A Phoenix Arizona Partial Release of Mortgage, also known as a Deed of Trust, is a legal document that signifies the partial release of a mortgage or deed of trust on a mineral or royalty interest. When an individual or entity sells off a portion of their mineral or royalty interest, they may choose to release a specific portion of the mortgage or deed of trust related to that particular interest. This type of partial release is commonly used in cases where the property owner retains a portion of the mineral or royalty interest and wants to release the mortgage or deed of trust only on the portion being sold. By doing so, the granter can free up the sold portion from any encumbrances, while retaining ownership of the remaining portion. The Phoenix Arizona Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Granter serves as evidence that the granter has relinquished their mortgage or deed of trust on the specified portion of the mineral or royalty interest. This document provides legal clarity and ensures that all parties involved are aware of the changes in ownership and release of encumbrances. In Phoenix Arizona, there can be different types of Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Granter, depending on the specific details of the transaction. Some of these variations may include: 1. Partial Release of Mortgage on a Mineral Interest: This type of release pertains to situations where the granter is only selling a portion of their mineral interest, and wishes to release the corresponding mortgage or deed of trust. 2. Partial Release of Deed of Trust on a Royalty Interest: In cases where the granter decides to sell only a part of their royalty interest, a partial release of the deed of trust may be executed to release the encumbrances on that specific portion. 3. Partial Release of Mortgage / Deed of Trust on Multiple Tracts: This type of release occurs when the granter sells different portions of their mineral or royalty interest across multiple tracts. Each specific portion's release is documented separately to avoid any ambiguities. It is important to consult legal professionals or real estate experts experienced in the Phoenix Arizona jurisdiction to ensure that the correct type of partial release is used and all legal requirements are met.

Phoenix Arizona Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

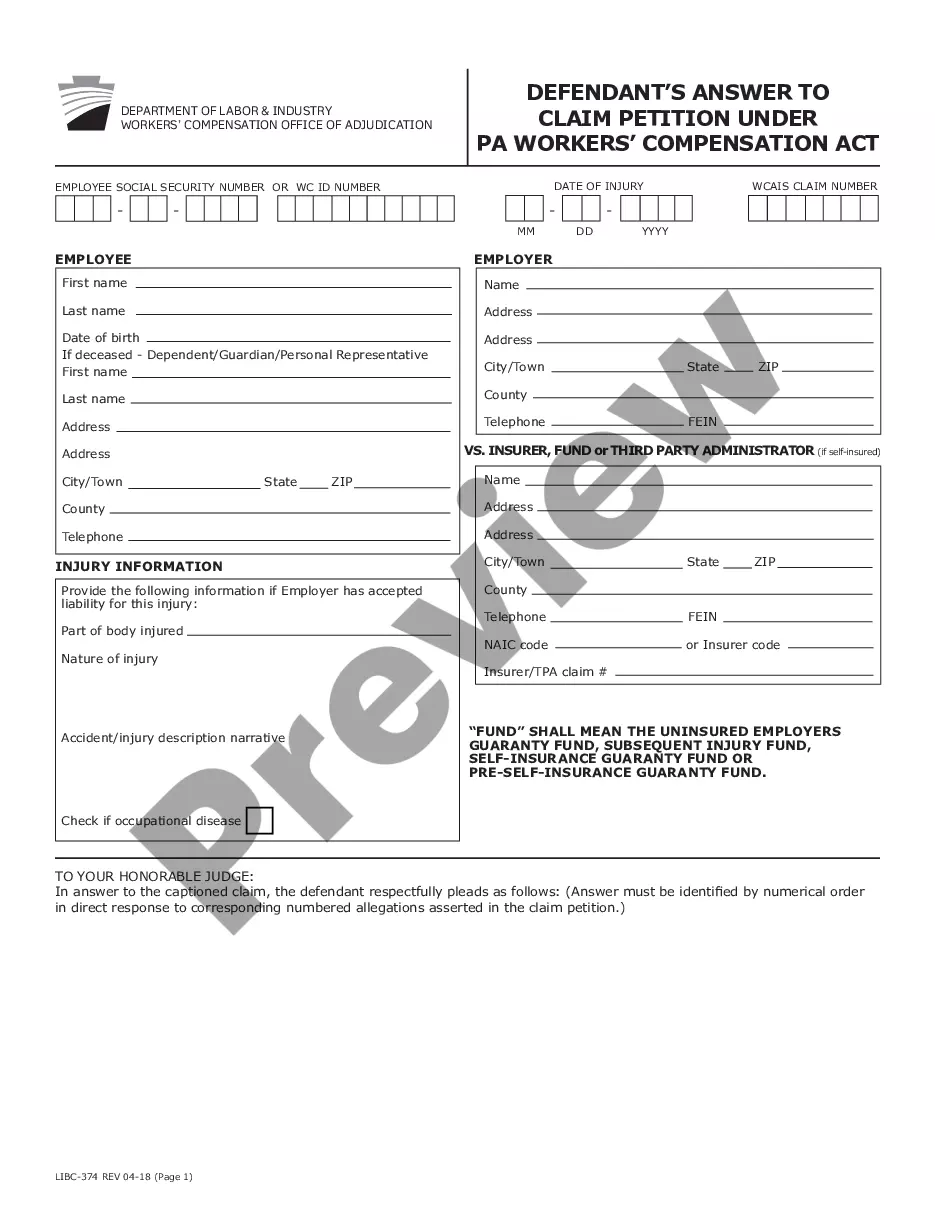

How to fill out Phoenix Arizona Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Phoenix Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Phoenix Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Phoenix Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor:

- Examine the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Also, the mineral rights owners keep the right to lease bonuses, shut-in payments, and lease bonuses. As the royalty rights owner, you would get the right to a percentage of the royalties on oil and gas production from the property without bearing any of the operational cost of production.

The first step in claiming your inherited mineral rights is to find the deed or title to the property. This document will outline who owns the mineral rights and how you can transfer them. Once you have the deed or title, you must contact the appropriate state agency to make a claim.

Reporting the sale of mineral rights for tax purposes If you sell mineral rights and need to report the gain, you should report the sale on Form 4797 and your Schedule D according to TurboTax.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Mineral rights do not expire in North Dakota. When a person purchases them, they own that right forever or until they sell the rights to another individual. These rights do not expire at any point.

The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907.

It may appear from the use of the word ?royalty? that X intends to convey to Y a royalty interest?an interest in the share of production. However, the phrase ?in and under? is typically utilized in conjunction with the conveyance or reservation of a mineral interest.

Are inherited mineral rights taxable? The federal government does not consider inherited mineral rights taxable. Still, any income you accumulate from those rights does have to be reported on your tax return. This is another question you should ask when you accept your inheritance.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.