Orange California Affidavit of Heirship for Small Estates

Description

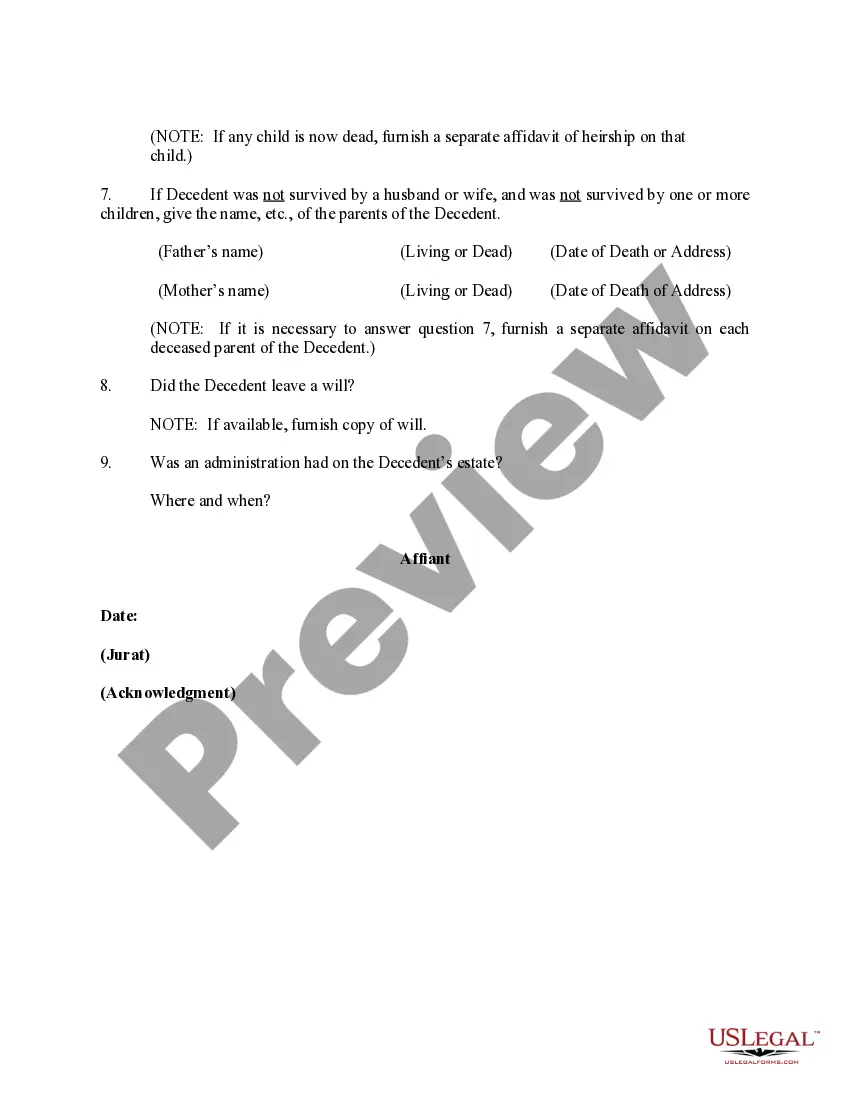

How to fill out Affidavit Of Heirship For Small Estates?

Do you require to swiftly create a legally-recognized Orange Affidavit of Heirship for Small Estates or potentially any other document to oversee your personal or business affairs.

You have two alternatives: consult a specialist to draft a legal document for you or compose it on your own from scratch. Fortunately, there's another option - US Legal Forms. It will assist you in obtaining well-crafted legal documents without incurring exorbitant costs for legal assistance.

If the document isn’t what you require, restart the search using the search box in the header.

Select the plan that best aligns with your needs and proceed to payment. Choose the format you wish to receive your document in and download it. Print it, complete it, and sign on the designated line. If you've already created an account, you can Log In to it easily, locate the Orange Affidavit of Heirship for Small Estates template, and download it. To re-download the form, simply go to the My documents tab. Buying and downloading legal forms from our catalog is straightforward. Furthermore, the templates we provide are vetted by legal professionals, which offers you enhanced reassurance when dealing with legal issues. Experience US Legal Forms today and discover the benefits for yourself!

- US Legal Forms presents a comprehensive selection of over 85,000 state-specific document templates, including the Orange Affidavit of Heirship for Small Estates and corresponding form packages.

- We offer papers for various life events: from divorce documentation to real estate paperwork.

- We have been in business for more than 25 years and have established a strong reputation among our clientele.

- Here’s how you can join our satisfied customers and obtain the template you need without unnecessary complications.

- First and foremost, ensure the Orange Affidavit of Heirship for Small Estates is suitable for your state's or county's laws.

- If the document includes a description, confirm its purpose.

Form popularity

FAQ

What Is Considered A Small Estate In California? As of January 1, 2020 the answer is: $166,250 or less. The old amount of assets to be considered a small estate in California was $150,000. $166,250 is also the new limit for small estate affidavits under California probate code section 13100.

California law provides that a probate is not necessary if the total value at the time of death of the assets, which are subject to probate, does not exceed the sum of $100,000. There is a simplified procedure for the transfer of these assets. The $100,000 figure does not include vehicles and certain other assets.

Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident. You can obtain it in person or by accessing your court's self-help center online and downloading the form there.

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.

If the Decedent's probate property has an aggregate fair market value of less than $184,500 (in 2022), or the Decedent's property is to pass to the Decedent's surviving spouse, or where the Decedent intended to transfer his/her property to his/her revocable living trust but failed to accomplish such transfer, a

What Is Considered A Small Estate In California? As of January 1, 2020 the answer is: $166,250 or less. The old amount of assets to be considered a small estate in California was $150,000. $166,250 is also the new limit for small estate affidavits under California probate code section 13100.

For decedents who died prior to April 1, 2022 the California Probate Code provides that probate estates of $166,250 or less do not need to be probated. Deaths on or after April 1, 2022 the threshold amount is $184,500. If the estate consists of assets in excess of the prescribed amount a probate is necessary.

A Texas Small Estate Affidavit can be used to expedite the distribution of the assets of a person who has died (known as a decedent) when the estate is worth $75,000 or less and lacks a will. A successor can use the form to claim assets without undergoing a complicated court proceeding.

California also offers small estate procedures that allow inheritors to use a streamlined version of probate when the value of the assets left behind is less than a certain amount. "Small estates" are defined as estates whose value is no more than $184,500 (for deaths on or after April 1, 2022).