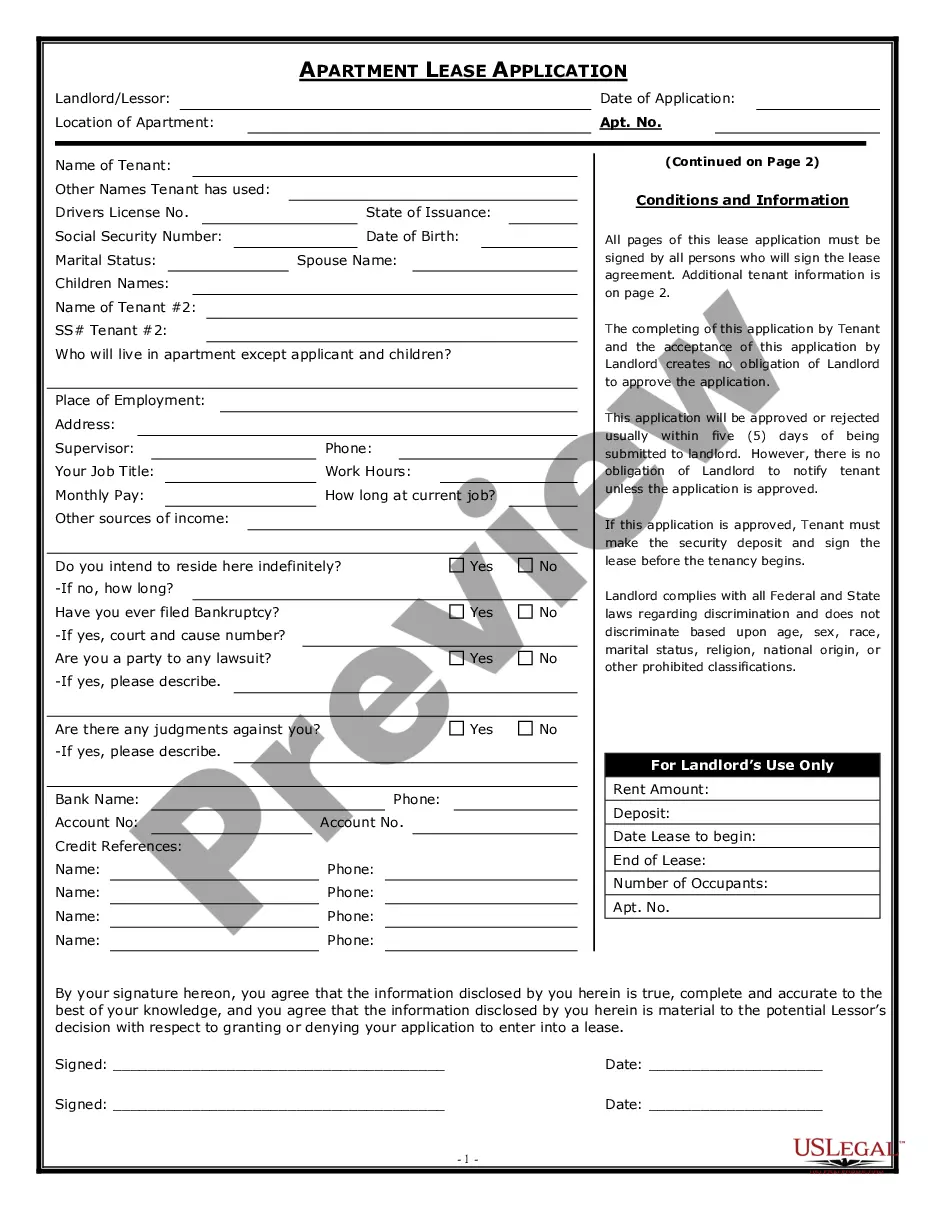

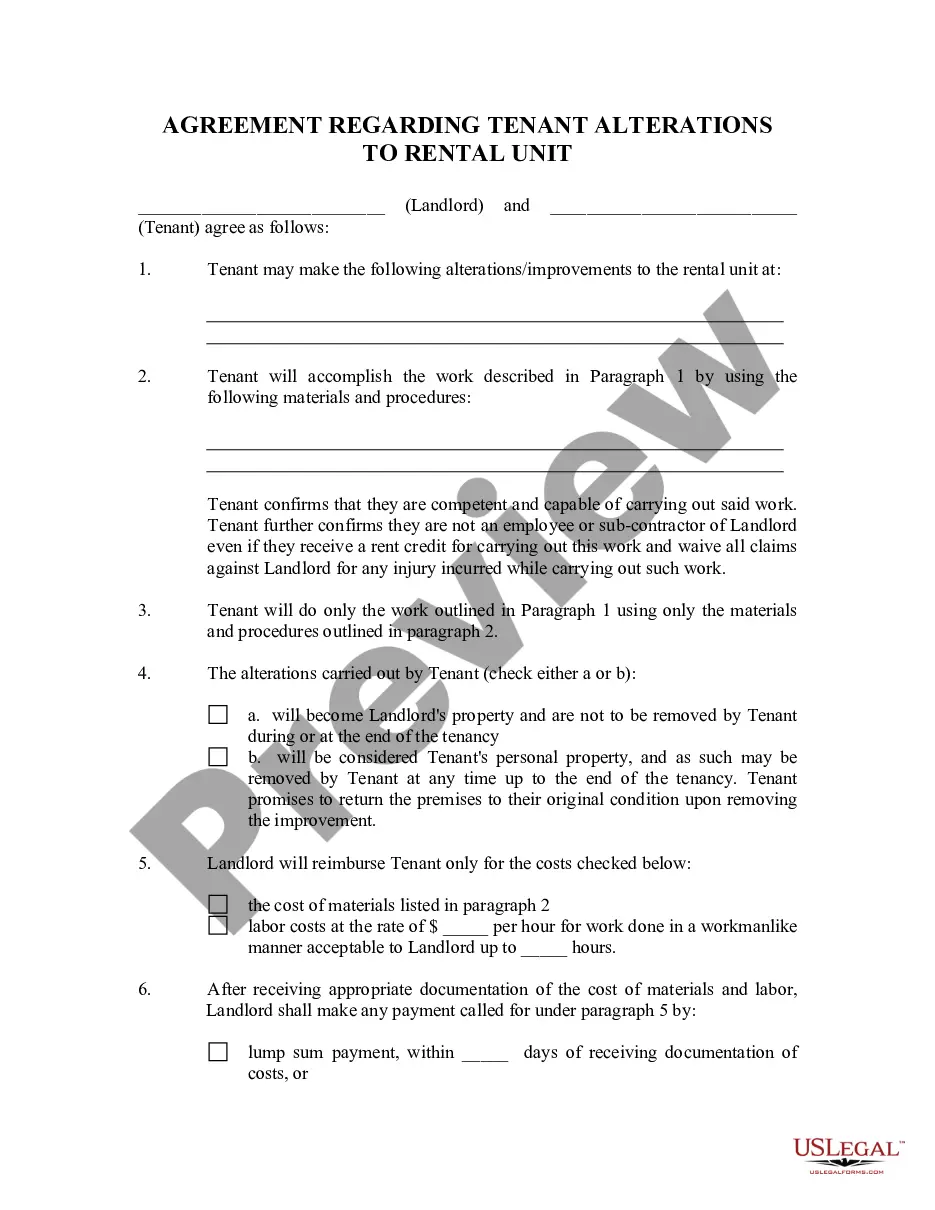

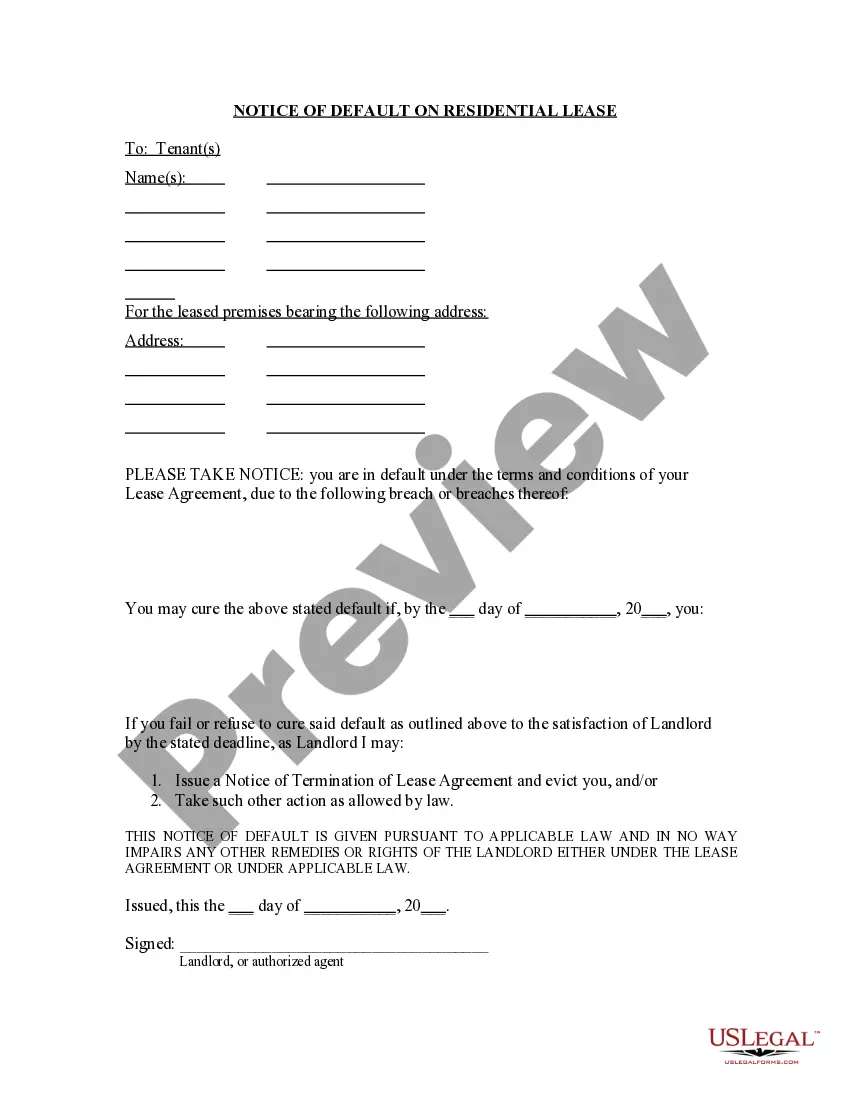

How to fill out Orange Florida Subordination Agreement (Deed Of Trust)?

Whether you plan to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so picking a copy like Orange Subordination Agreement (Deed of Trust) is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Orange Subordination Agreement (Deed of Trust). Follow the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Orange Subordination Agreement (Deed of Trust) in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Often, all the information needed will be available from your mortgage lender and the title company. The process usually takes approximately 25 business days.

A subordination agreement refers to a legal agreement that prioritizes one debt over another for securing repayments from a borrower. The agreement changes the lien position. A lien is a right allowing one party to possess a property of another party who owns a debt until the debt is dissolved.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

A subordination agreement is a legal document that establishes one debt or claim as ranking behind another in priority for repayment. The priority of debt repayment can become very important if a company or individual defaults on their debt repayment obligations and declares bankruptcy.

What Is Mortgage Subordination? Subordination itself is the act of placing something in a lower-ranking position. Mortgage subordination boils down to a ranking system on the liens secured by your home. A lien is a legal agreement that grants the lender a right to repossess the property if you default on the loan.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Subordinate Liens Being "subordinate" means they can be paid only after more senior liens are released. In other words, if the mortgage lender has the primary lien, that lender must be paid in full before any subordinate liens are paid.