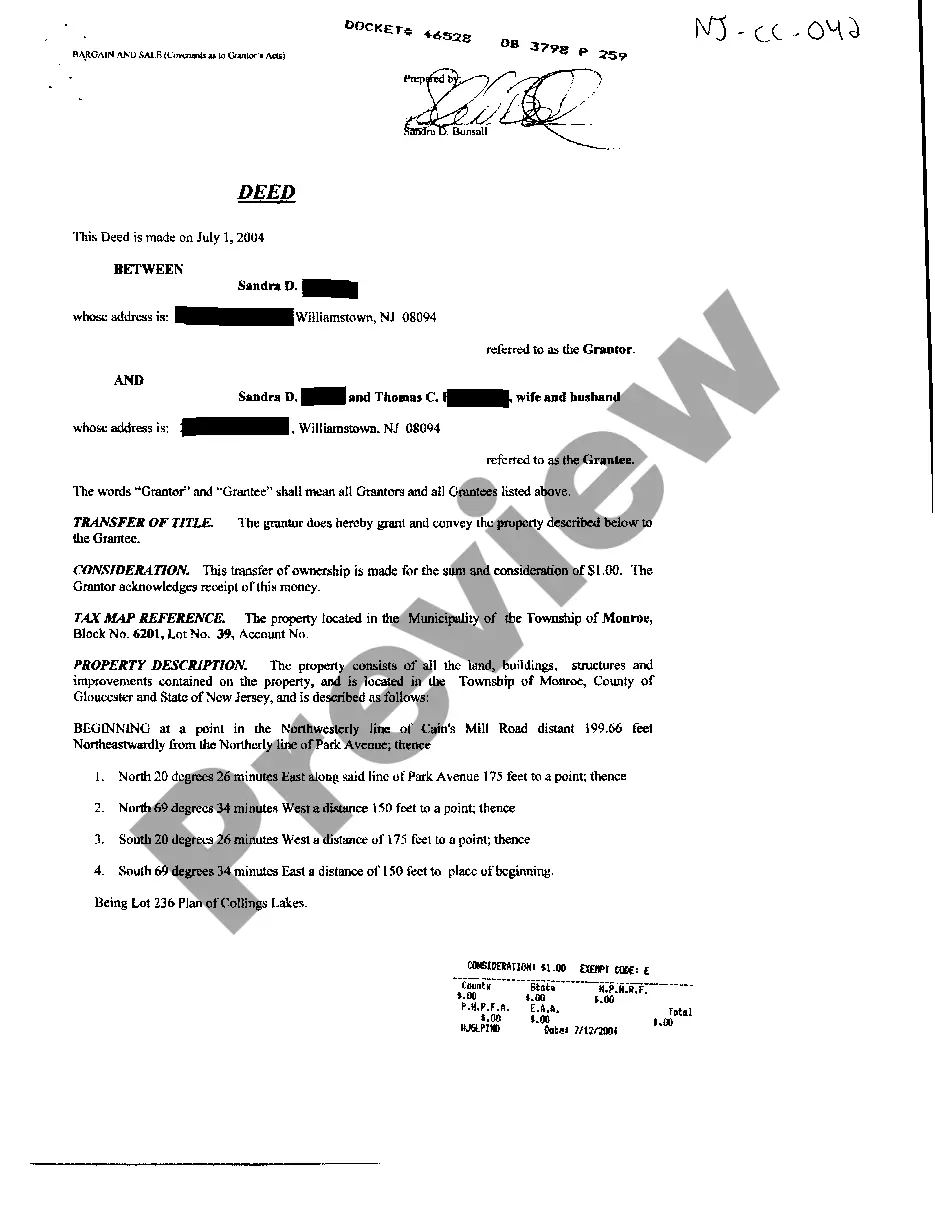

Lima, Arizona is a city located in Pima County, Arizona. When examining the seller's files, there are several types of legal documents and financial records that may be present, including Lima Arizona Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits. Lima Arizona Liens: — Property Liens: These are legal claims placed on a property by a creditor to secure repayment of debt. — Mechanic's Liens: Filed by construction professionals or contractors, these liens secure payment for labor or materials used in property improvement projects. Mortgages/Deeds of Trust: — Mortgage: A legal agreement between a borrower and a lender that allows the lender to take possession of the property if the borrower fails to make mortgage payments. — Deed of Trust: Similar to a mortgage, this document places a property as collateral for the loan. In case of default, a trustee handles the foreclosure process. UCC Statements: — UCC-1 Financing Statements: Filed by a lender to establish their security interest in personal property owned by a debtor. — UCC-3 Amendments: Modified or updated UCC-1 Financing Statements. Bankruptcies: — Chapter 7 Bankruptcy: Also known as "liquidation bankruptcy," it involves the sale of the debtor's non-exempt assets to repay creditors. — Chapter 11 Bankruptcy: Primarily used by businesses, it allows them to reorganize their debts and continue operations. — Chapter 13 Bankruptcy: Enables individuals with a regular source of income to create a repayment plan to settle their debts. Lawsuits: — Civil Lawsuits: Legal disputes between individuals, businesses, or other parties seeking monetary damages or other forms of relief. — Small Claims Lawsuits: Handled in a specialized court, these cases involve individuals seeking relatively low amounts of money (typically under a certain threshold) for damages or other claims. When reviewing the seller's files, it is crucial to analyze these documents thoroughly to understand any potential financial encumbrances, legal claims, or liabilities associated with the property. Seeking professional advice from a real estate attorney or title company is strongly recommended ensuring a clear understanding of the property's legal and financial status.

Pima Arizona Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Pima Arizona Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

Preparing documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Pima Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Pima Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Pima Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

A purchase money security interest (PMSI) is an exception to the first-in-time rule. It gives secured creditors who meet its requirements a special advantage to jump ahead in line of other creditors with respect to certain collateral.

Summary. The Uniform Commercial Code (UCC) is a comprehensive set of laws governing all commercial transactions in the United States. It is not a federal law, but a uniformly adopted state law.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

A UCC filing creates a lien against the collateral a borrower pledges for a business loan. The uniform commercial code is a set of rules governing commercial transactions. When a business owner receives financing secured by collateral, a lender can file a UCC lien against the assets pledged by the business owner.

A UCC filing is a legal statement that a lender would file when you take out a business loan that requires you to put up some or all of your business assets as collateral. A UCC filing gives the lender the right to claim those assets if you default on your payments.

1 filing is a legal form that a creditor files to secure its interest in a borrower's property or assets used as collateral for a loan. The filing serves as a public notice that the creditor has the right to take possession of the assets as repayment on the underlying debt.

UCC stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

A UCC financing statement also called a UCC-1 financing statement or a UCC-1 filing is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

The Uniform Commercial Code allows a creditor, typically a financial institution or lender, to notify other creditors about a debtor's assets used as collateral for a secured transaction by filing a public notice (financing statement) with a particular filing office.