Kings New York Subordination of Lien, also known as Deed of Trust/Mortgage Subordination, refers to a legal agreement that allows a mortgage or lien holder to voluntarily give up their position of priority on a property title. This document is commonly used in real estate transactions, particularly during refinancing or when a homeowner wants to take out a second mortgage or secure additional financing. The purpose of a Kings New York Subordination of Lien is to enable the property owner to obtain a new loan, usually with more favorable terms, while protecting the interests of the original lien holders. By subordinating their lien, the mortgage or deed of trust holder consents to the new loan taking priority over their existing claim on the property. This ensures that in the event of foreclosure or sale, the new loan will be paid off first before the original mortgage or lien. There are different types of Kings New York Subordination of Lien, including: 1. First Lien Subordination: In this scenario, the original lien holder agrees to subordinate their position to a newly recorded lien. This allows the homeowner to obtain additional financing without disturbing the priority of the original mortgage. 2. Second Lien Subordination: Here, the second mortgage lender agrees to subordinate their lien to the existing first mortgage. This often occurs when a homeowner wants to borrow against their property's equity but needs the permission and cooperation of the primary lien holder. 3. Subordinate Lien Release: This type of subordination occurs when the original lien holder releases their claim on the property. This can happen when a borrower pays off their first mortgage or when refinancing consolidates multiple liens into a single loan. 4. Intercreditor Agreement: This form of subordination involves multiple lien holders, commonly seen when a property has multiple mortgages or liens against it. Intercreditor agreements determine the order in which these claims will be satisfied during a foreclosure or sale. It's important to note that a Kings New York Subordination of Lien is a legally binding agreement that requires the consent of all parties involved, including the property owner, existing lien holders, and any potential new lenders. This document must be recorded in the county where the property is located to ensure its enforceability and protect the rights of all interested parties. In conclusion, a Kings New York Subordination of Lien is a crucial legal instrument that allows homeowners to obtain additional financing or refinance their property while maintaining the priority rights of existing mortgage or lien holders. Understanding the various types of subordination is vital for navigating real estate transactions and ensuring the protection of all parties' interests.

Kings New York Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out Kings New York Subordination Of Lien (Deed Of Trust/Mortgage)?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Kings Subordination of Lien (Deed of Trust/Mortgage), with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks associated with paperwork execution simple.

Here's how to purchase and download Kings Subordination of Lien (Deed of Trust/Mortgage).

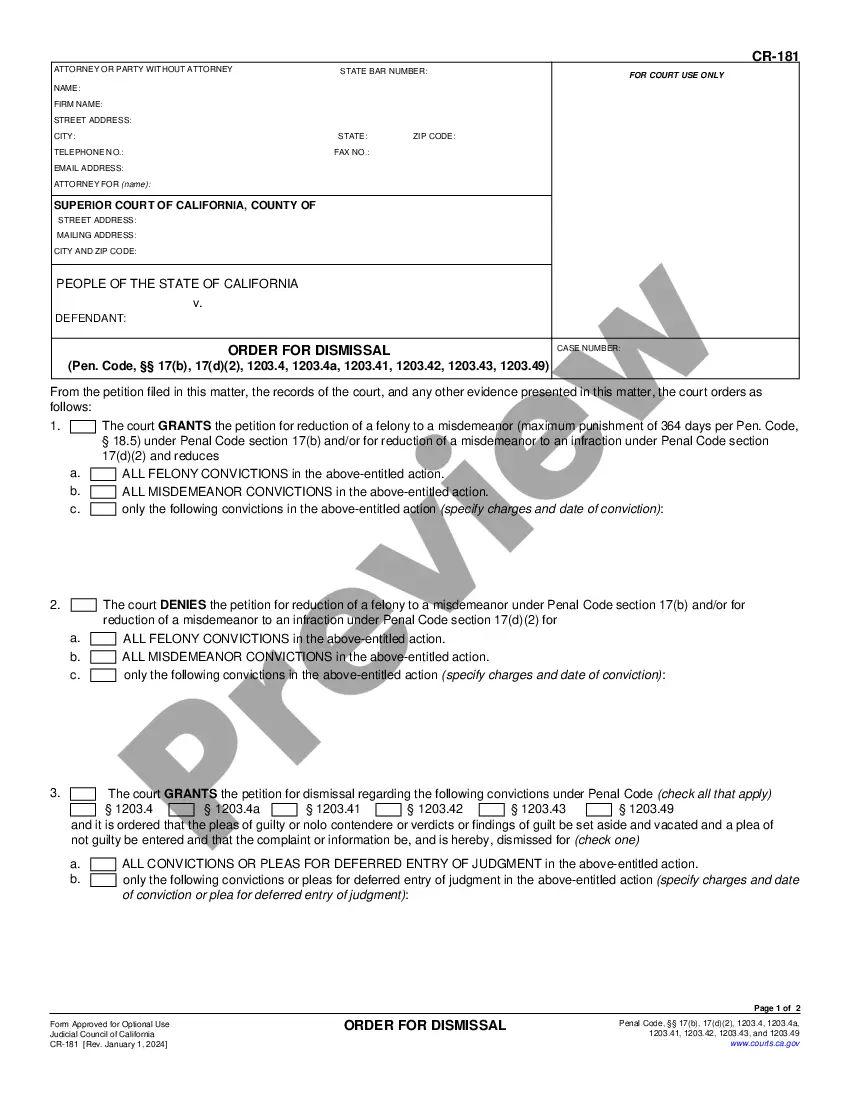

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Examine the similar forms or start the search over to find the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Kings Subordination of Lien (Deed of Trust/Mortgage).

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Kings Subordination of Lien (Deed of Trust/Mortgage), log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to cope with an extremely complicated situation, we advise using the services of an attorney to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!