San Diego, California Subordination of Lien (Deed of Trust/Mortgage) refers to a legal process where a lien holder agrees to subordinate their lien position to another lien holder. A lien, in this context, is a legal claim against a property that is used as collateral for a loan or debt. This subordination arrangement is commonly seen when homeowners in San Diego wish to refinance their mortgage or take out a home equity loan or line of credit. By subordinating their lien, the original lien holder (usually the bank or lender) agrees to let a new lender have a higher priority lien position. This allows the new lender to have first claim on the property in case of foreclosure or sale. There are different types of subordination of lien in San Diego, California, each having its own specific purpose and implications: 1. Intercreditor Agreement: This is a type of subordination where multiple lien holders agree on the priority of their liens against a property. This agreement clearly defines the rights and responsibilities of each lien holder, usually in the context of a refinancing transaction. 2. Property Tax Lien Subordination: Property owners who have unpaid property taxes may request a subordination of their tax lien to facilitate a refinancing or second mortgage. The tax lien moves to a lower priority position, allowing the new lender to have the first claim on the property. 3. Home Equity Loan Subordination: Homeowners looking to tap into their home's equity through a new loan can utilize subordination. The existing mortgage lender subordinates their lien position to the new lender providing the equity loan, allowing the homeowner to access additional funds while keeping the primary mortgage intact. 4. Subordination Agreement for Construction Loans: This type of subordination occurs when a homeowner wants to build or renovate their property. The construction lender typically requires the existing lien holder to subordinate their lien during the construction period to secure their interest in the property. It is crucial to consult with legal professionals, such as real estate attorneys, before entering into any subordination agreement in San Diego. They can ensure that the subordination process meets legal requirements and protect the interests of all parties involved. In conclusion, San Diego, California Subordination of Lien (Deed of Trust/Mortgage) involves the process of one lien holder agreeing to subordinate their lien position to another lien holder. Various types of subordination exist, including intercreditor agreements, property tax lien subordination, home equity loan subordination, and subordination agreements for construction loans. Seeking professional legal advice is highly recommended navigating this complex process effectively.

San Diego California Subordination of Lien (Deed of Trust/Mortgage)

Description

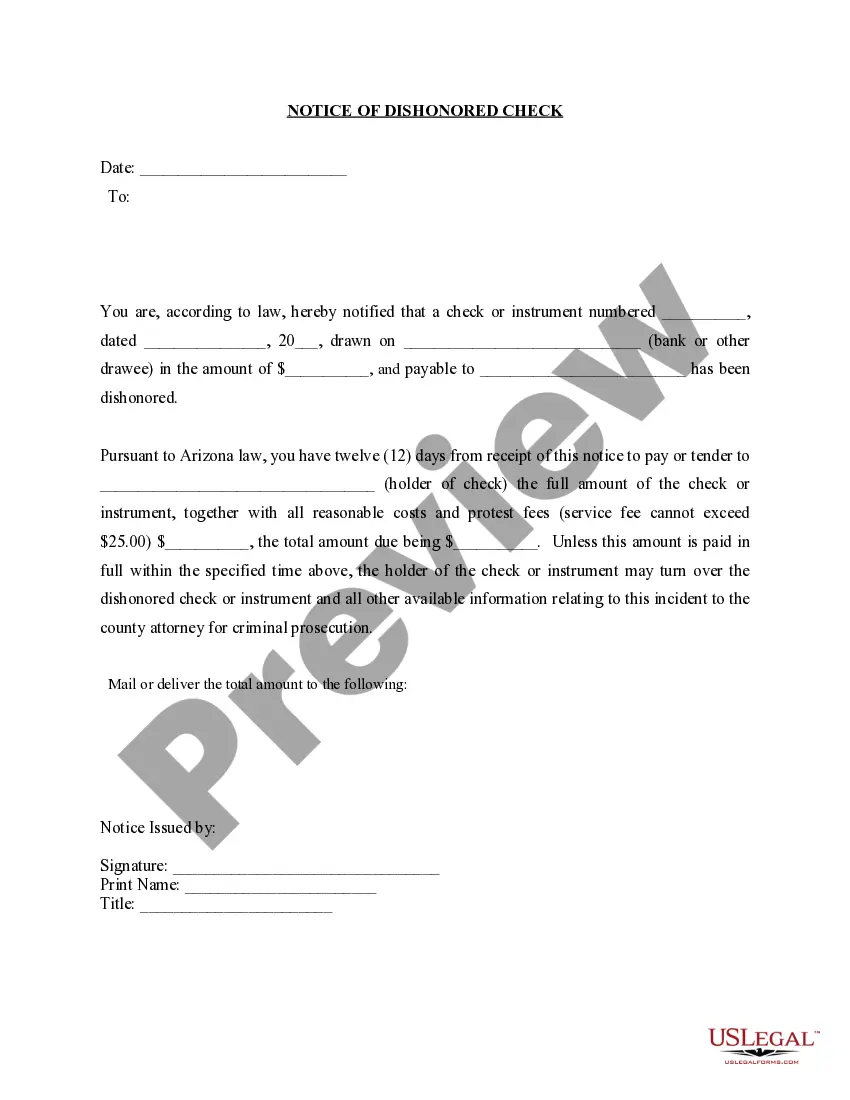

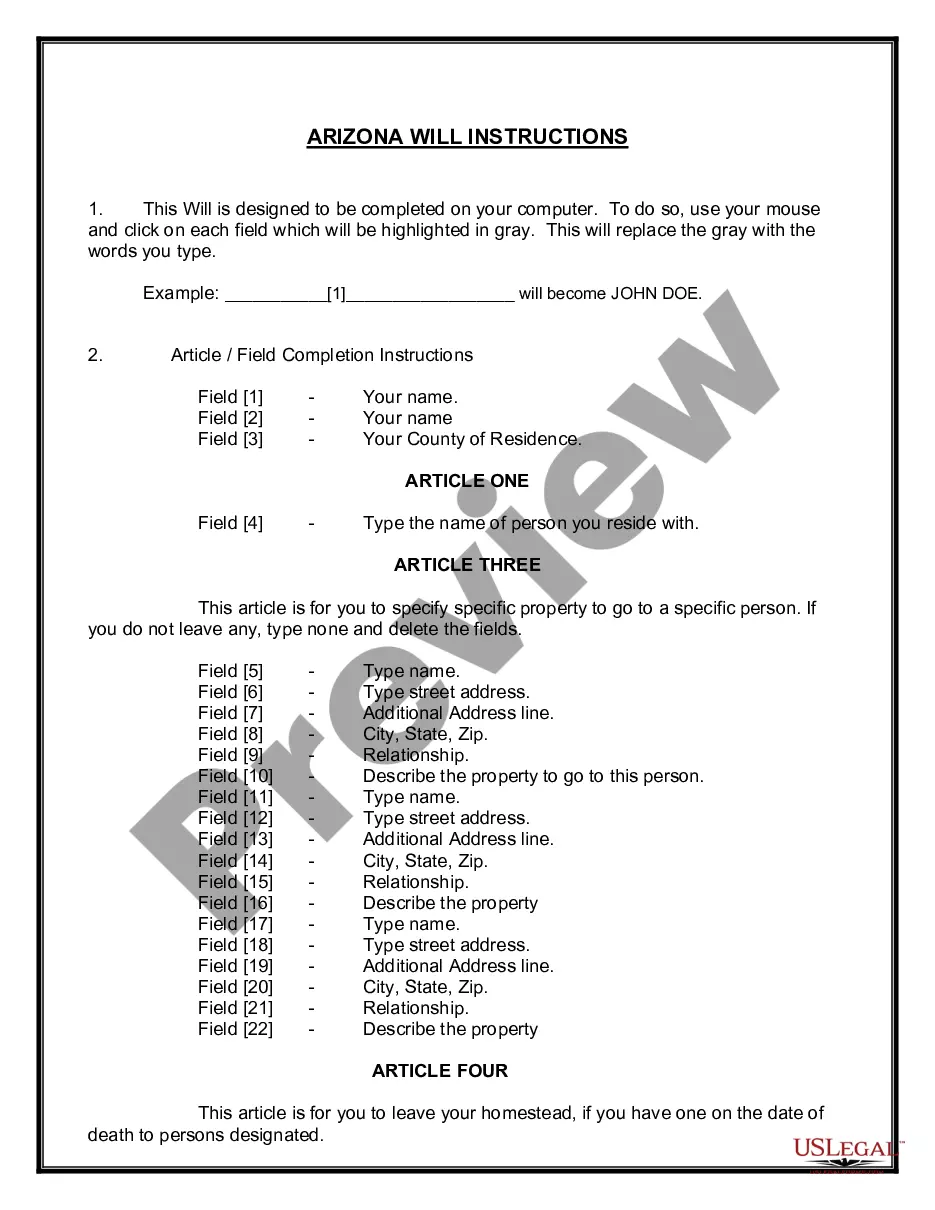

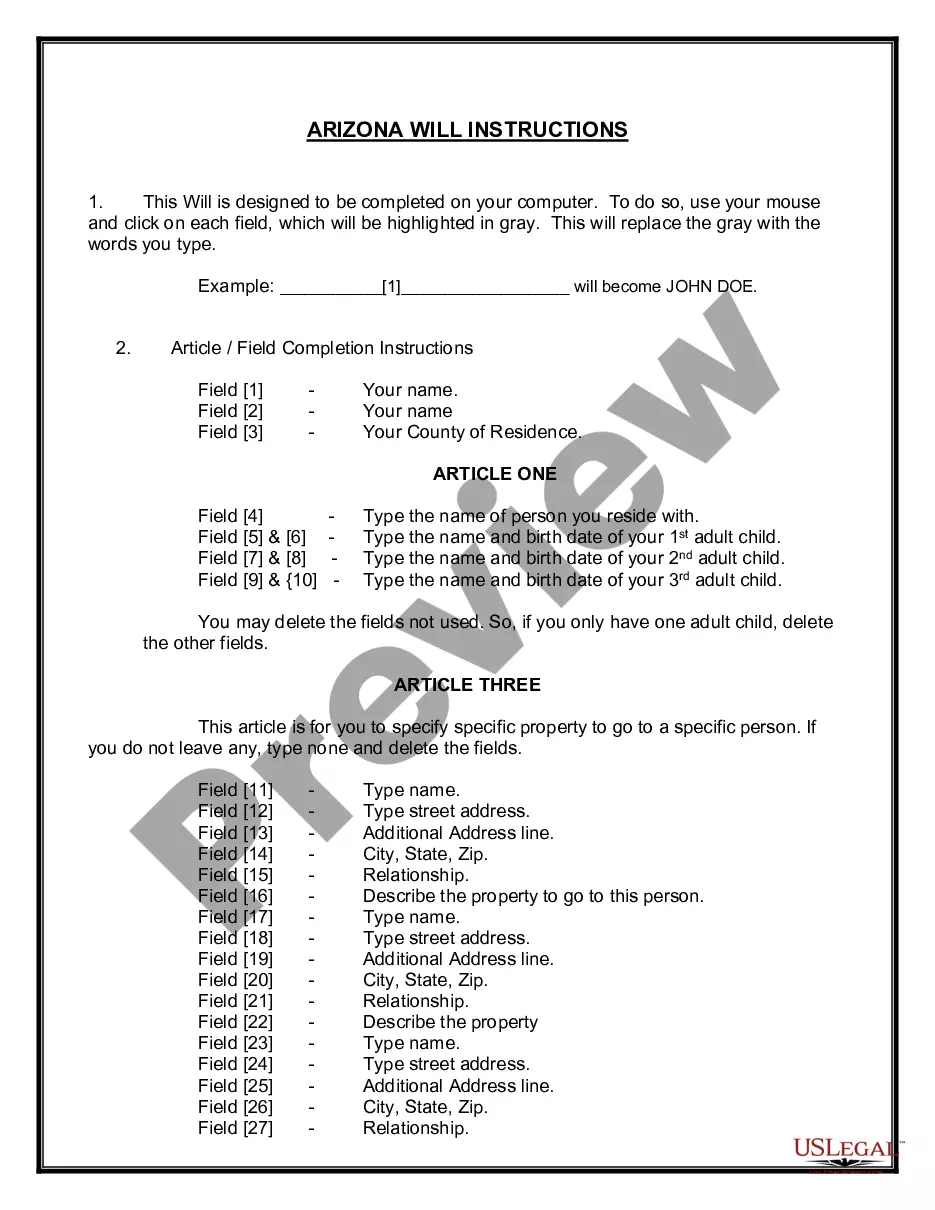

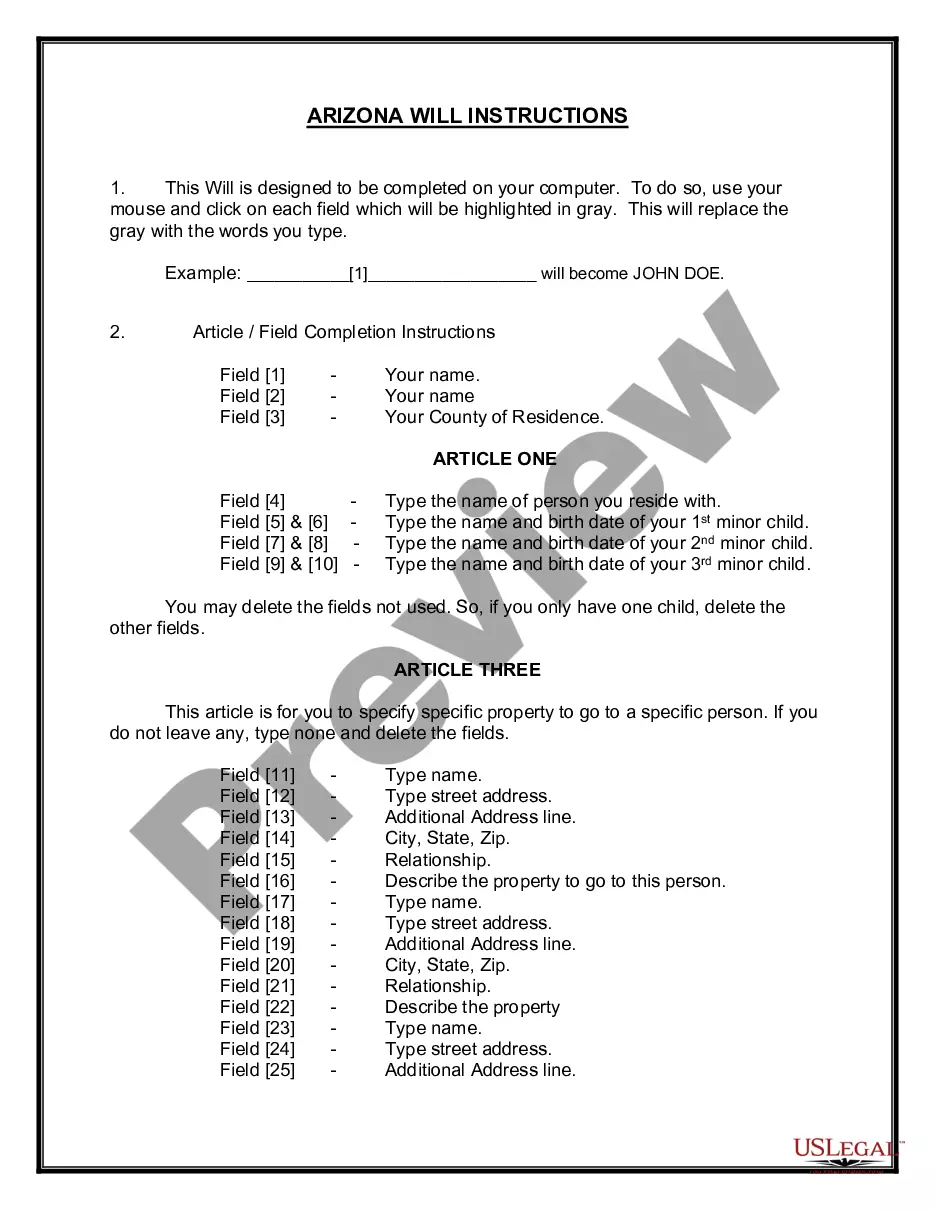

How to fill out San Diego California Subordination Of Lien (Deed Of Trust/Mortgage)?

Do you need to quickly create a legally-binding San Diego Subordination of Lien (Deed of Trust/Mortgage) or probably any other form to manage your own or corporate affairs? You can select one of the two options: contact a legal advisor to write a legal document for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including San Diego Subordination of Lien (Deed of Trust/Mortgage) and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the San Diego Subordination of Lien (Deed of Trust/Mortgage) is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the San Diego Subordination of Lien (Deed of Trust/Mortgage) template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the templates we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!