Allegheny Pennsylvania Affidavit of Heirship for Mineral Rights

Description

How to fill out Affidavit Of Heirship For Mineral Rights?

Formulating legal documents is essential in the current era. Nevertheless, seeking expert help to create some from scratch is not always necessary, including the Allegheny Affidavit of Heirship for Mineral Rights, when utilizing a service like US Legal Forms.

US Legal Forms boasts more than 85,000 documents across various categories, spanning from living wills to real estate forms and divorce papers. All documents are classified by their respective state, enhancing the user experience while searching.

Additionally, you can find informational resources and guides on the site to facilitate any tasks related to the execution of paperwork.

If you are a current subscriber to US Legal Forms, you can find the relevant Allegheny Affidavit of Heirship for Mineral Rights, Log In to your account, and download it. Naturally, our platform cannot entirely replace a lawyer. For highly complex cases, we recommend utilizing an attorney's services to review your document before execution and filing.

With over 25 years in business, US Legal Forms has become a preferred platform for a wide array of legal documents for millions of clients. Join them today and easily obtain your state-specific paperwork!

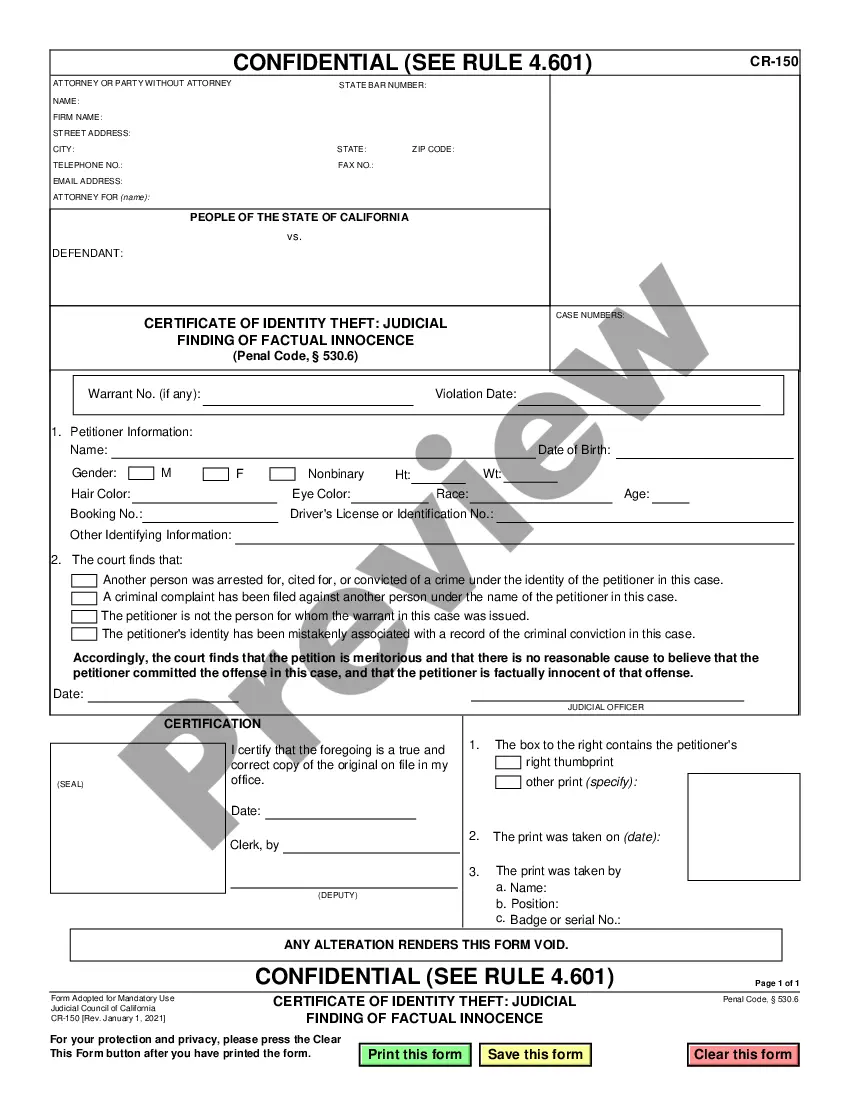

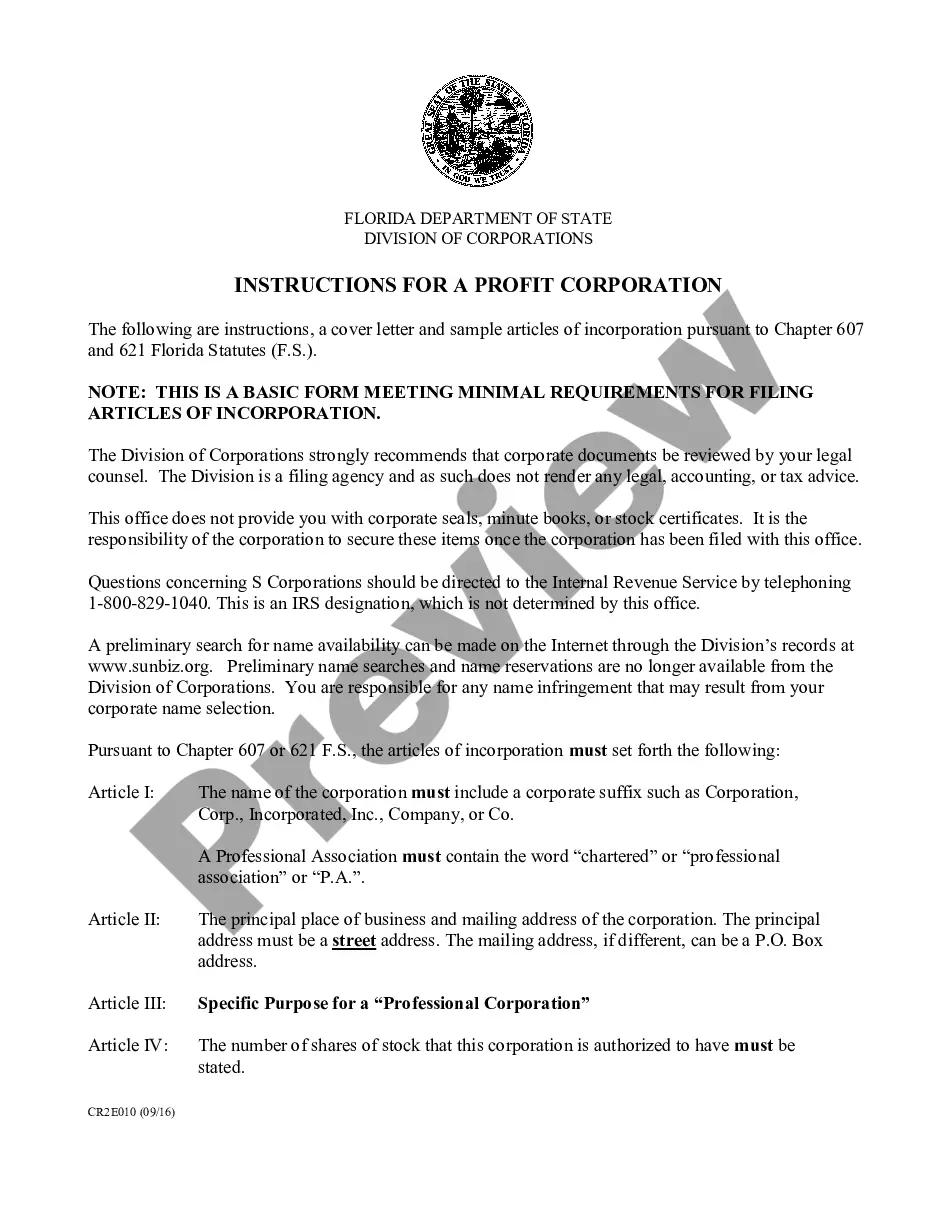

- Review the document's preview and outline (if available) to gain a basic understanding of what you'll receive once you download the form.

- Confirm that the document selected is suitable for your state/county/region, as state regulations can influence the legitimacy of certain records.

- Inspect similar document templates or restart the search to find the correct file.

- Click Buy now and create your account. If you already possess one, choose to Log In.

- Select the pricing {plan, followed by the preferred payment gateway, and acquire the Allegheny Affidavit of Heirship for Mineral Rights.

- Opt to save the form template in any accessible file format.

- Navigate to the My documents section to re-download the file.

Form popularity

FAQ

Are inherited mineral rights taxable? The federal government does not consider inherited mineral rights taxable. Still, any income you accumulate from those rights does have to be reported on your tax return. This is another question you should ask when you accept your inheritance.

Mineral rights give the owner the right to drill for and sell any oil, water, or precious minerals that can be found underground. Some property owners opt to separate their interest in the land's mineral rights from the surface rights, and can pass down that interest to their heirs.

A sale is usually a forever transaction; once sold they are gone. A mineral lease can be long term if there is mineral production, or shorter if the acreage is not part of a drilling unit that produces royalties. Continual ownership may provide the opportunity to lease multiple times and receive multiple bonuses.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

The purpose of a division order is to protect the company paying the royalty (payor) from double liability. If you sign a division order and it turns out that you should have been paid a larger interest than shown on the division order, the company is protected as long as it paid according to the division order.

Go to the Courthouse to Search Mineral Ownership Records If you don't have the description, go to the tax office first. As a surface owner, you are paying property taxes and they can assist you with your property description. It's best if you have the deed that was signed when you or a relative purchased the property.

The statute allowing for an affidavit of tangible personal property to transfer an estate's personal assets also allows for an affidavit of death and heirship to transfer severed mineral interests to an heir. The affidavit must be filed with the county clerk in the county where the property is located.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that all minerals are included.