A San Diego California Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lien holder is a legal agreement that establishes the priority of interests between a mortgage or deed of trust on a property and an oil and gas lease with bonus and royalty payments. This type of subordination agreement is commonly used in situations where the property owner wishes to lease the mineral rights to an oil and gas company. The purpose of the subordination agreement is to clarify that the mortgage or deed of trust will be subordinate to the oil and gas lease, meaning that the lease will take priority in terms of receiving payments from the oil and gas company. The agreement also specifies that these payments, including bonus and royalty payments, will be directed to the lessor until the lien holder (the mortgagee or beneficiary of the deed of trust) provides notice of their claim. By creating this subordination agreement, the lessor (property owner) can lease the mineral rights and receive payments from the oil and gas company without any conflicts arising with the mortgage lender or beneficiary. It ensures that the oil and gas lease payments will be made to the lessor until the lien holder asserts their claim and provides proper notice. In San Diego, California, there might be different types of subordination agreements depending on the specific circumstances and parties involved. For example: 1. Subordination of Mortgage to Oil and Gas Lease with Bonus and Royalty Payments: This type of agreement applies when there is a mortgage on the property, and the property owner wants to lease the mineral rights for oil and gas exploration or extraction. 2. Subordination of Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments: In this scenario, the property is subject to a deed of trust rather than a conventional mortgage. The property owner wants to lease the mineral rights while ensuring that the lease payments go to the lessor until the lien holder provides notice. It is important for property owners, mortgage lenders, and lessors to consult with legal professionals experienced in real estate and oil and gas law to ensure that all agreements are drafted correctly and adequately protect the interests of all parties involved.

San Diego California Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder

Description

How to fill out San Diego California Subordination Of Mortgage / Deed Of Trust To Oil And Gas Lease With Bonus And Royalty Payments To Go To Lessor Until Notice From Lienholder?

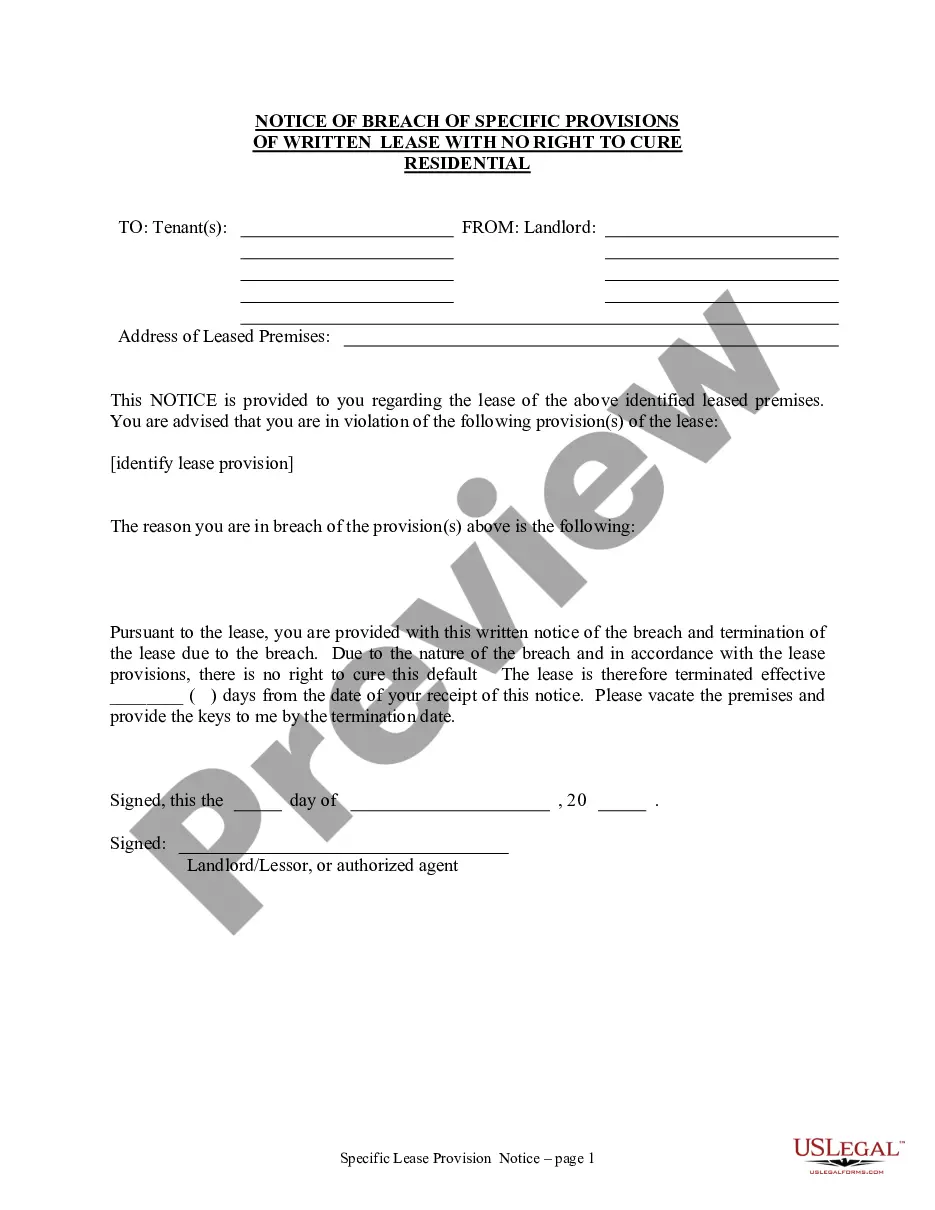

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the latest version of the San Diego Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your San Diego Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

A Pugh Clause is meant to prevent a lessee from declaring all lands under an oil and gas lease as being held by production, even if production only occurs on a fraction of the property.

The basic royalty calculation is: the landowner's acreage in the unit / (divided by) total number of acres in the unit x (multiplied by) royalty rate x (multiplied by) production = (equals the) gross royalty. An example may be helpful.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

In general terms, the Pugh Clause provides that production from a unitized or pooled area located on or including a portion of the leased lands will not be sufficient to extend the primary term for the entire leasehold.

The horizontal Pugh clause operates to release all lands not included in a pooled unit, typically at the end of the primary term or after cessation of continuous drilling operations, if the lease provides for same. The horizontal Pugh clause releases land at the surface as to all depths.

Average Oil Royalty Payment For Oil Or Gas Lease The federal government charges oil and gas companies a royalty on hydrocarbon resources extracted from public lands. The standard Federal royalty payment was 12.5%, or a 1/8th royalty.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, according to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

1/6 royalty = $50,100/year = $1,252.50/acre/year. 3/16 royalty = $56,400/year = $1,410/acre/year. 0.20 royalty = $60,000/year = $1,500/acre/year. 0.25 royalty = $75,000 = $1,875/acre/year.

Again, negotiating oil leases takes time. Don't Respond That You're Not Interested.Don't Rush to Hire a Lawyer.Don't Start Spending Money You Don't Yet Have.Don't Warrant the Mineral Title.Don't Lease Multiple Non-contiguous Tracts on One Lease Form.Don't Spout Off during Negotiating.