Dallas, Texas Subordination of Lien (Deed of Trust/Mortgage to Right of Way) is a legal process that involves prioritizing the rights of certain individuals or entities in terms of property ownership, especially when it comes to right of way access. In Dallas, Texas, there are various types of Subordination of Lien (Deed of Trust/Mortgage to Right of Way) depending on the specific circumstances. Some of these types include: 1. Voluntary Subordination: This occurs when the property owner willingly agrees to subordinate their deed of trust or mortgage to allow for the establishment or continuation of a right of way. This is often done to facilitate the construction, maintenance, or improvement of an access road, utility line, or any other infrastructure necessary for development. 2. Easement Subordination: In certain cases, an easement may already exist on the property, giving another party the right to access or use a portion of it. If a lien, such as a deed of trust or mortgage, exists on the same property, an easement subordination may be necessary to establish the priority of the easement over the lien. 3. Partial Subordination: When only a portion of the property is affected by the right of way, a partial subordination may be utilized. This allows for the lien holder to maintain their priority on the unaffected portion of the property while subordinating the lien to the right of way on the affected portion. 4. Temporary Subordination: In certain cases, a right of way access might be needed temporarily, such as for construction purposes or maintenance activities. Temporary subordination allows for the lien holder to temporarily subordinate their lien to the right of way for a specified period. The process of subordination involves proper documentation and legal procedures. It typically requires the consent and agreement of all parties involved, including the lien holder, property owner, and any party with an interest in the right of way. An attorney or a title company is usually involved in preparing the necessary subordination documents and coordinating the subordination process. By using relevant keywords such as "Dallas, Texas Subordination of Lien," "Deed of Trust/Mortgage to Right of Way," and the specific types mentioned above, it ensures that the content will be more easily discoverable by individuals seeking specific information on subordination processes in Dallas, Texas.

Dallas Texas Subordination of Lien (Deed of Trust/Mortgage to Right of Way)

Description

How to fill out Dallas Texas Subordination Of Lien (Deed Of Trust/Mortgage To Right Of Way)?

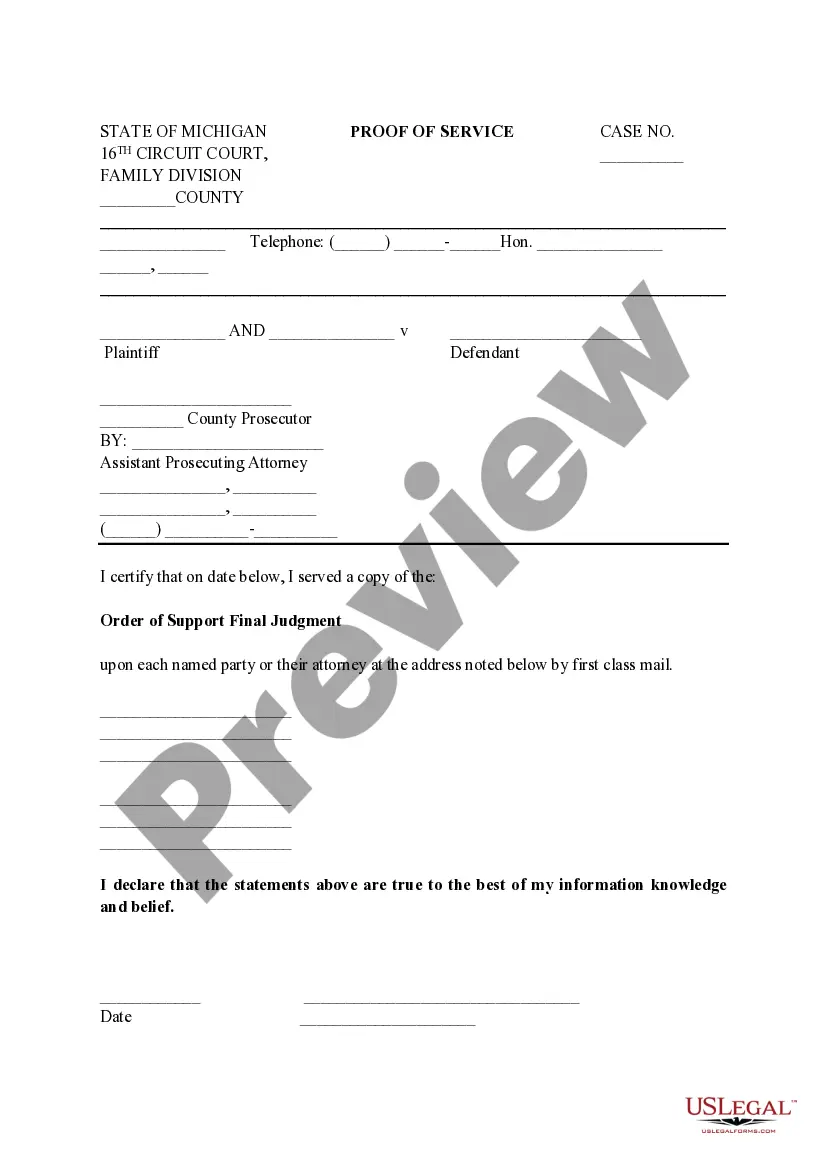

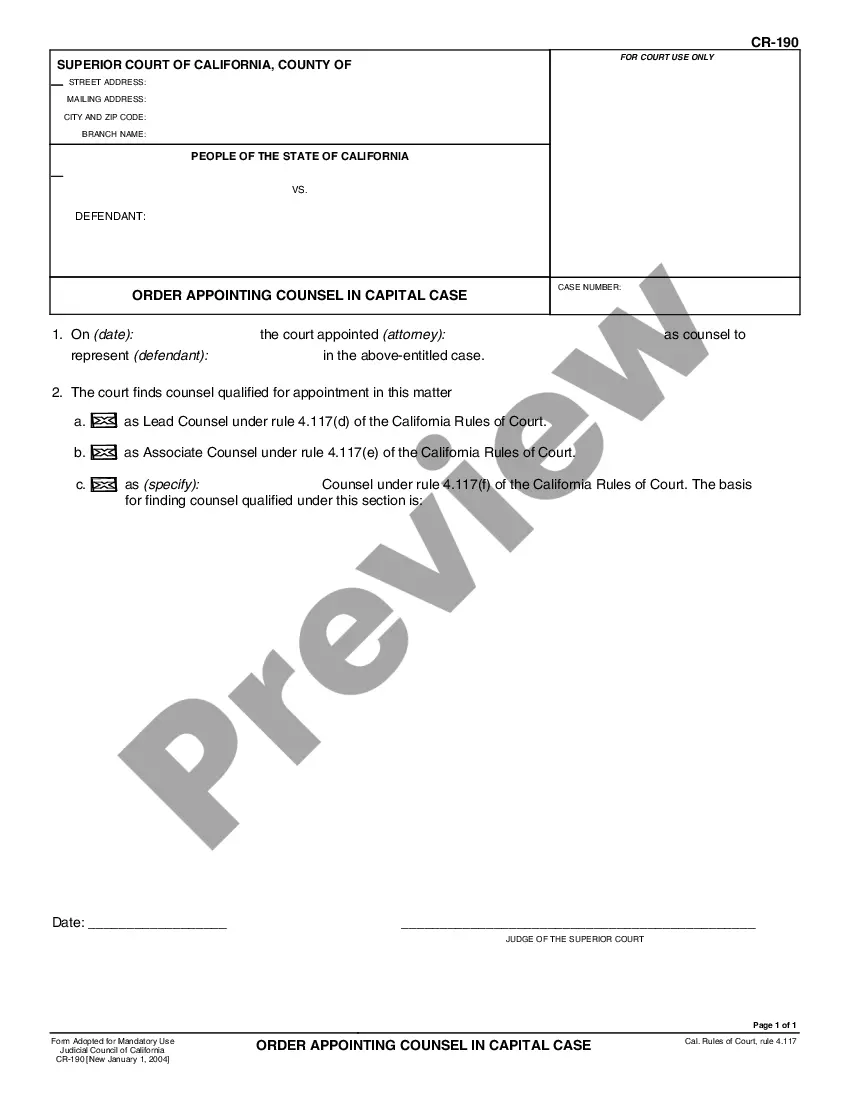

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Dallas Subordination of Lien (Deed of Trust/Mortgage to Right of Way), you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Dallas Subordination of Lien (Deed of Trust/Mortgage to Right of Way) from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Dallas Subordination of Lien (Deed of Trust/Mortgage to Right of Way):

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Put simply, a subordination agreement is a legal agreement which establishes one debt as ranking behind another debt in the priority for collecting repayment from a debtor. It is an arrangement that alters the lien position.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

A subordination clause is a lease provision whereby the tenant subordinates its possessory interest in the leased premises to a third-party lender, usually a bank (the rights of the tenant are thus subject to the rights of the lender).

The Deed of Trust puts a lien on the property to secure the promise. The Warranty Deed transfers the property to the Buyer.

Deed of trust vs. mortgage Deed of trustMortgageWho holds the titleThe trusteeThe borrowerHow a foreclosure happensThe trustee can sell the property without a court orderThe lender must attain a court orderWho's involvedThree entities: The borrower, the lender and the trusteeTwo entities: The borrower and the lender

A subordination clause is a clause in an agreement which states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.