King Washington Division Orders are legal documents that outline the terms, conditions, and obligations between mineral owners and oil and gas operators. These orders establish the ownership rights and revenue allocation for oil and gas production in a specific geographical area. The King Washington Division Orders typically include key information such as the property description, lease name, effective date, and the names of both the mineral owners and the operators involved. They also provide the legal description of the land where the oil and gas production is taking place. There are different types of King Washington Division Orders, based on various factors such as the nature of the ownership, the type of mineral agreement, and the specific regulations in place. Some common types include: 1. Standard King Washington Division Orders: These are the most common type and are used when the operators and mineral owners agree to the terms and conditions set forth in the standard order. It establishes the percentage of interest each owner has in the production revenue. 2. Modified King Washington Division Orders: These orders are used when the parties involved negotiate specific modifications or alterations to the standard order. These modifications can include changes in revenue allocation, deductions, or additional clauses to protect the interests of the mineral owners. 3. Shut-in Royalty King Washington Division Orders: These orders come into play when the oil and gas production from a particular well is temporarily halted, often due to technical issues, market conditions, or force majeure events. They outline the payment obligations and terms during the shut-in period. 4. Unitization King Washington Division Orders: These orders are used when multiple tracts of land are combined to form a production unit in order to improve operational efficiency and maximize resource recovery. Unitization orders address the allocation of production and revenue among the participating owners. In summary, King Washington Division Orders are crucial legal documents that establish the rights, responsibilities, and revenue allocation for oil and gas production. They provide clarity and transparency for all parties involved and ensure fair distribution of proceeds from the production activities.

King Washington Division Orders

Description

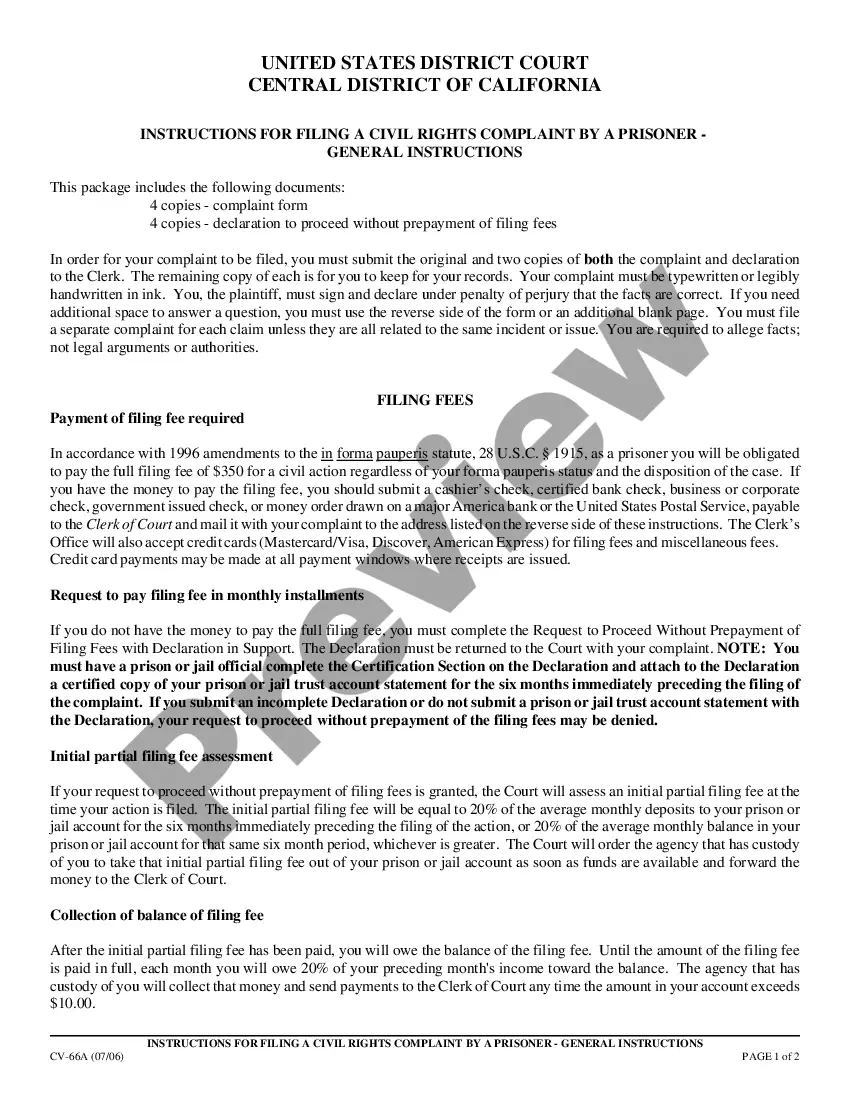

How to fill out King Washington Division Orders?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like King Division Orders is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the King Division Orders. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the King Division Orders in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

To estimate mineral rights value for producing properties, take the average of your last 3 months of royalty income. Once you have a monthly average, plug it into the mineral rights calculator below. You can expect to sell mineral rights for around 4 years to 6 years times the average monthly income you receive.

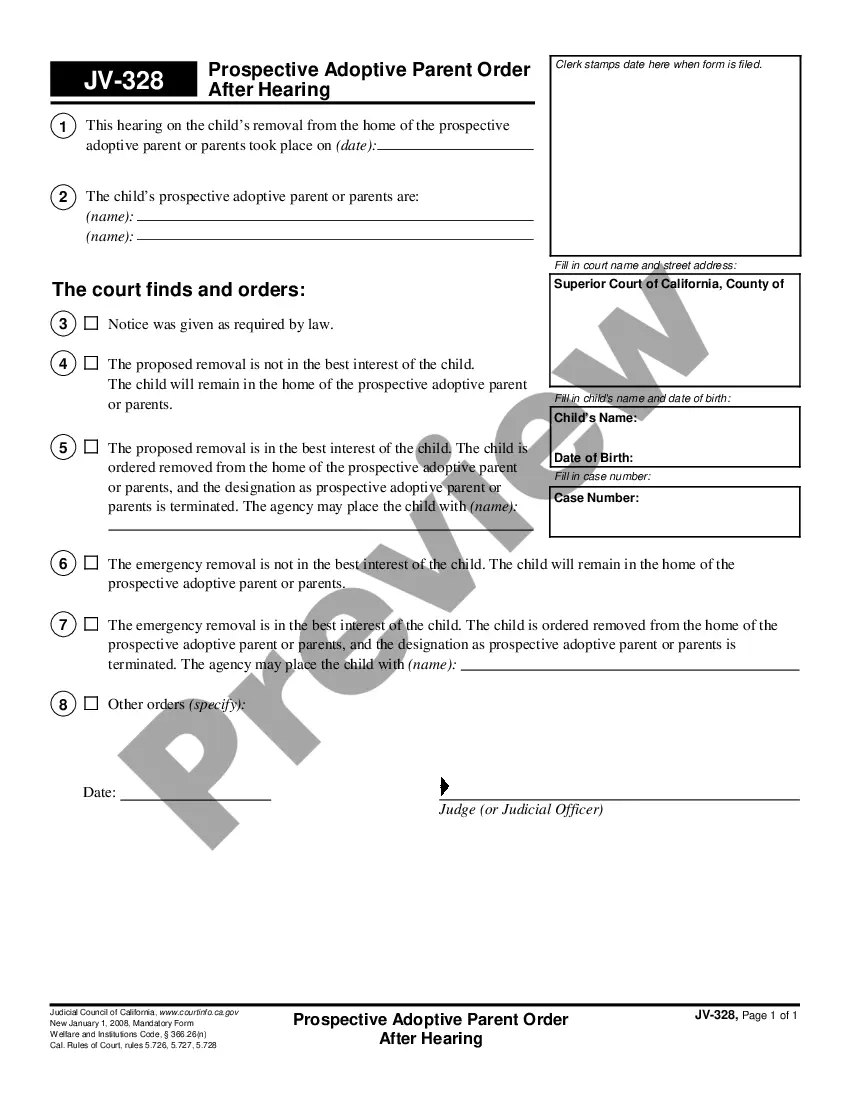

The Division Order is a document whereby the revenue distributor (either the Operator or the 1st Purchaser) and the recipient (the royalty owner) agree on the exact decimal interest (Net Revenue Interest or NRI) owned within a well, lease, production unit, or field-wide unit.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

The royalty payment may range from 12.525 percent. The landowner can also sell options on the right to buy mineral rights and profit even if the options are not exercised.

Royalties are calculated as a percentage of the revenue from the minerals extracted from your property. For example, if oil is selling for $60 per barrel and the you negotiated a 1/16th royalty, you would receive $3.75 for every barrel of oil recovered from your land.

In Texas, courts have held that division orders are executed without consideration, but that they are an enforceable agreement until they are revoked. A division order can be revoked at any time by either party, after which it has no further effect.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.