San Bernardino California Subordination of Lien (Deed of Trust/Mortgage) is a legal process that involves the rearrangement of liens on a property, specifically the priority in which they are paid off in the event of a foreclosure or sale. This process is crucial when refinancing an existing loan, obtaining a home equity line of credit (HELOT), or pursuing a second mortgage, as it ensures clear property title ownership and sets the order of priorities for lien holders. In San Bernardino, California, various types of Subordination of Lien (Deed of Trust/Mortgage) might exist, including: 1. First-Position Subordination: This type of subordination occurs when the existing first mortgage holder agrees to subordinate their lien to a new loan. The first-position lien holder would receive payment first in case of foreclosure or sale, while the new loan lender would move to a second position. 2. Second-Position Subordination: In this scenario, a homeowner wants to obtain a second mortgage or home equity loan, but the existing first mortgage should maintain its priority position. The second mortgage lender requests a subordination agreement from the first mortgage holder, allowing them to have a lien in the second position. 3. Intercreditor Agreement: Sometimes, two or more lenders agree to share the priority of their liens, securing their respective interests. This agreement clarifies the order of payment in case of foreclosure or sale of the property. San Bernardino California Subordination of Lien (Deed of Trust/Mortgage) is a complex legal process that involves negotiations and agreements among lenders, borrowers, and lien holders. It requires thorough documentation and is usually facilitated by the services of a qualified attorney or title company to ensure compliance with state laws and regulations. When considering or pursuing a Subordination of Lien (Deed of Trust/Mortgage) in San Bernardino, California, it is advisable to consult with a real estate attorney or title company experienced in handling such transactions. They can guide homeowners or borrowers through the process, ensuring legal compliance, and protecting their rights and interests.

San Bernardino California Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out San Bernardino California Subordination Of Lien (Deed Of Trust/Mortgage)?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including San Bernardino Subordination of Lien (Deed of Trust/Mortgage), with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can purchase and download San Bernardino Subordination of Lien (Deed of Trust/Mortgage).

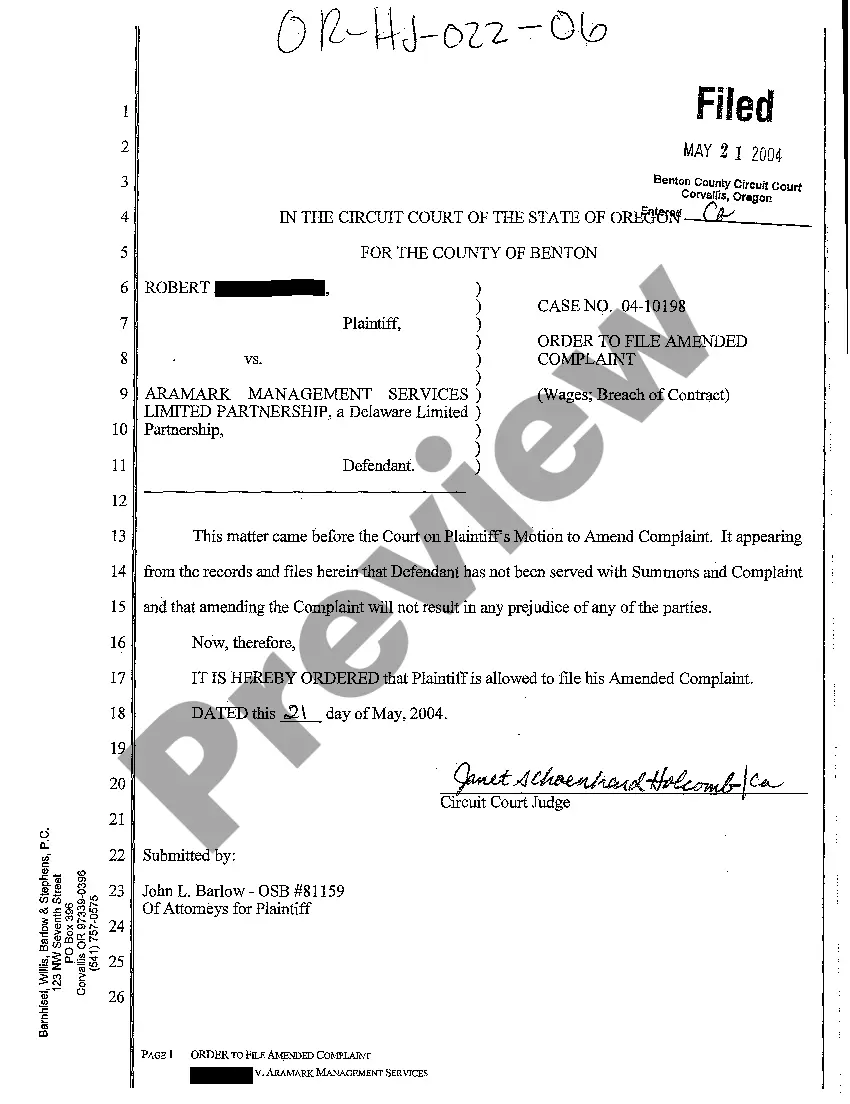

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase San Bernardino Subordination of Lien (Deed of Trust/Mortgage).

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Bernardino Subordination of Lien (Deed of Trust/Mortgage), log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you need to cope with an extremely difficult situation, we recommend using the services of a lawyer to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!