Allegheny Pennsylvania is a county located in the southwestern part of the state. As with any real estate transaction, it is crucial to thoroughly review all relevant information in the Seller's Files to identify any Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits that may impact the property. Such information can provide valuable insights into the property's financial and legal standing, allowing potential buyers to make informed decisions. Liens are legal claims against the property that arise from unpaid debts. Different types of liens may exist in the Seller's Files, such as tax liens, mechanic's liens, or judgment liens. Tax liens can be placed by government agencies for unpaid property taxes, while mechanic's liens are filed by contractors or suppliers for unpaid work or materials. Judgment liens result from court orders satisfying outstanding debts. Mortgages/Deeds of Trust, on the other hand, reflect loans secured by the property as collateral. These documents provide details about the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and potential foreclosure procedures. UCC Statements, short for Uniform Commercial Code statements, demonstrate any secured transactions involving personal property. These filings typically ensure that lenders have a legal claim to specific assets if the borrower defaults on the loan. UCC Statements are particularly relevant for commercial properties or cases involving equipment financing. Bankruptcies can have significant implications for a property transaction. If a bankruptcy filing exists in the Seller's Files, it suggests that the owner or previous owners had financial hardships. Depending on the type of bankruptcy, such as Chapter 7 or Chapter 13, there may be certain restrictions or obligations associated with the property's sale. Lawsuits in the Seller's Files indicate any ongoing or resolved legal disputes concerning the property. These could range from property-related issues, such as boundary disputes or zoning violations, to personal injury claims or contract disagreements. Understanding the nature and outcome of these lawsuits is crucial to assess any potential risks or encumbrances that might affect the property's value or marketability. When analyzing Allegheny Pennsylvania Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits from the Seller's Files, it is vital to review each document thoroughly and consult with legal professionals if necessary. By doing so, prospective buyers can make informed decisions while mitigating any potential risks tied to the property's financial or legal history.

Allegheny Pennsylvania Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

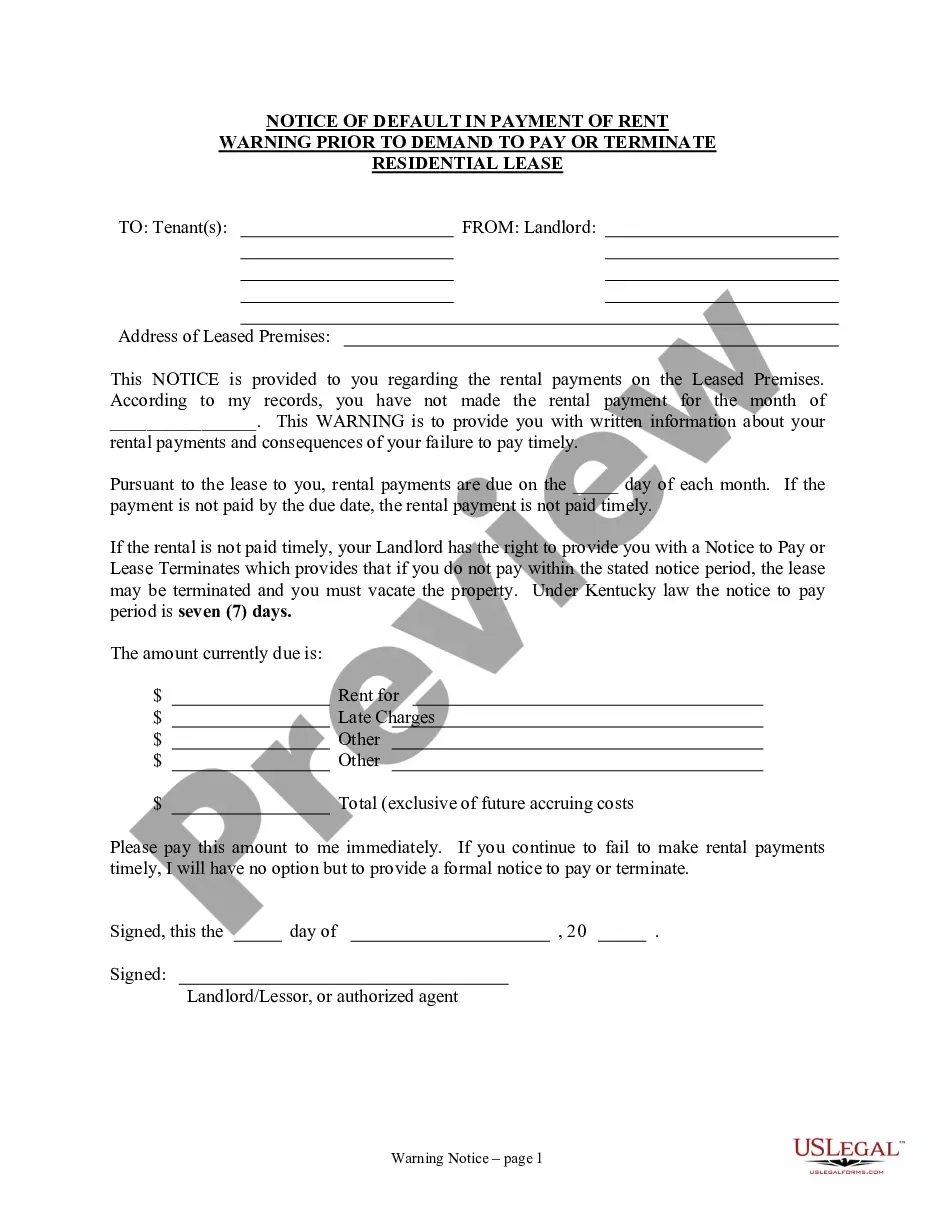

Description

How to fill out Allegheny Pennsylvania Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

Draftwing paperwork, like Allegheny Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files, to manage your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for various cases and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Allegheny Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before downloading Allegheny Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files:

- Make sure that your form is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Allegheny Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our service and download the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!