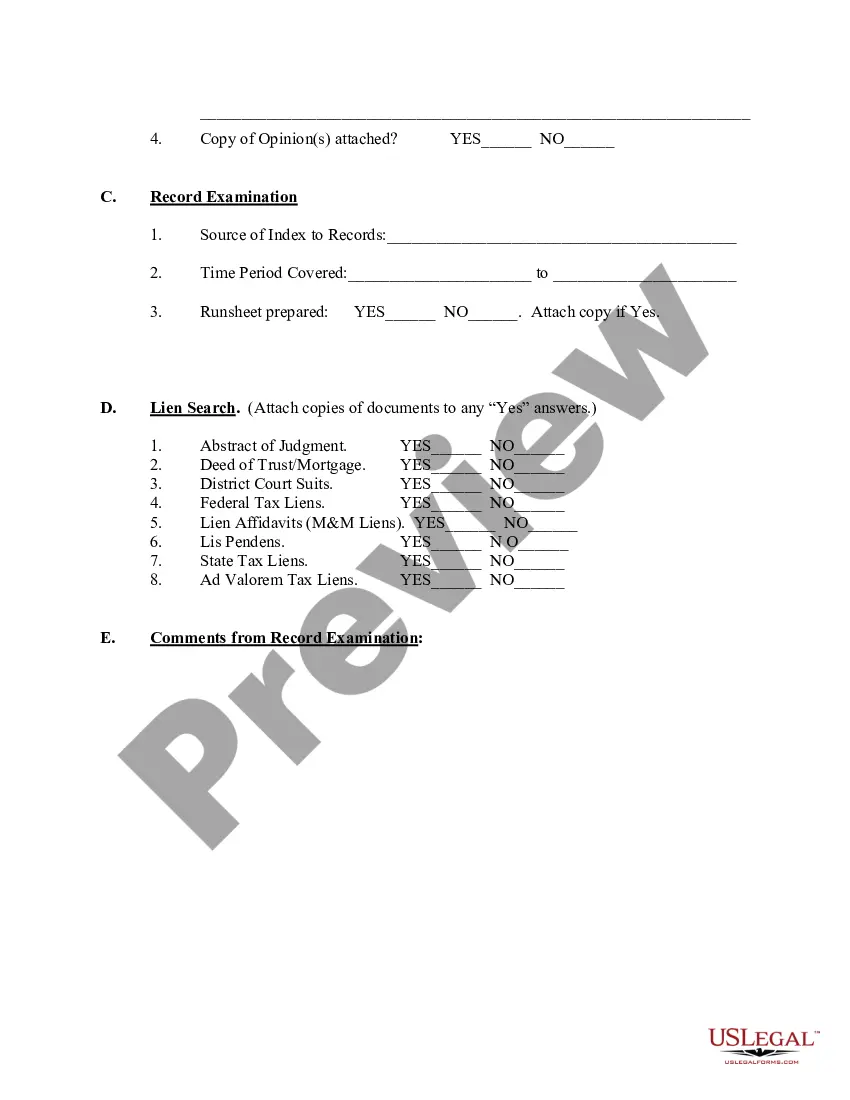

Maricopa Arizona Due Diligence Field Review and Checklist is a comprehensive assessment process used in the real estate industry to evaluate properties within the Maricopa region for potential acquisition, development, or investment purposes. This review is crucial for making informed decisions and mitigating risks associated with property transactions. The Maricopa Arizona Due Diligence Field Review and Checklist deploys a systematic approach to examine various aspects of the property under consideration. Field inspections are conducted to inspect the condition, characteristics, and potential issues related to the land, buildings, infrastructure, and the surrounding environment. This detailed investigation aims to identify any hidden factors that might affect the property's value, usability, or compliance with regulatory requirements. To conduct a thorough due diligence process, various key areas of investigation are covered in the checklist. These may include: 1. Legal and Ownership Documentation: This involves a review of the property's title, deeds, easements, encumbrances, liens, zoning regulations, permits, and other legal documents to ensure clear ownership and proper compliance. 2. Physical Inspection: A detailed examination of the property, including soil conditions, topography, drainage, utilities, structures, and any potential environmental concerns, is carried out. This helps identify any necessary repairs, defects, or compliance issues. 3. Environmental Assessment: Assessing the property's potential environmental risks is essential to detect any past contamination or hazards that may affect future development plans or investment returns. This may involve evaluating the site's history, nearby pollutant sources, and conducting soil and water quality tests. 4. Market Analysis: Thorough market research and analysis are conducted to evaluate the property's market value, demand, and competitiveness in the local area. This includes assessing comparable sales data, rental rates, vacancy rates, and future growth projections. 5. Financial Evaluation: An in-depth examination of the property's financials, such as current income and expenses, leasing agreements, tax obligations, insurance, and potential operating costs, is performed. This helps assess the property's profitability and return on investment. It is important to note that while the Maricopa Arizona Due Diligence Field Review and Checklist generally follows a standardized process, there might be variations based on the particular property type, such as residential, commercial, industrial, or agricultural. Each type may have specific considerations, regulations, or industry standards that need to be addressed during the due diligence process. By meticulously conducting a Maricopa Arizona Due Diligence Field Review and Checklist, investors and property stakeholders can gain a comprehensive understanding of the property's suitability, risks, and potential. This knowledge enables them to make well-informed decisions, negotiate appropriate terms, and ensure a successful transaction or development outcome.

Maricopa Arizona Due Diligence Field Review and Checklist

Description

How to fill out Maricopa Arizona Due Diligence Field Review And Checklist?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Maricopa Due Diligence Field Review and Checklist, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Due Diligence Field Review and Checklist from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Maricopa Due Diligence Field Review and Checklist:

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!