Dallas Texas Due Diligence Information Request is a process frequently utilized in various sectors to obtain comprehensive and reliable information for assessing the feasibility or potential risks associated with a business venture or investment opportunity in the Dallas, Texas area. It involves thorough research and investigation to gather essential data, documents, and facts that provide insights into legal, financial, operational, and other relevant aspects of a targeted business, property, or project. Some key components typically included in a Dallas Texas Due Diligence Information Request are: 1. Legal and Regulatory Analysis: This entails reviewing legal documents such as contracts, leases, licenses, permits, and compliance records to ensure adherence to local, state, and federal laws in Dallas, Texas. It may also involve assessing any pending litigation, lawsuits, or regulatory issues that may impact the venture. 2. Financial Documentation: This category covers financial statements, tax records, accounts payable and receivable, cash flow statements, and other related financial information. Analyzing these documents helps evaluate the financial stability, profitability, and growth potential of the target business or property in Dallas, Texas. 3. Operational Evaluation: An examination of the target entity's operational structure, including business plans, organizational charts, inventory management procedures, and quality control measures. Understanding the operational intricacies provides a clarity on scalability, efficiency, and potential risks associated with the venture. 4. Environmental Assessments: Environmental due diligence involves investigating the presence of any hazardous materials, soil contamination, or potential environmental liabilities related to the target property in Dallas, Texas. Environmental reports, permits, and other related documents are collected to ascertain compliance with environmental regulations. 5. Market Analysis: Assessing the Dallas, Texas market is crucial in determining the viability of investment opportunities. This includes analyzing market trends, target demographics, competition, growth potential, and conducting customer surveys or interviews. Different types of Dallas Texas Due Diligence Information Requests may vary based on the specific industry or purpose for which due diligence is being conducted. For instance: — Real Estate Due Diligence: Focused on evaluating the legal and regulatory compliance, financial viability, and market analysis of a property in Dallas, Texas. — Merger and Acquisition Due Diligence: Involves reviewing financial records, legal agreements, employment contracts, and intellectual property assets associated with a business being considered for acquisition or merger in Dallas, Texas. — Financial Due Diligence: Concentrated on analyzing financial statements, financial projections, and cash flow analysis to assess the value and risk of investment opportunities in Dallas, Texas. In summary, Dallas Texas Due Diligence Information Request is a comprehensive research and analysis process aimed at gathering pertinent data to evaluate potential risks, opportunities, and viability of investments or business ventures in the Dallas, Texas area.

Dallas Texas Due Diligence Information Request

Description

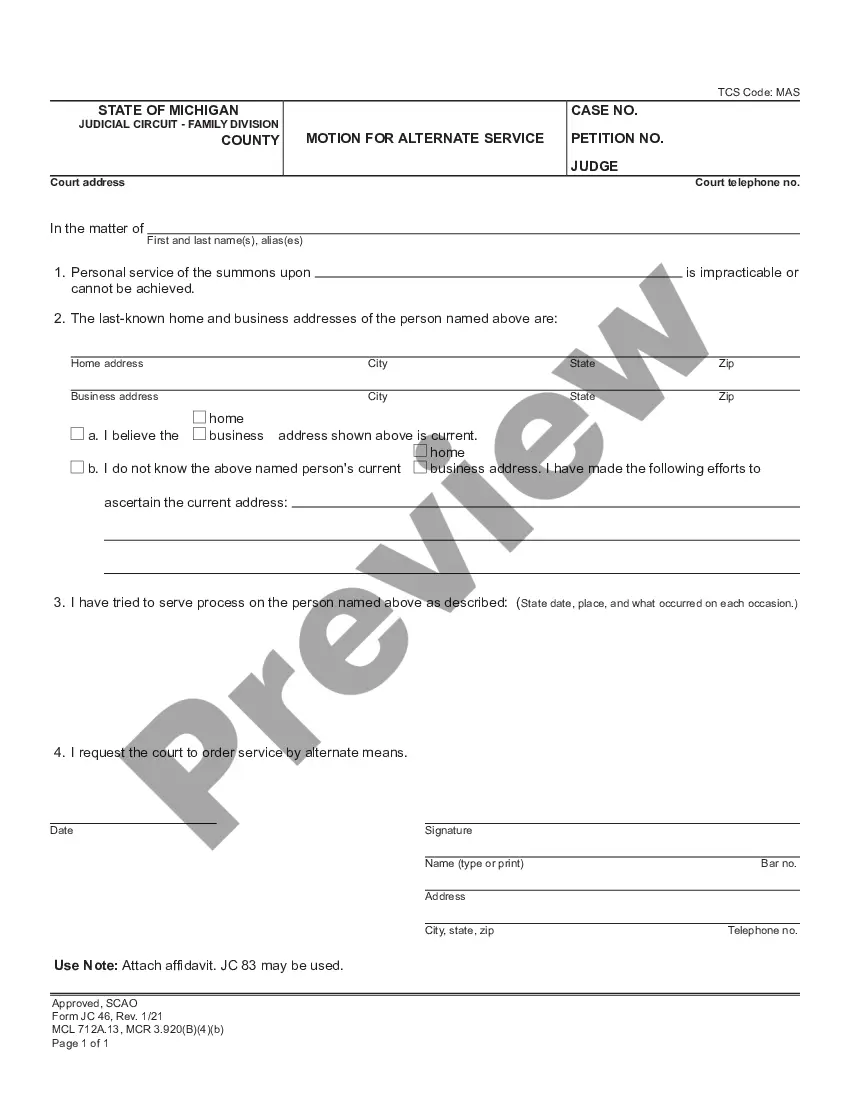

How to fill out Dallas Texas Due Diligence Information Request?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Dallas Due Diligence Information Request, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and tutorials on the website to make any activities associated with document completion simple.

Here's how to find and download Dallas Due Diligence Information Request.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Dallas Due Diligence Information Request.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Dallas Due Diligence Information Request, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you need to deal with an exceptionally complicated case, we advise getting an attorney to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

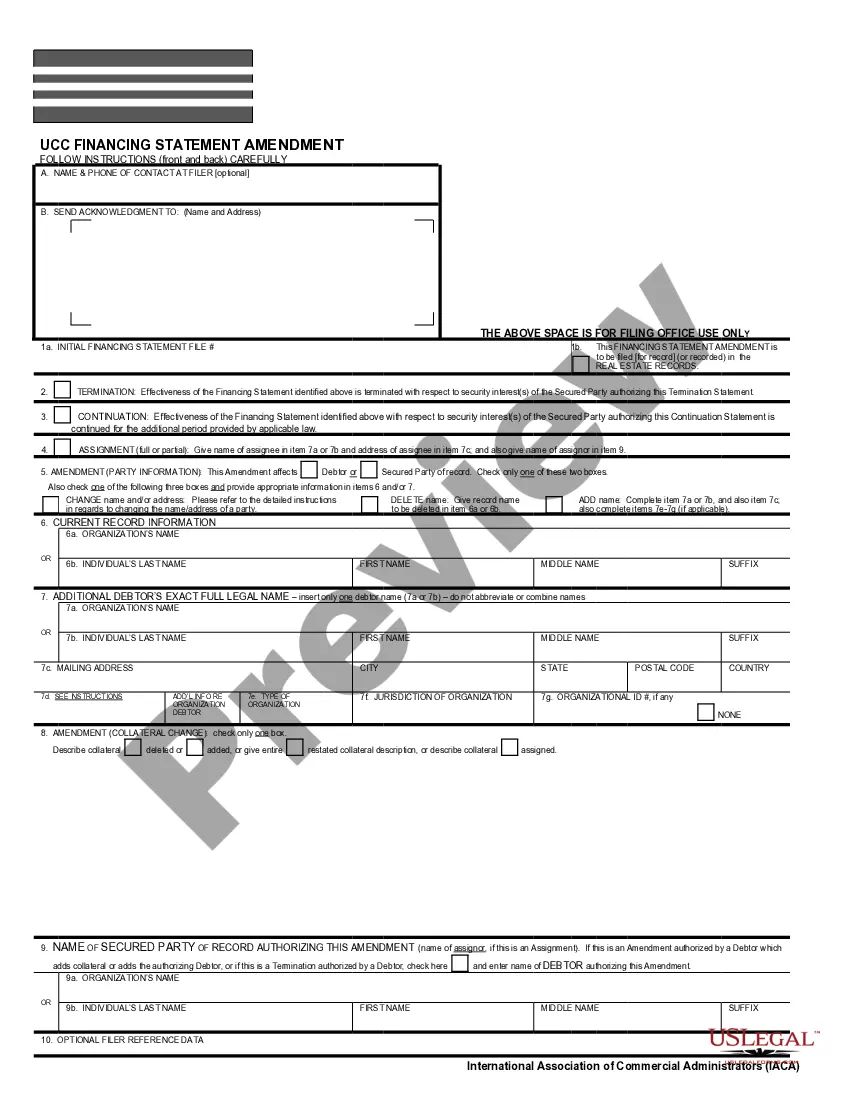

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

These processes usually include information about assets, financial projections, contracts, intellectual property ownership, equity holdings, information about your team, and/or outstanding legal issues.

Sample Due Diligence Request List Formation documents and operating agreements. Detailed ownership information and member register. Details of any other investment or ownership interest in any other entity held by the company.

The complete list of due diligence documents to be collected Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

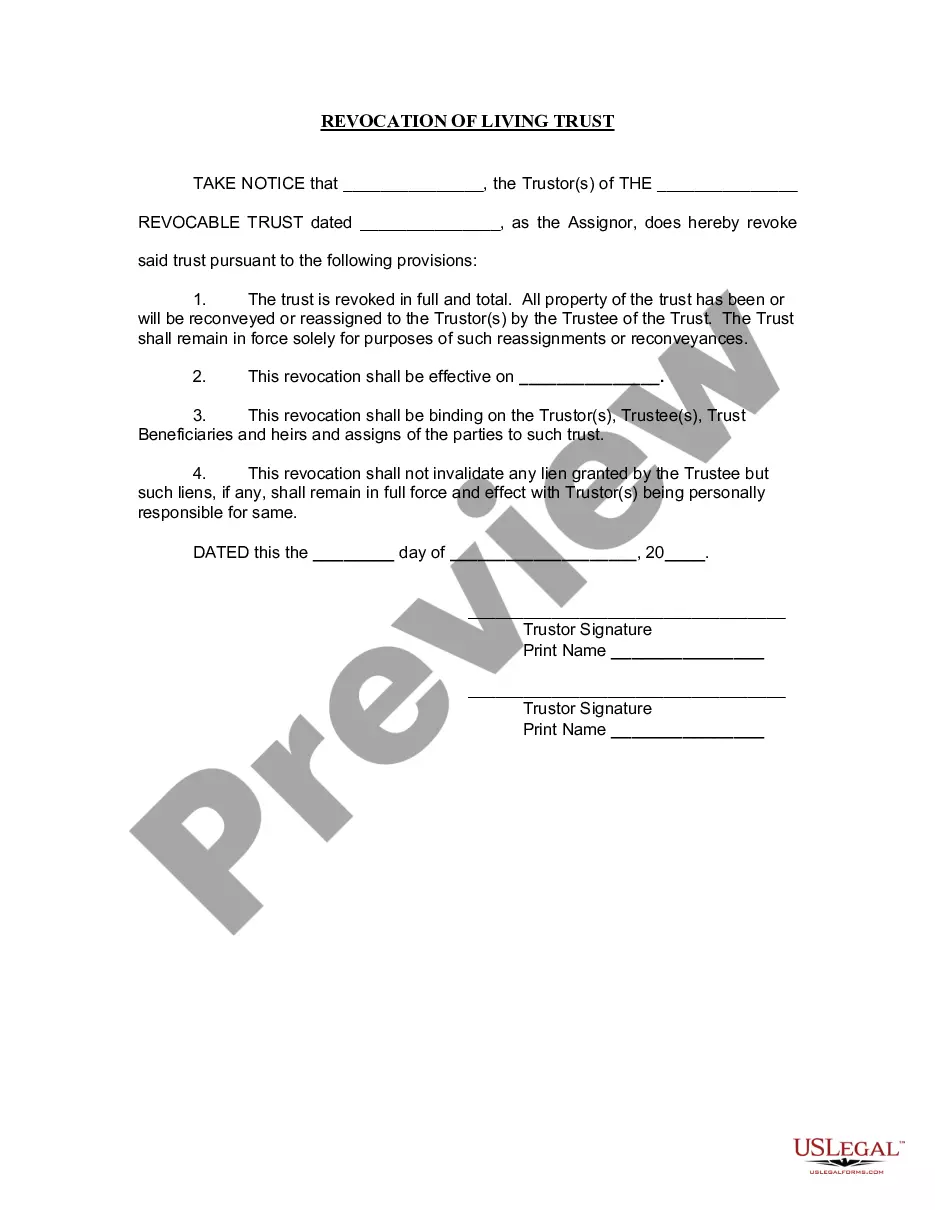

Types of Due Diligence - Financial, Legal, HR and more Ansarada.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.

What is due diligence? Due diligence (DD) is the process of putting potential deal partners under the microscope. A key part of any major transaction like mergers and acquisitions, the due diligence process is a structured approach to carefully examining every part of a business.

The most effective way to prove due diligence is through records of your food safety systems. In particular, records of your food safety practices and HACCP procedures will help to demonstrate compliance. These will show that you follow all the necessary safety standards and procedures to make food safe.

13 Critical Things To Do During The Due Diligence Period Research Home Prices.Look up Taxes.Find a Seasoned Real Estate Agent.Find a Lender.Read Disclosures.Home Inspection.Cost of Repairs.Insurance.

The Role of Due Diligence The process validates the accuracy of the information presented, ensures that the transaction complies with the criteria laid out in the purchase agreement, verifies that the parties consider all benefits and risks, and allows the buyer to know what they are buying.