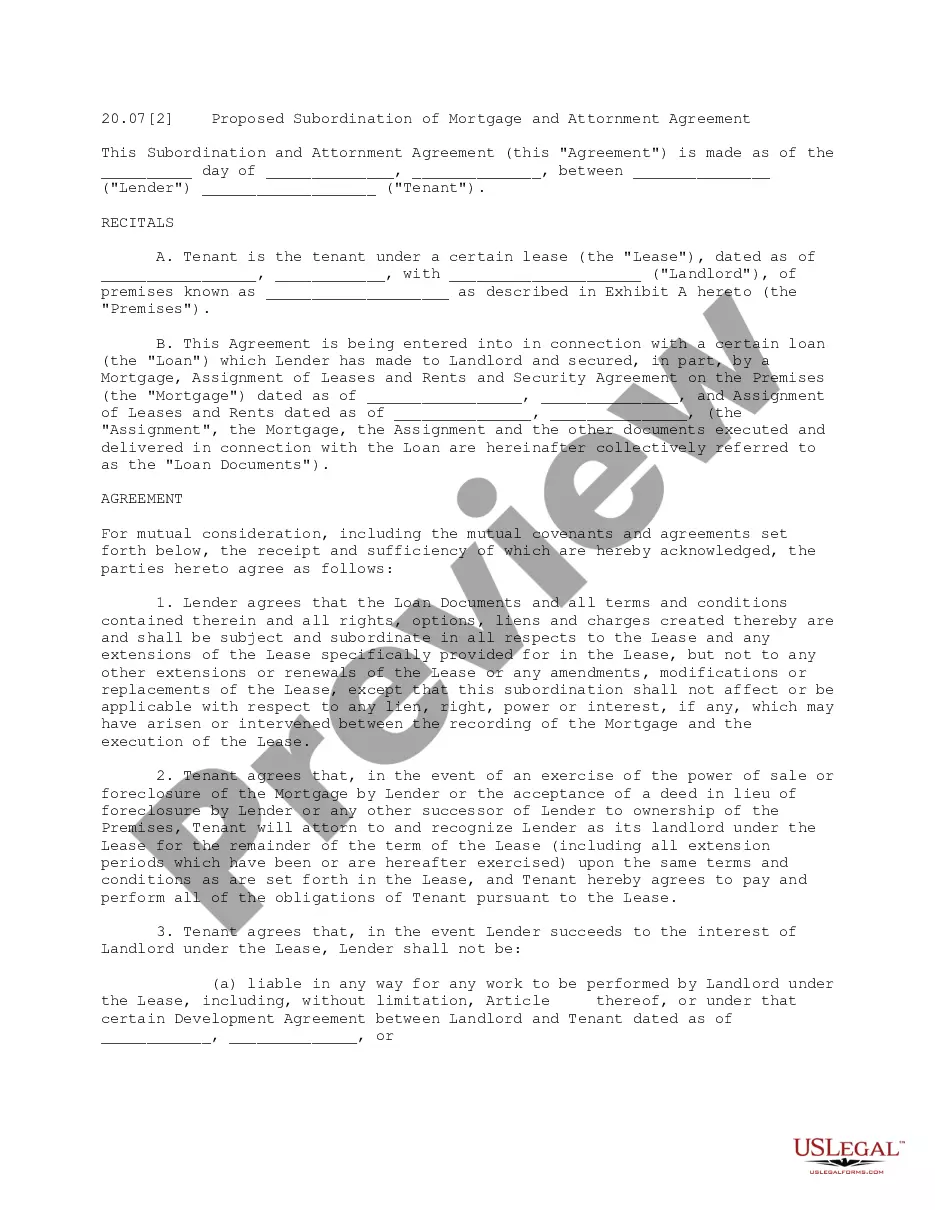

King Washington Subordination of Lien (Deed of Trust/Mortgage) is a legal process that involves rearranging the priority of a lien or mortgage on a property. It is usually intended to facilitate a refinancing or to secure a new loan on the property. This detailed description will provide an overview of what King Washington Subordination of Lien entails, along with the different types of subordination available. In King Washington, a subordination of lien refers to the act of voluntarily moving an existing lien or mortgage behind another lien or mortgage. This rearrangement of priority ensures that the newly acquired lien or mortgage takes precedence over the existing one. The subordination of lien is achieved through a written agreement between the parties involved, including the lien holders, the property owner, and any potential lenders. The primary purpose of subordination of lien is to allow property owners to refinance their existing mortgage or obtain additional financing without jeopardizing the rights of the subsequent lender. By subordinating their lien, the existing lien holder agrees that if there is a foreclosure or sale of the property, the proceeds will first be used to satisfy the newly prioritized lien. This reassures potential lenders that their loan will be prioritized in case of default or liquidation. Different types of King Washington Subordination of Lien (Deed of Trust/Mortgage) include: 1. Junior Lien Subordination: This type of subordination involves a subordinate lien holder willingly moving their position behind a newly acquired senior lien or mortgage. Junior lien holders agree to accept a lower priority position, ensuring the primary lender's interests are protected. 2. Intercreditor Agreement: An intercreditor agreement outlines the relationship and priority of multiple lenders in a specific order. This agreement is often used when multiple financing sources exist, such as a first mortgage lender and a mezzanine lender, ensuring that each party's rights are clearly defined. 3. Deed of Trust/Mortgage Subordination: A deed of trust or a mortgage can both be subordinated if necessary. These legal documents define the terms of the loan, including interest rates, repayment schedules, and default provisions. Subordination of a deed of trust or mortgage involves modifying the original terms to reflect the new priority status. Subordinating a lien or mortgage in King Washington requires careful consideration and legal expertise to ensure all parties' interests are protected. It is crucial to consult with a real estate attorney, mortgage lender, or financial advisor specializing in property transactions to navigate the subordination process successfully. Keywords: King Washington, Subordination of Lien, Deed of Trust, Mortgage, Junior Lien Subordination, Intercreditor Agreement, Deed of Trust/Mortgage Subordination, Prioritization, Refinancing, Financing, Foreclosure.

King Washington Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out King Washington Subordination Of Lien (Deed Of Trust/Mortgage)?

Do you need to quickly create a legally-binding King Subordination of Lien (Deed of Trust/Mortgage) or maybe any other document to manage your own or business affairs? You can go with two options: hire a legal advisor to draft a legal paper for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including King Subordination of Lien (Deed of Trust/Mortgage) and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, carefully verify if the King Subordination of Lien (Deed of Trust/Mortgage) is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the King Subordination of Lien (Deed of Trust/Mortgage) template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!