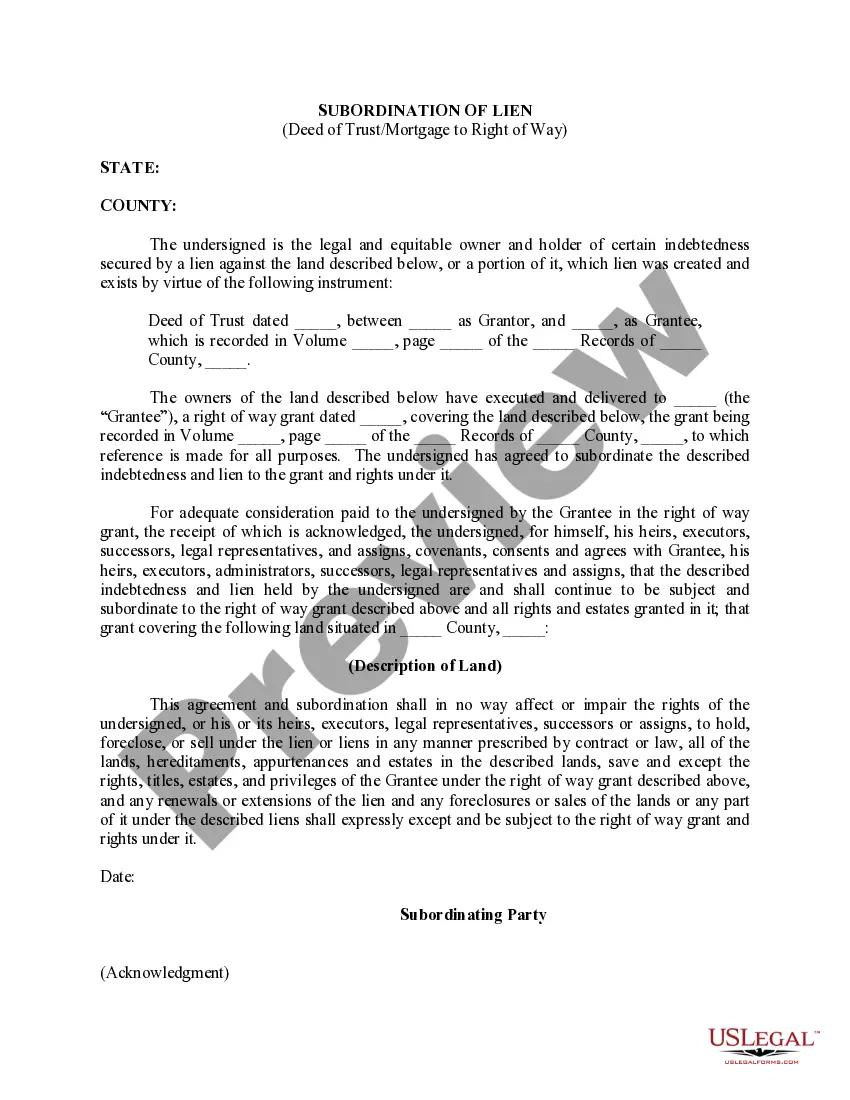

Clark Nevada Subordinaton of Mortgage Lien to Easement and Right of Way

Description

How to fill out Subordinaton Of Mortgage Lien To Easement And Right Of Way?

If you're looking for a dependable legal document provider to acquire the Clark Subordination of Mortgage Lien to Easement and Right of Way, think about US Legal Forms. Regardless of whether you are initiating your LLC venture or managing your asset allocation, we’ve got you covered. You don’t need to be an expert in law to locate and download the suitable template.

Easily choose to search or peruse the Clark Subordination of Mortgage Lien to Easement and Right of Way, either by a keyword or by the state/county for which the form is designed.

Upon finding the desired template, you can Log In to download it or save it in the My documents section.

No account? It’s simple to begin! Just locate the Clark Subordination of Mortgage Lien to Easement and Right of Way template and view the form’s preview and brief introductory details (if available). If you find the template’s wording acceptable, proceed to click Buy now.

Create an account and choose a subscription plan. The template will be available for immediate download once the payment is processed. You can now complete the form. Managing your legal affairs doesn’t have to be costly or time-intensive. US Legal Forms is here to show you otherwise. Our extensive selection of legal forms makes this process less expensive and more manageable. Start your first business, arrange your advance care planning, draft a real estate agreement, or complete the Clark Subordination of Mortgage Lien to Easement and Right of Way—all from the comfort of your home. Register for US Legal Forms today!

- You can browse over 85,000 forms categorized by state/county and case.

- The user-friendly interface, plethora of educational resources, and dedicated support personnel simplify the process of finding and completing various documents.

- US Legal Forms is a trustworthy service providing legal documents to millions since 1997.

Form popularity

FAQ

There are several types of easements, including: utility easements. private easements. easements by necessity, and. prescriptive easements (acquired by someone's use of property).

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Subordinated debt is secondary debt that is paid after all first liens have been paid in the event of a default. Because subordinated loans are secondary, they often have higher interest rates to offset the risk to the lender.

There is no legal reason why any HELOC lender must agree to subordinate. In fact, many such lenders have started to either restrict the amount of money that can be tapped from HELOC loans or actually have canceled them outright.

What is a Subordinate Mortgage? Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Often, all the information needed will be available from your mortgage lender and the title company. The process usually takes approximately 25 business days.

When an easement is dedicated or granted, the owner retains the fee simple ownership while another party receives the right to use the specific area for a specific purpose which is described in the easement. Public easements are dedicated either to the public or to a specific governmental unit.

So, the purpose of a subordination agreement is to adjust the new loan's priority so that in the event of a foreclosure, that lien gets paid off first. In a subordination agreement, a prior lienholder agrees that its lien will be subordinate (junior) to a subsequently recorded lien.