A Dallas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lien holder is a legal agreement that outlines the hierarchy of rights between a mortgage or deed of trust and an oil and gas lease on a property located in Dallas, Texas. This arrangement is commonly used when a property owner wishes to lease their land for oil and gas exploration and production while still having an existing mortgage or deed of trust on the property. The purpose of this subordination is to establish the priority of payments received from the oil and gas lease. Typically, the lease provides for a bonus payment, which is a lump sum paid upfront, and royalty payments, which are a percentage of the revenue generated from oil and gas production on the property. Under this subordination agreement, these payments are directed to the lessor (property owner) until the lien holder (mortgage or deed of trust holder) receives a notice. By subordinating the mortgage or deed of trust to the oil and gas lease, the lessor ensures that they can receive the bonus and royalty payments without interference from the lien holder, as long as the lien holder has not given notice. Once the lien holder receives notice, they may assert their right to redirect the payments to satisfy the outstanding mortgage or deed of trust. Different types of Dallas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lien holder can vary based on specific terms and conditions agreed upon between the parties involved. The exact terms may include the duration of the subordination, the percentage of royalty payments owed to the lessor, any restrictions on the use of the property during leasing, and the manner in which notice should be given to the lien holder. In conclusion, a Dallas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lien holder allows property owners to lease their land for oil and gas exploration while still honoring their mortgage or deed of trust obligations. This arrangement ensures a clear understanding of payment priorities and protects the interests of both the lessor and the lien holder.

Dallas Texas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder

Description

How to fill out Dallas Texas Subordination Of Mortgage / Deed Of Trust To Oil And Gas Lease With Bonus And Royalty Payments To Go To Lessor Until Notice From Lienholder?

Drafting paperwork for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Dallas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder without professional help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Dallas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Dallas Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder:

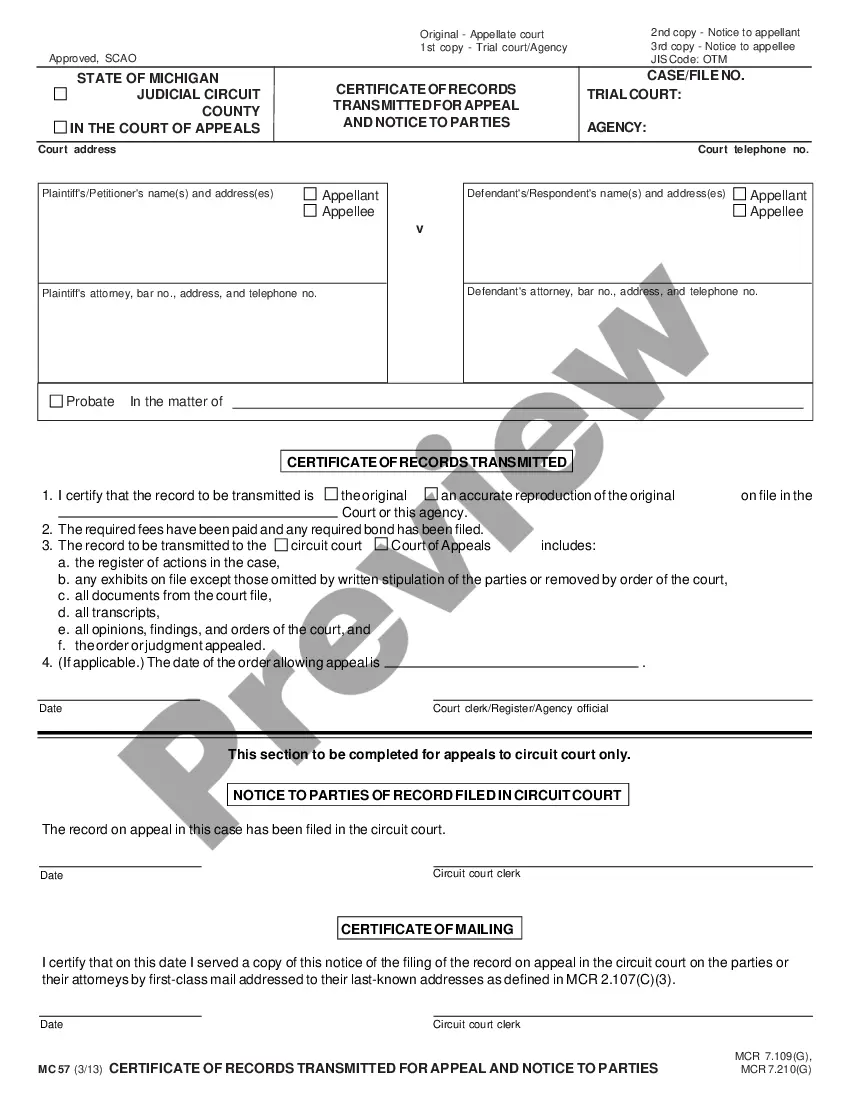

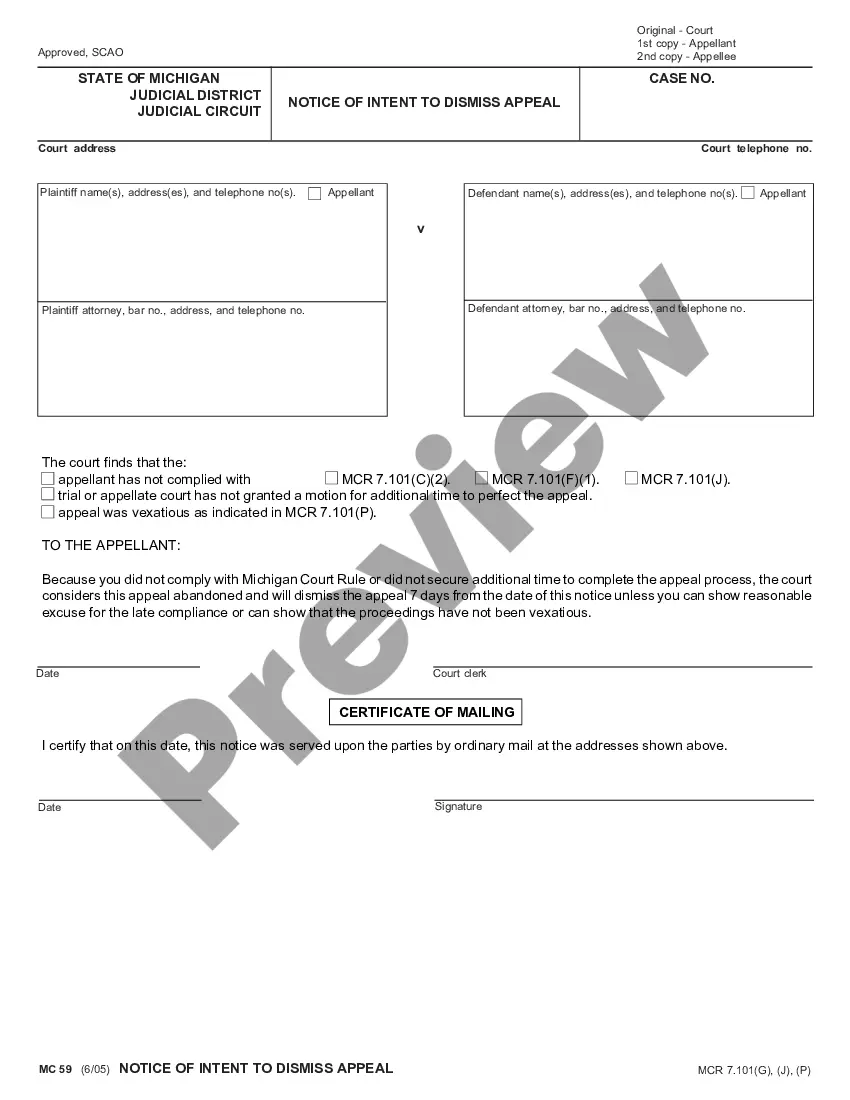

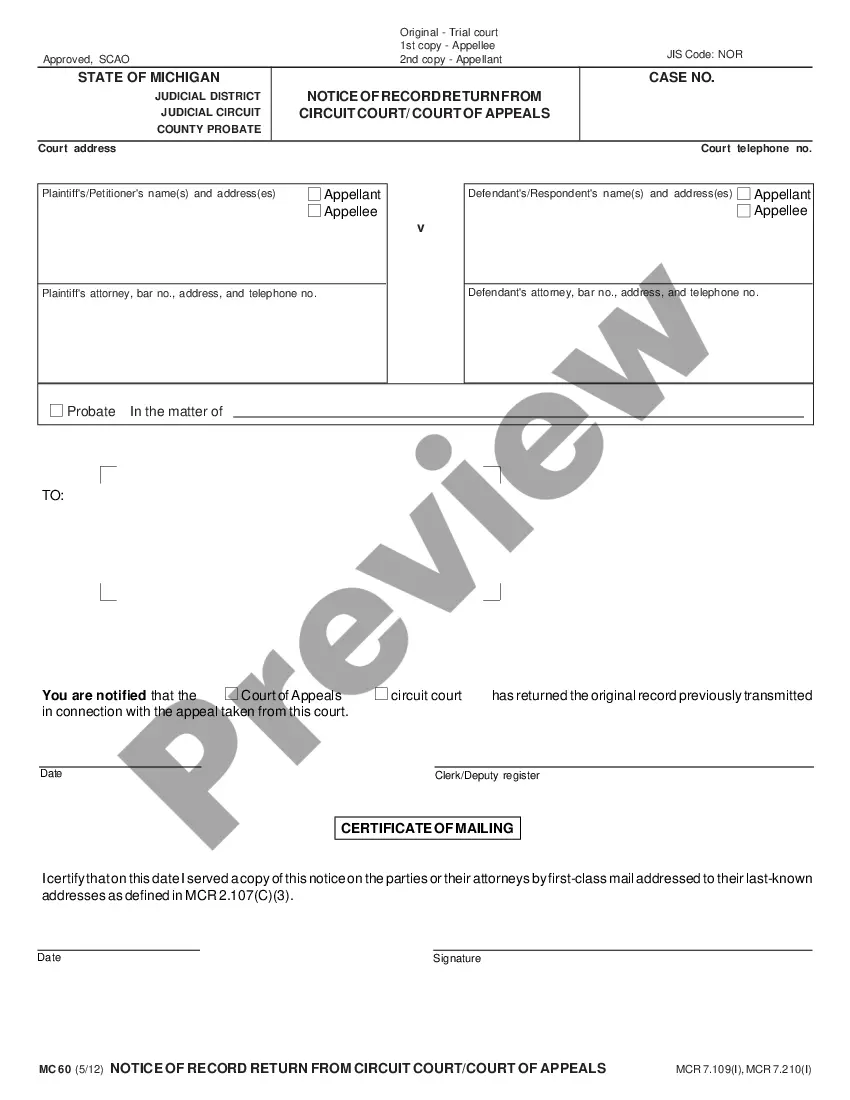

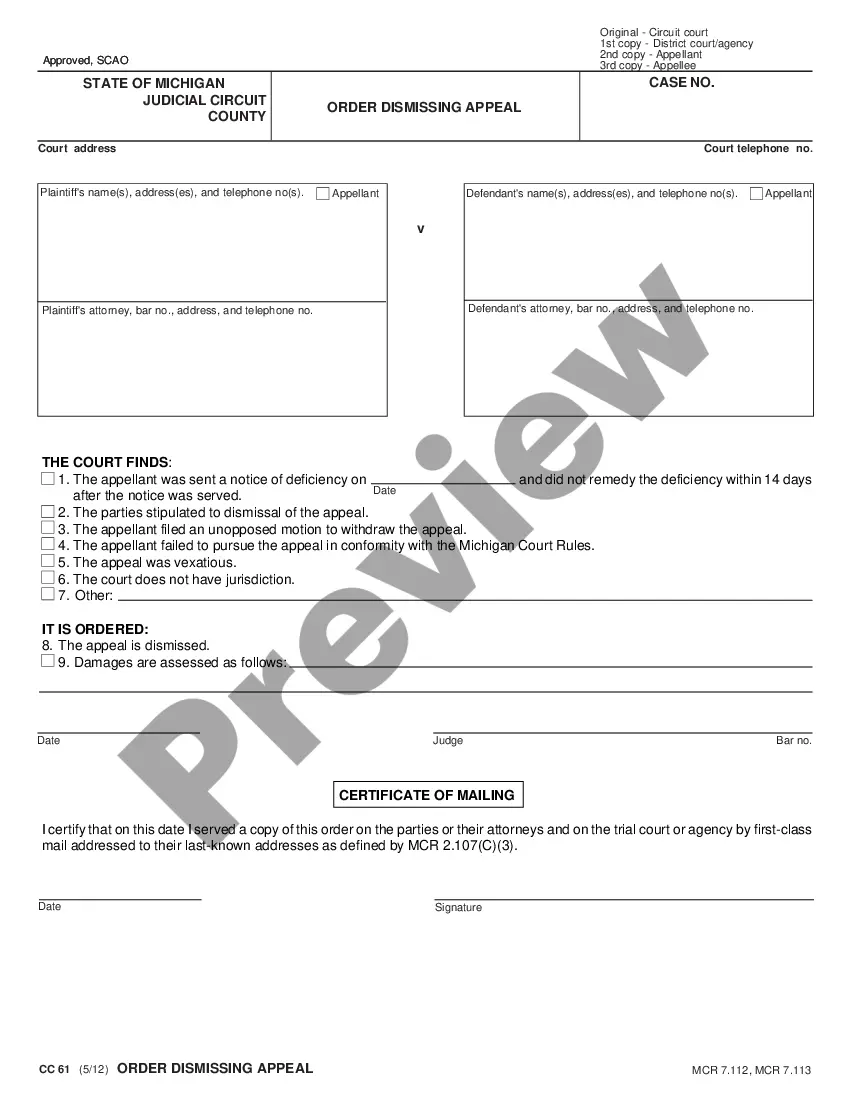

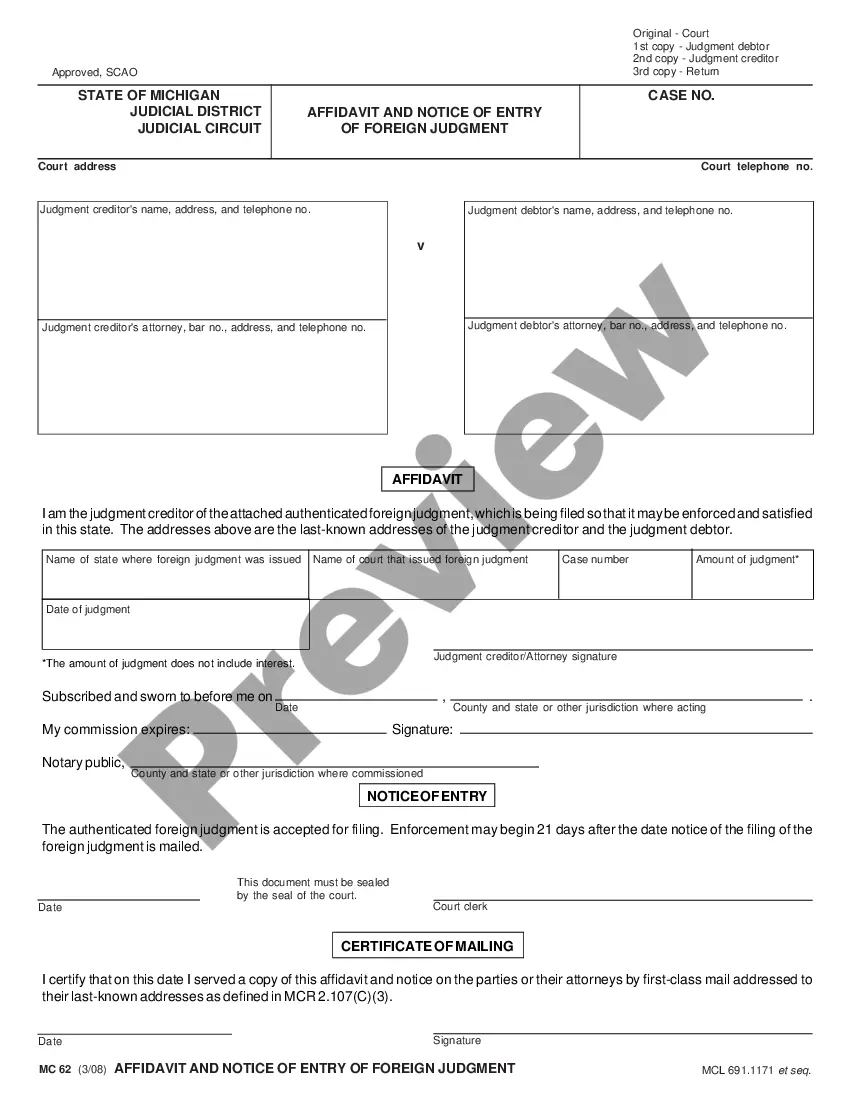

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!