The Hennepin County Recorder's Office in Minnesota oversees the process of recording and releasing mortgages and deeds of trust. When a mortgage or deed of trust on a property is fully paid off or satisfied, a Release of Mortgage or Deed of Trust — Full Release must be filed to remove the lien from the property's title. This legal document protects the borrower's rights and ensures that the property can be freely transferred without any encumbrances. The Hennepin Minnesota Release of Mortgage / Deed of Trust — Full Release is a crucial step in the real estate transaction process, as it confirms the discharge of the debt and the transfer of property ownership. This release document contains specific details pertaining to the mortgage, such as the names of the borrower and lender, property address, original loan amount, loan number, and recording information. In Hennepin County, there are various types of Release of Mortgage / Deed of Trust — Full Release forms available, depending on the circumstances and parties involved. Some common types include: 1. Individual Release of Mortgage: This form is used when an individual borrower has paid off the mortgage or deed of trust on their property and requires the lender's release. 2. Joint Release of Mortgage: When multiple borrowers are involved, such as co-owners or spouses, this release form is used. It ensures that all parties are released from the mortgage or deed of trust. 3. Refinance Release of Mortgage: When a property is refinanced, the existing mortgage is often paid off and replaced with a new loan. This release form is used to remove the previous lender's claim on the property. 4. Lender Release of Mortgage: In some cases, the lender may initiate the release of the mortgage or deed of trust, acknowledging that the debt has been satisfied. This form is typically used when a loan is paid off in full. Regardless of the specific type of Hennepin Minnesota Release of Mortgage / Deed of Trust — Full Release, it is essential to ensure that it is properly prepared, executed, and recorded with the county's Recorder's Office. Doing so will guarantee that the lien is removed from the property title, and the ownership can be freely transferred in any future transactions. NOTE: Please consult with legal professionals or visit the official Hennepin County Recorder's Office website for the most accurate and up-to-date information on the specific requirements and forms related to the Release of Mortgage / Deed of Trust — Full Release process in Hennepin County, Minnesota.

Hennepin Minnesota Release of Mortgage / Deed of Trust - Full Release

Description

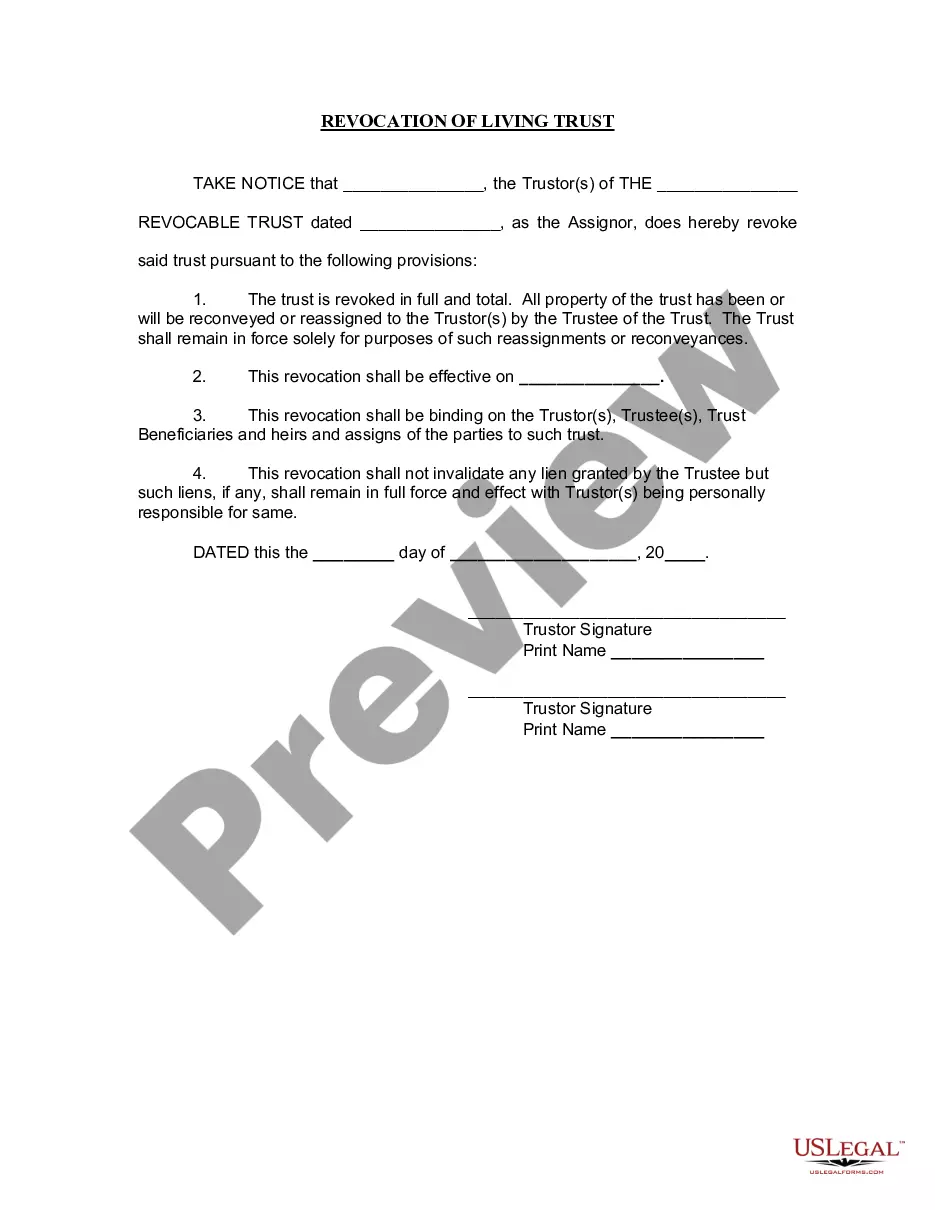

How to fill out Hennepin Minnesota Release Of Mortgage / Deed Of Trust - Full Release?

Preparing paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Hennepin Release of Mortgage / Deed of Trust - Full Release without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Hennepin Release of Mortgage / Deed of Trust - Full Release on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Hennepin Release of Mortgage / Deed of Trust - Full Release:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!