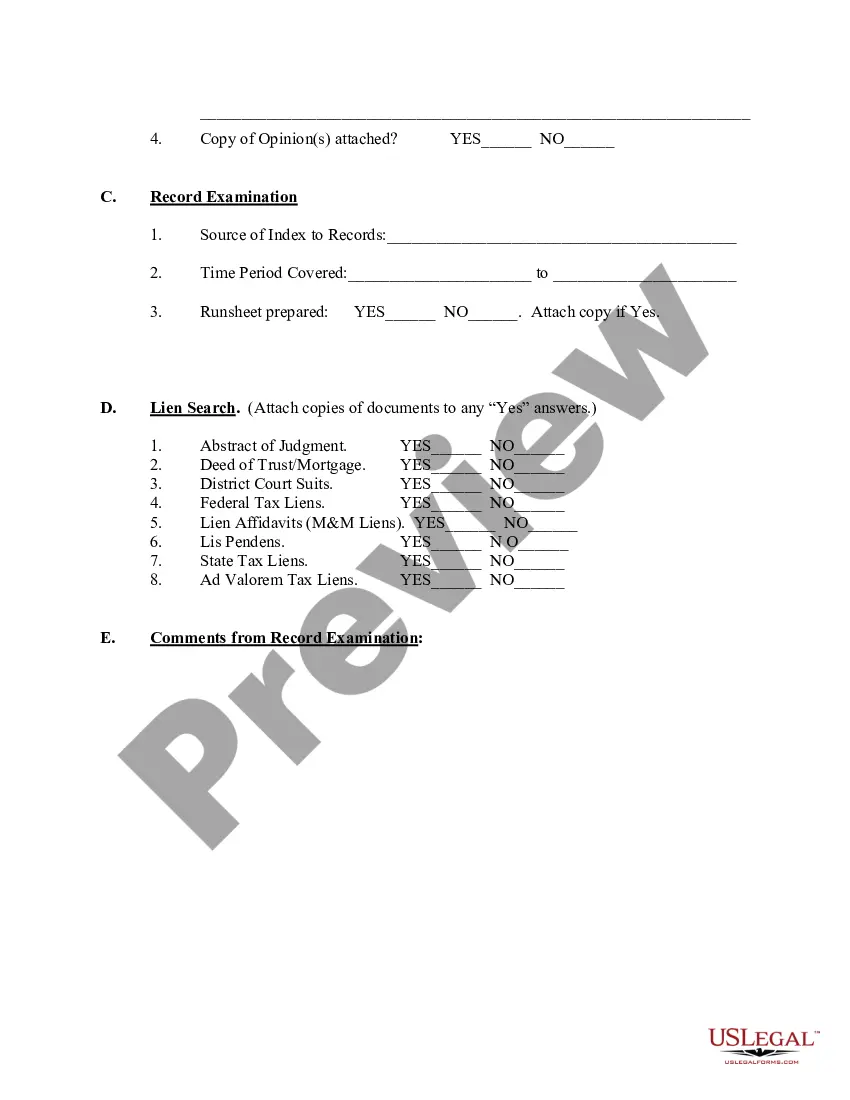

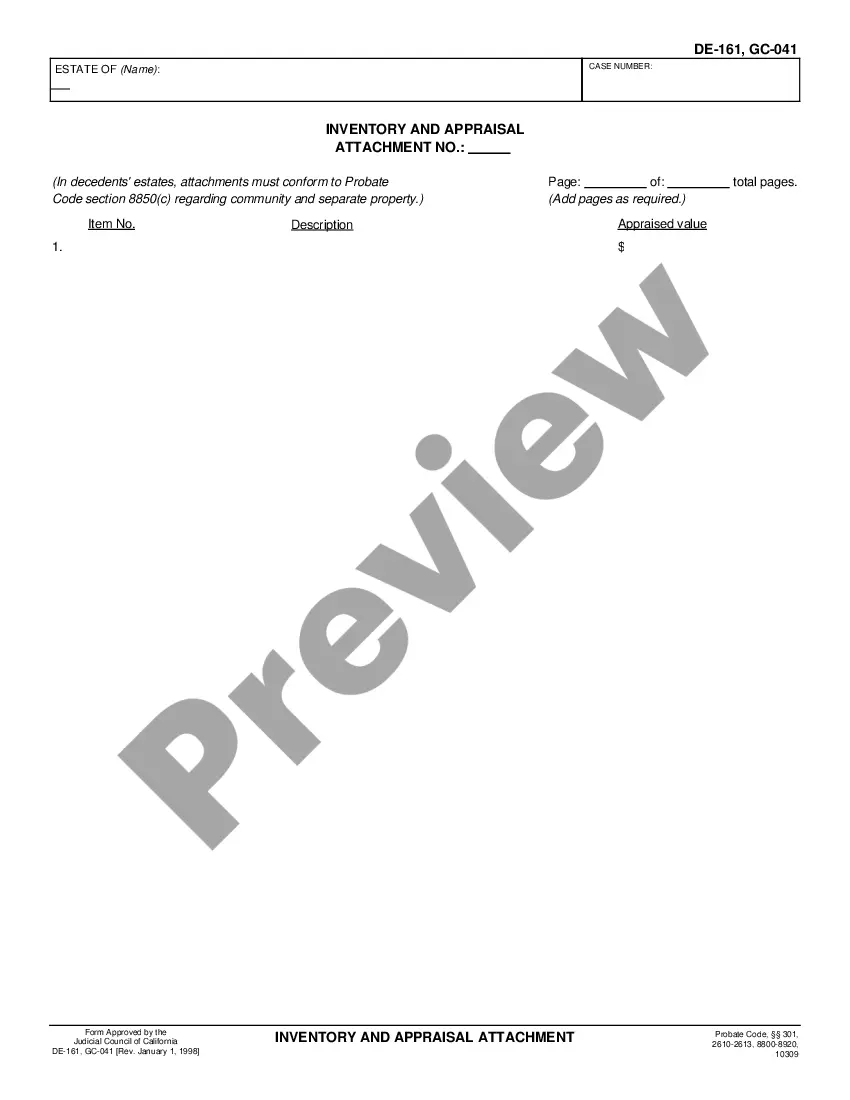

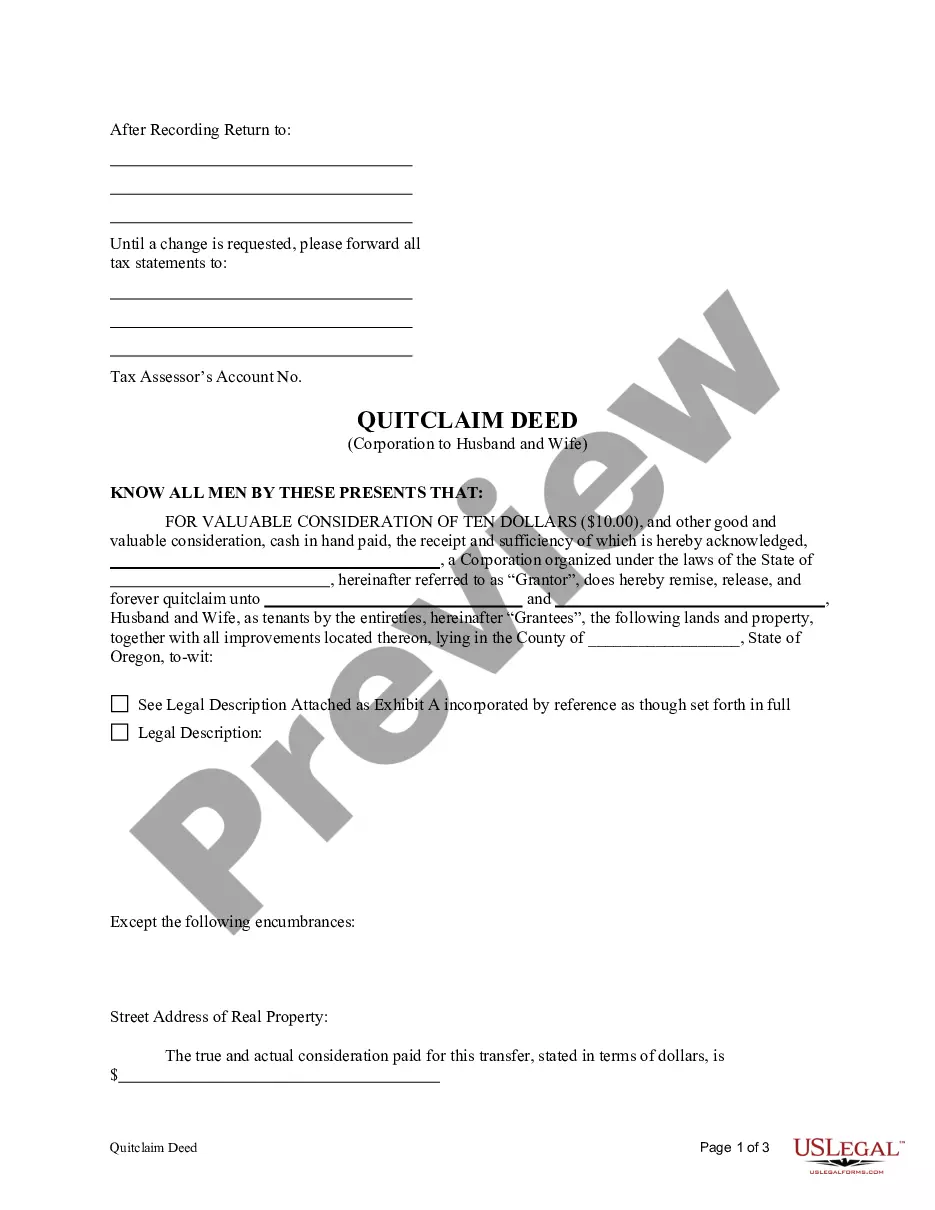

Houston, Texas Due Diligence Field Review and Checklist is a comprehensive evaluation process utilized in real estate transactions and property development projects in Houston, Texas. This review and checklist aim to ensure that all necessary information is gathered, analyzed, and considered before making important investment decisions. A primary objective of the Houston Due Diligence Field Review and Checklist is to minimize risks associated with property investments. It involves an in-depth investigation of various aspects such as legal, environmental, financial, and physical conditions of a property. By conducting this review, potential investors or developers can make informed decisions and mitigate any potential issues that may arise later. The Houston Due Diligence Field Review encompasses several key areas which may include: 1. Legal Due Diligence: This involves examining property documents, lease agreements, title deeds, liens, encumbrances, and other legal contracts related to the property. This ensures the property's legal status, ownership, and any potential legal complications are thoroughly understood. 2. Environmental Due Diligence: Houston's checklist also includes environmental assessment and analysis. This aims to identify any potential risks or liability associated with historical contamination, hazardous materials, or any environmental restrictions that may affect the property's development or value. 3. Financial Due Diligence: The financial aspect reviews the property's financial statements, cash flows, leases, and rental agreements. This helps assess the property's income potential, expenses, and profitability. It is important to understand the financial viability of the property and potential cash flow risks before investing. 4. Physical Due Diligence: This stage involves a physical inspection of the property to assess its current condition, construction quality, structural issues, maintenance requirements, and any potential operational constraints. Additional types of Houston Texas Due Diligence Field Review and Checklist may include: — Zoning Due Diligence: Involves assessing regulatory land-use restrictions, zoning ordinances, building codes, and applicable permits required for the property. This ensures compliance with local regulations and determines the property's development potential. — Market and Economic Due Diligence: This type of due diligence examines the local market conditions, demographic trends, competition, economic indicators, and growth projections. It helps determine the property's market value and potential demand for its intended use. In summary, Houston Texas Due Diligence Field Review and Checklist comprise a comprehensive analysis of legal, environmental, financial, and physical factors related to a property. This process aids potential investors and developers in making well-informed decisions and identifying potential risks associated with property investment in Houston, Texas.

Houston Texas Due Diligence Field Review and Checklist

Description

How to fill out Houston Texas Due Diligence Field Review And Checklist?

Drafting paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Houston Due Diligence Field Review and Checklist without professional assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Houston Due Diligence Field Review and Checklist by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Houston Due Diligence Field Review and Checklist:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

Other Types of Due Diligence ?Field due diligence,? for example, is a process used to measure the viability of certain investment sectors, such as renewable energy or agriculture, through the employment of sector-specific experts.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

Questions to ask during due diligence begin with financial information....When it comes to financial information, ask for: Credit reports. Tax returns. Audit and revenue reports. List of all physical assets. List of expenses (fixed and variable) Gross profit margins. Owner's benefit. Any debt.

What does due diligence mean? Due diligence most generally means reasonable care and caution or the proper actions that a situation calls for, especially those that help to avoid harm or risk.

1 Due diligence is an obligation of conduct on the part of a subject of law (Subjects of International Law). Normally, the criterion applied in assessing whether a subject has met that obligation is that of the responsible citizen or responsible government (Governments).

Focus on five financial due diligence factors Power of customers. Start by understanding the borrower's target market.Power of suppliers. Likewise, identify the companies that a borrower purchases raw materials and resources from.Competition.Ease of entry.Product substitution.

Listed are general due diligence process steps. Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

As part of this process we focus on three main areas: Commercial due diligence. Financial due diligence. Legal due diligence.

Due diligence (DD) is an extensive process undertaken by an acquiring firm in order to thoroughly and completely assess the target company's business, assets, capabilities, and financial performance. There may be as many as 20 or more angles of due diligence analysis.

Due Diligence Examples An underwriter auditing an issuer's business and operations prior to selling it. A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service.