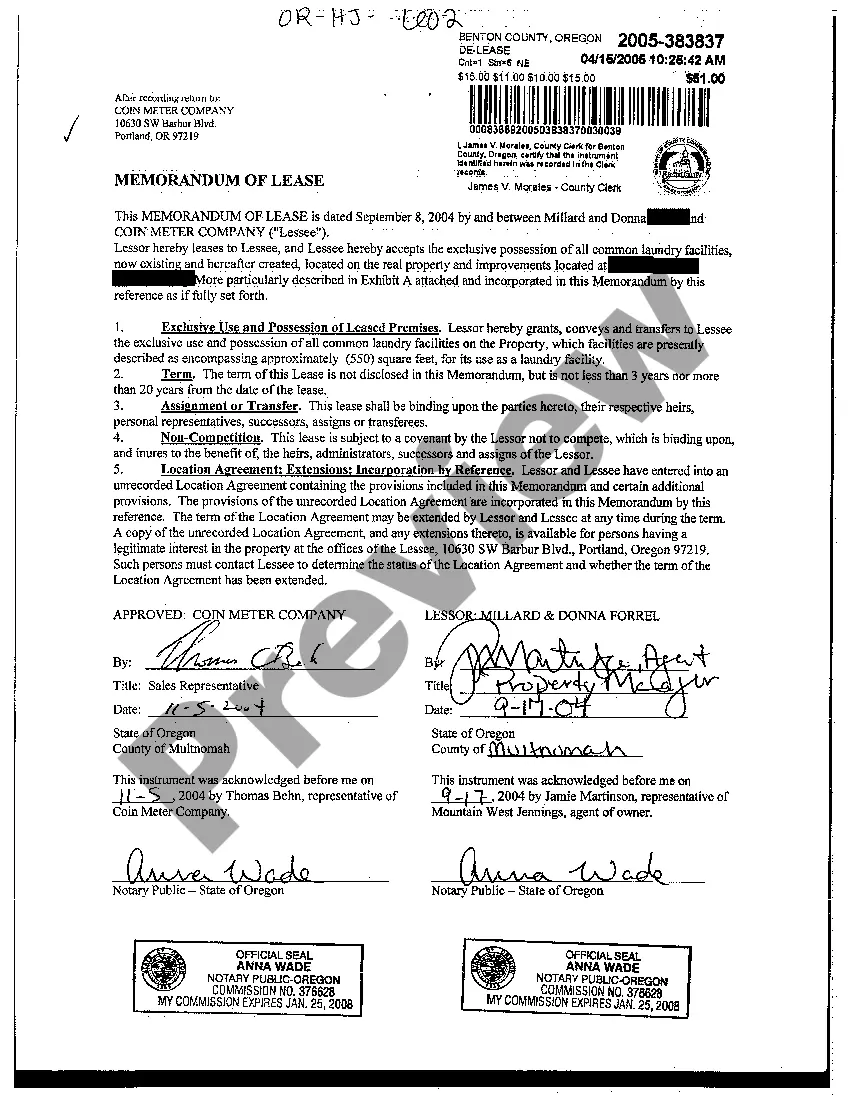

Orange California Subordination Agreement with no Reservation by Lien holder is a legally binding document that establishes the priority of liens on a property in the Orange area of California. This agreement is typically used in real estate transactions when a property owner wants to obtain new financing or refinance their existing loan. A subordination agreement is entered into between the current lien holder (usually a mortgage lender) and the new lender to determine the order of priority in case of default or foreclosure. This agreement ensures that the new loan will be given higher priority over the existing lien, allowing the new lender to secure their interest in the property. In Orange California, there are various types of subordination agreements available, each with its own specific purpose. These include: 1. First Lien Subordination Agreement: This type of subordination agreement is commonly used when the property owner wants to obtain a second mortgage or secure additional financing. By agreeing to subordinate the existing lien, the first lien holder agrees to let the new lender hold the first position on the property. 2. Second Lien Subordination Agreement: In situations where the property owner already has a first mortgage and wants to obtain a second loan, this agreement is used. The first lien holder, in this case, agrees to subordinate their lien to the new lender, allowing the second lender to hold the second position on the property. 3. Subordinated Deed of Trust Agreement: This type of subordination agreement is used when the property owner wants to refinance their existing loan. The existing lender agrees to subordinate their lien to the new lender, allowing the property owner to secure a new loan and potentially obtain more favorable terms. It's important to note that in all these types of subordination agreements, the lien holder agrees to waive their right to retain any reservations or preferences, ensuring that the new lender takes precedence in case of default or foreclosure. Orange California Subordination Agreement with no Reservation by Lien holder is a crucial legal document that helps property owners secure additional financing or refinance their existing loans. It provides clarity and establishes the order of priority between multiple lenders, ensuring a smooth transaction and protecting the interests of all parties involved.

Orange California Subordination Agreement with no Reservation by Lienholder

Description

How to fill out Orange California Subordination Agreement With No Reservation By Lienholder?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Orange Subordination Agreement with no Reservation by Lienholder meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Orange Subordination Agreement with no Reservation by Lienholder, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Orange Subordination Agreement with no Reservation by Lienholder:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Orange Subordination Agreement with no Reservation by Lienholder.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!