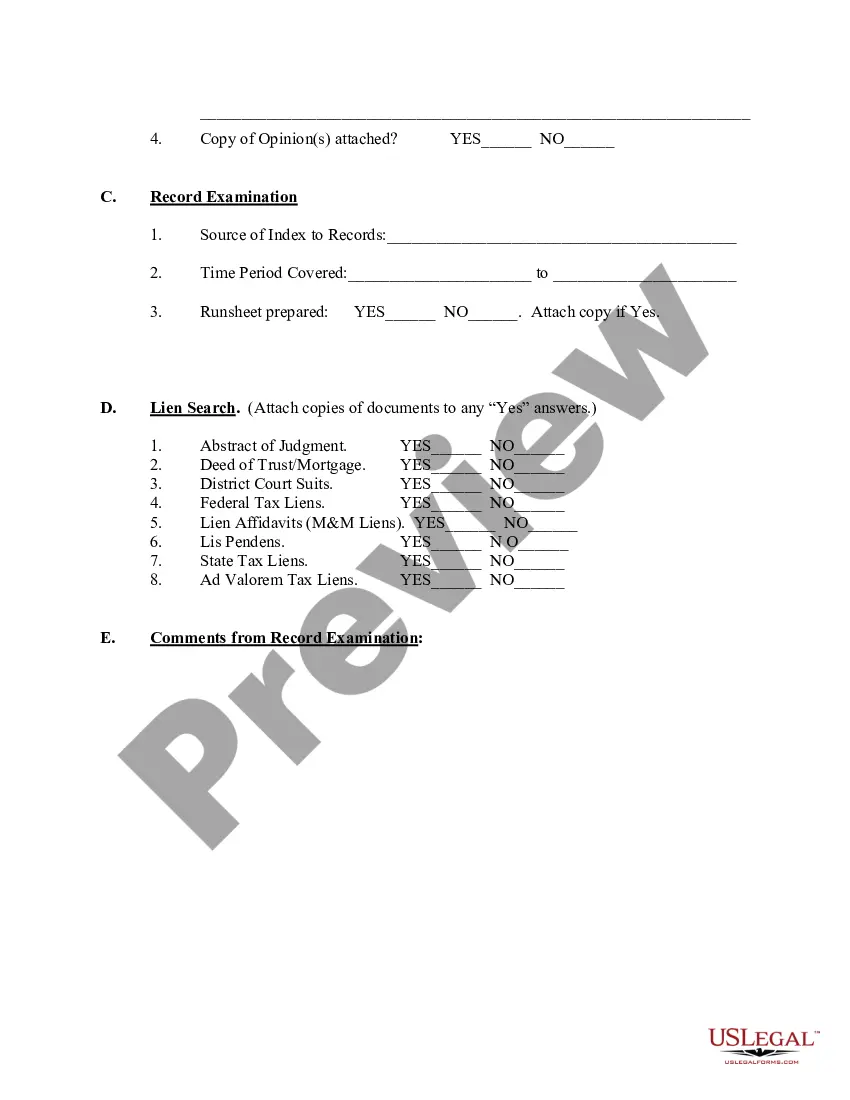

Nassau New York Due Diligence Field Review and Checklist is an essential process for thoroughly evaluating a property in Nassau County, New York. This procedure aims to assess various aspects of a property before making an informed decision, such as purchasing, leasing, or investing. The checklist used during this field review is designed to ensure that all crucial factors are considered and analyzed properly. The Nassau New York Due Diligence Field Review and Checklist cover a wide range of components related to the property, including legal, financial, environmental, and physical aspects. By conducting a thorough examination of these factors, buyers and investors can minimize risks and make well-informed decisions. Some key elements covered in the Nassau New York Due Diligence Field Review and Checklist may include: 1. Legal Review: — Verification of property ownership and title status — Examination of any outstanding liens, encumbrances, or legal disputes — Review of any relevant zoning laws, local regulations, or restrictions 2. Financial Assessment: — Analysis of financial statements, if available, to evaluate the property's financial performance — Examination of lease agreements, rental contracts, or any other agreements related to the property — Review of property taxes, insurance, and other financial obligations 3. Environmental Assessment: — Evaluation of possible environmental risks or contamination on the property — Review of any prior environmental assessments or reports — Identification of potential encroachments, wetlands, or other environmentally sensitive areas 4. Physical Inspection: — Thorough examination of the property's physical condition — Assessment of building structures, infrastructure, and systems — Identification of any necessary repairs, maintenance, or upgrades — Evaluation of compliance with building codes and regulations The Nassau New York Due Diligence Field Review and Checklist ensure that all relevant information is thoroughly examined to mitigate potential risks and uncover any hidden problems. By conducting this assessment, buyers and investors can make informed decisions based on accurate and comprehensive data. Different types of Nassau New York Due Diligence Field Review and Checklist may vary based on the specific needs and requirements of the property under consideration. For instance, there might be specific checklists designed for residential properties, commercial buildings, industrial warehouses, or vacant land. Each type of property may have unique considerations and potential risks that require specific attention during the due diligence process. In conclusion, the Nassau New York Due Diligence Field Review and Checklist provide a systematic approach to evaluating properties in Nassau County. This process involves a comprehensive analysis of legal, financial, environmental, and physical factors, ensuring that buyers and investors have a clear understanding of the property's conditions and risks. Utilizing specific checklists tailored to different property types enables a more targeted approach to due diligence, resulting in well-informed decisions and reduced uncertainties.

Nassau New York Due Diligence Field Review and Checklist

Description

How to fill out Nassau New York Due Diligence Field Review And Checklist?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Nassau Due Diligence Field Review and Checklist, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how you can purchase and download Nassau Due Diligence Field Review and Checklist.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the similar forms or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Nassau Due Diligence Field Review and Checklist.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Nassau Due Diligence Field Review and Checklist, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you have to cope with an exceptionally difficult situation, we recommend getting an attorney to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!