Salt Lake Utah is a diverse and vibrant city, located in the northern part of the state. Known for its stunning natural beauty and thriving economy, Salt Lake Utah offers a unique blend of urban amenities and outdoor recreational opportunities. One particular aspect of real estate transactions in this area involves the subordination of a mortgage or deed of trust to an oil and gas lease, with bonus and royalty payments going to the lessor until notice from the lien holder. The subordination of a mortgage or deed of trust to an oil and gas lease in Salt Lake Utah is a legal agreement that allows the owner of the land to lease their property for oil and gas exploration and production. In this arrangement, the owner of the land, known as the lessor, agrees to receive bonus and royalty payments from the oil and gas company in exchange for granting them access to the valuable natural resources beneath the surface. However, in order to protect the interests of the lien holder, who holds a mortgage or deed of trust on the property, a subordination agreement is required. This agreement ensures that the lien holder will be paid first in the event of foreclosure, even if the property is producing oil or gas. There are different types of Salt Lake Utah subordination of mortgage or deed of trust to oil and gas lease with bonus and royalty payments to go to the lessor until notice from the lien holder. Some common variations include: 1. Partial subordination: This type of agreement allows for the partial subordination of the mortgage or deed of trust. In this case, only a portion of the bonus and royalty payments will be redirected to the lessor until notice from the lien holder. 2. Temporary subordination: This agreement specifies a fixed period during which bonus and royalty payments will go to the lessor until notice from the lien holder. Once the specified time period elapses, the lien holder will receive the payments as per the original mortgage or deed of trust terms. 3. Full subordination: This type of agreement completely subordinates the mortgage or deed of trust to the oil and gas lease, meaning that all bonus and royalty payments will be directed to the lessor until notice from the lien holder. It is important for all parties involved, including the lessor, the oil and gas company, and the lien holder, to carefully review and negotiate the terms of the subordination agreement to ensure their respective interests are protected. Legal counsel is often recommended ensuring compliance with local laws and regulations. In conclusion, the subordination of mortgage or deed of trust to an oil and gas lease with bonus and royalty payments going to the lessor until notice from the lien holder is a significant aspect of real estate transactions in Salt Lake Utah. By understanding the different types and implications of these agreements, all parties can work towards a mutually beneficial arrangement that allows for both oil and gas exploration and the protection of financial interests.

Salt Lake Utah Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder

Description

How to fill out Salt Lake Utah Subordination Of Mortgage / Deed Of Trust To Oil And Gas Lease With Bonus And Royalty Payments To Go To Lessor Until Notice From Lienholder?

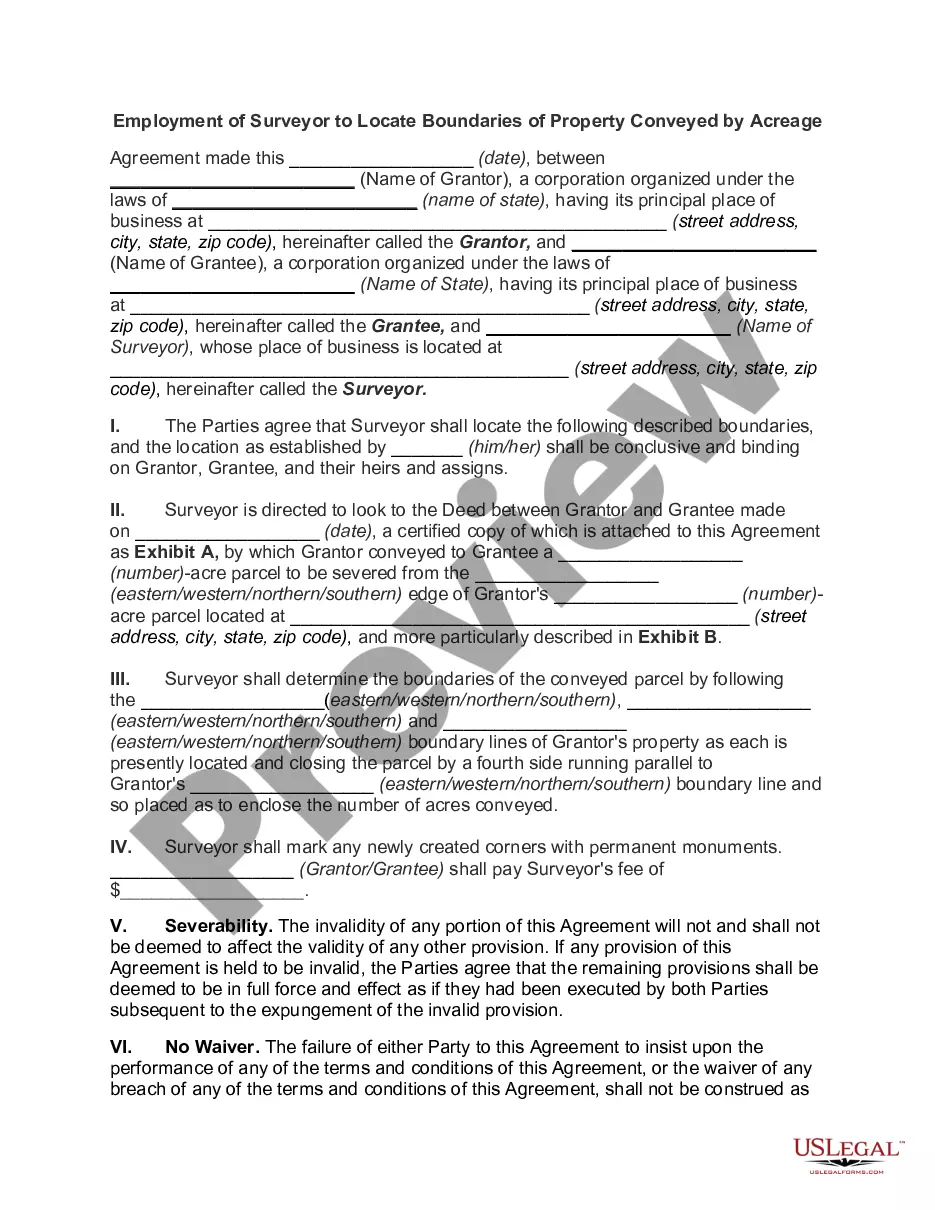

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Salt Lake Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder.

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Salt Lake Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Salt Lake Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder:

- Ensure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Salt Lake Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

So, the purpose of a subordination agreement is to adjust the new loan's priority so that in the event of a foreclosure, that lien gets paid off first. In a subordination agreement, a prior lienholder agrees that its lien will be subordinate (junior) to a subsequently recorded lien.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

Often, all the information needed will be available from your mortgage lender and the title company. The process usually takes approximately 25 business days.

Put simply, a subordination agreement is a legal agreement which establishes one debt as ranking behind another debt in the priority for collecting repayment from a debtor. It is an arrangement that alters the lien position.

The lender of the first mortgage refinancing will now require that a subordination agreement be signed by the second mortgage lender to reposition it in top priority for debt repayment. The priority interests of each creditor are changed by agreement from what they would otherwise have become.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

A subordination agreement refers to a legal agreement that prioritizes one debt over another for securing repayments from a borrower. The agreement changes the lien position. A lien is a right allowing one party to possess a property of another party who owns a debt until the debt is dissolved.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.