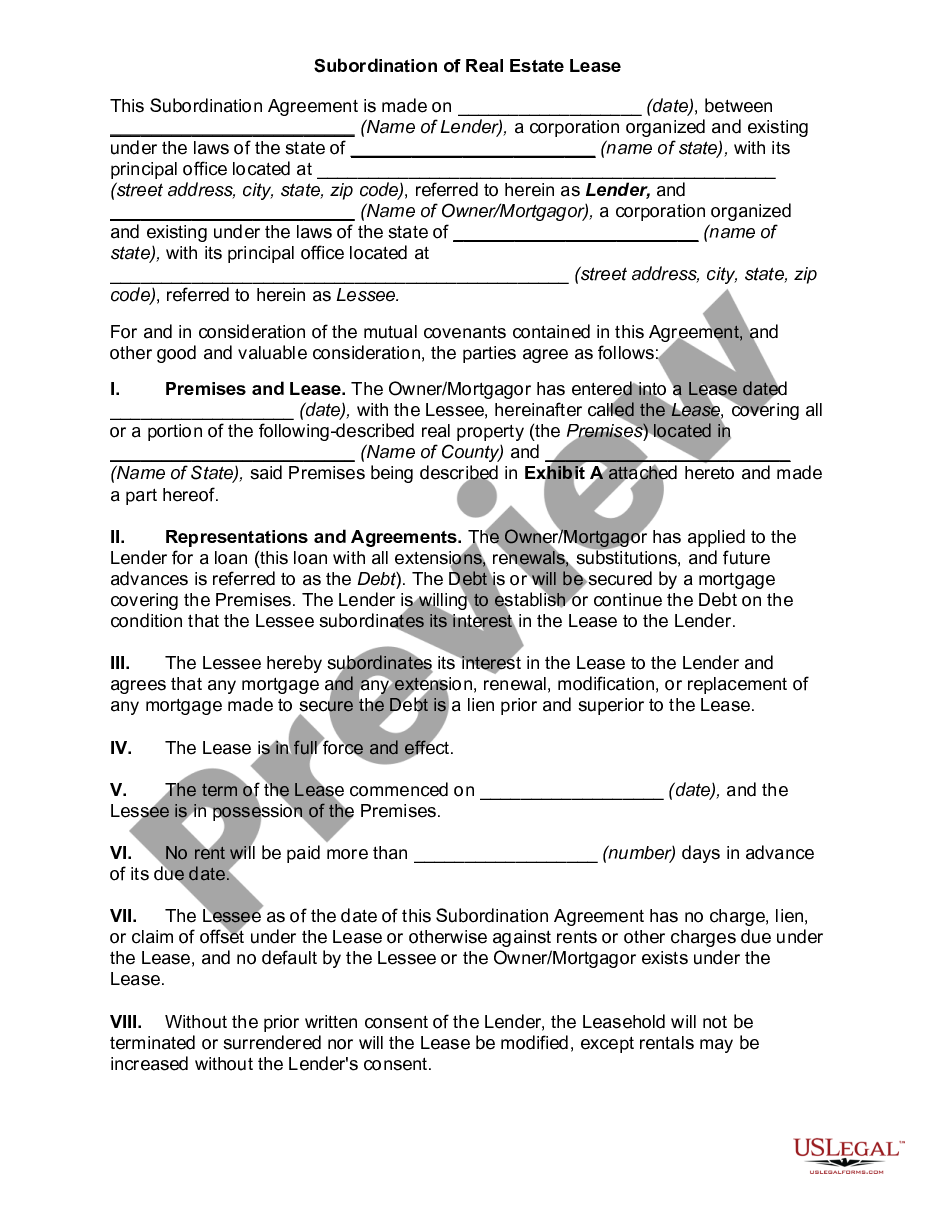

Allegheny Pennsylvania Surface Tenant's Subordination to An Oil and Gas Lease

Description

How to fill out Surface Tenant's Subordination To An Oil And Gas Lease?

Preparing documentation, such as the Allegheny Surface Tenant's Subordination to An Oil and Gas Lease, for managing your legal matters can be a challenging and time-intensive endeavor. Many circumstances necessitate the engagement of a lawyer, which also renders this process costly. Nevertheless, you have the option to handle your legal issues independently. US Legal Forms is here to assist. Our platform offers more than 85,000 legal documents designed for a range of cases and life scenarios. We guarantee that each document adheres to state laws, alleviating concerns about possible compliance-related legal complications.

If you're already acquainted with our platform and hold a subscription with US, you're likely aware of how effortless it is to obtain the Allegheny Surface Tenant's Subordination to An Oil and Gas Lease template. Simply Log In to your account, download the form, and tailor it to your specifications. Have you misplaced your document? Don’t fret. You can retrieve it from the My documents section of your account - accessible on both desktop and mobile.

The onboarding process for new users is quite simple! Here’s what you need to do prior to downloading the Allegheny Surface Tenant's Subordination to An Oil and Gas Lease: Ensure that your document complies with your state or county, as the regulations for creating legal documents may vary from one jurisdiction to another. Learn more about the form by previewing it or reviewing a brief description. If the Allegheny Surface Tenant's Subordination to An Oil and Gas Lease isn’t what you were searching for, use the header to find another option. Sign in or create an account to start utilizing our service and acquire the form.

Locating and purchasing the suitable template through US Legal Forms is a straightforward endeavor. Countless organizations and individuals are already benefiting from our vast assortment. Subscribe now to discover what additional advantages you can gain with US Legal Forms!

- Everything appears satisfactory on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment method and input your payment details.

- Your template is prepared for use. You can attempt to download it.

Form popularity

FAQ

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

Subordination agreement is a contract which guarantees senior debt will be paid before other subordinated debt if the debtor becomes bankrupt.

Subordination clauses are commonly used when a home loan is refinanced. Refinancing results in the original home loan being paid off and a newer loan with a different interest rate being established.

Subordination is putting something in a lower position or rank. Therefore, a subordination agreement puts the lease below the mortgage loan in priority. Mortgage lenders want the leases to be subordinate to the mortgage. That way, the mortgage loan is paid first if there is a foreclosure.

We briefly discuss three types of agreements below. An executory subordination agreement is an agreement under which the subordinating party, like the seller of land, agrees to execute a subsequent instrument subordinating his or her security interest to another security interest, like the lien of a construction loan.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

A subordination clause is a lease provision whereby the tenant subordinates its possessory interest in the leased premises to a third-party lender, usually a bank (the rights of the tenant are thus subject to the rights of the lender).

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Subordinate Liens means Liens in favor of Lender, securing all or any portion of the Obligation, including, but not limited to, Rights in any Collateral created in favor of Lender, whether by mortgage, pledge, hypothecation, assignment, transfer, or other grant or creation of Liens.