Cuyahoga Ohio Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

A paperwork process constantly accompanies any legal action you undertake.

Starting a business, applying for or accepting an employment offer, transferring ownership, and many other life circumstances necessitate that you prepare official documentation that varies across regions.

That’s why having everything organized in one location is highly advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

All the available templates in our library are expertly composed and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters proficiently with US Legal Forms!

- On this site, you can effortlessly find and download a document for any personal or corporate use relevant to your jurisdiction, including the Cuyahoga Affidavit of Heirship for Real Property.

- Finding templates on the site is incredibly straightforward.

- If you already possess a subscription to our service, Log In to your account, search for the template through the search field, and click Download to save it on your device.

- Subsequently, the Cuyahoga Affidavit of Heirship for Real Property will be accessible for further utilization in the My documents section of your profile.

- If this is your first experience with US Legal Forms, follow this brief guide to acquire the Cuyahoga Affidavit of Heirship for Real Property.

- Ensure you have reached the correct page with your local form.

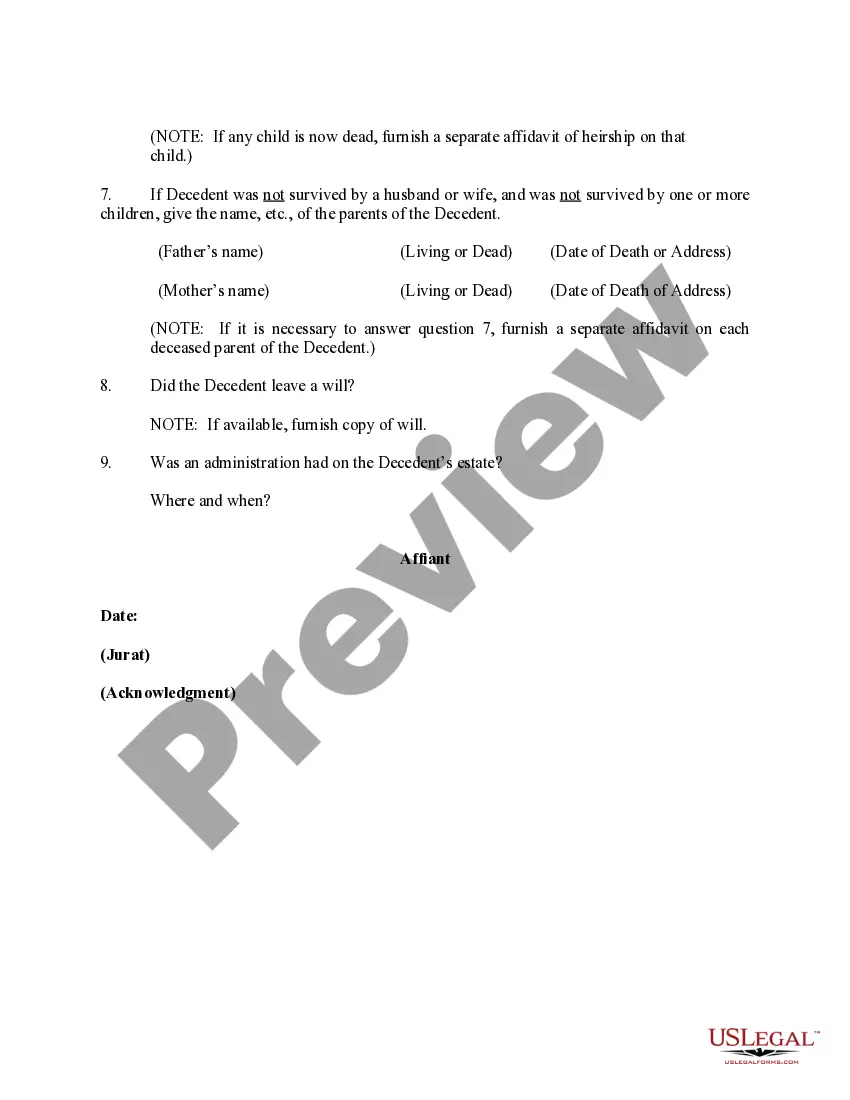

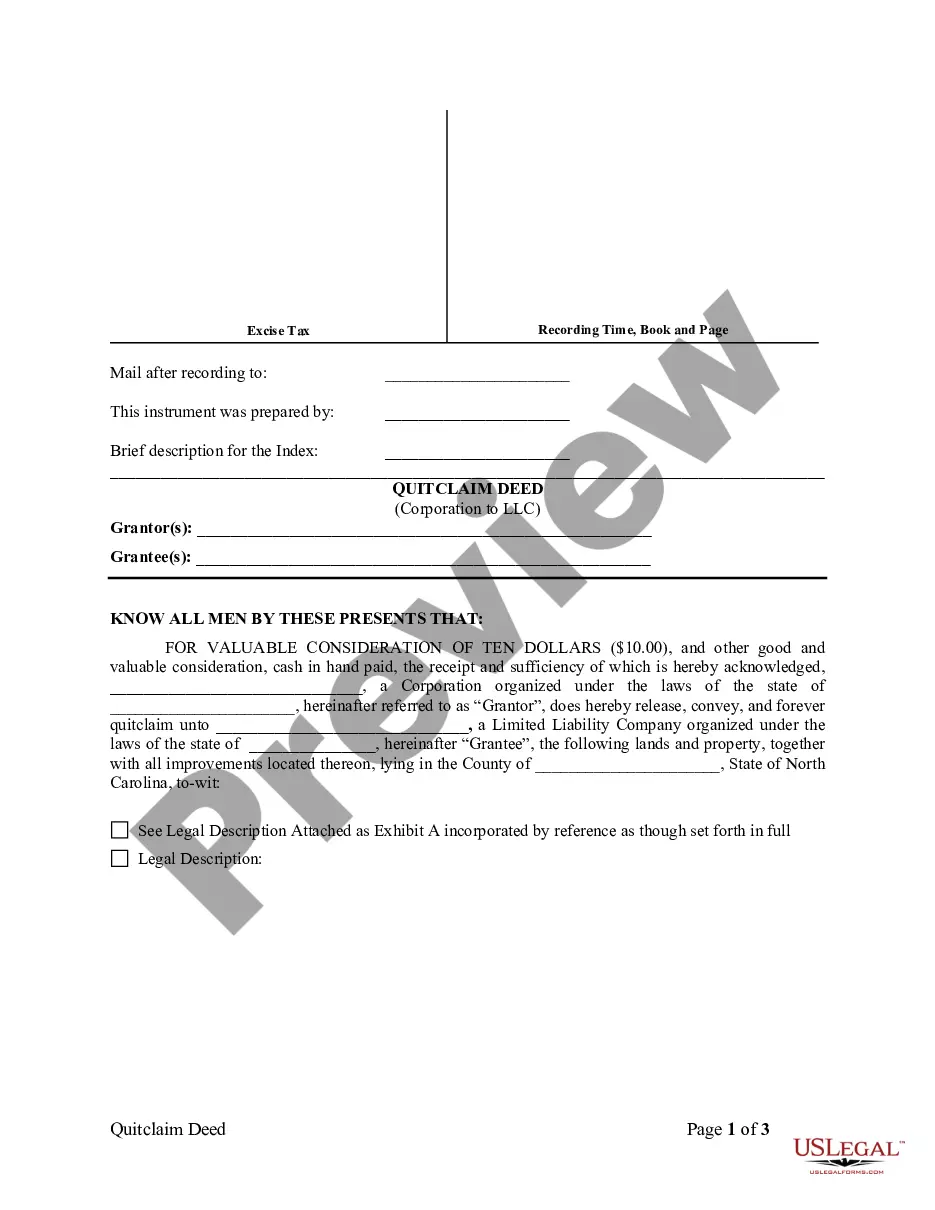

- Utilize the Preview option (if available) and examine the template.

Form popularity

FAQ

Finding out details of money owed by the person who has died. preparing a detailed list of the property, money and possessions and debts in the estate. working out the amount of inheritance tax due and arranging to pay it. preparing and sending off the documents required by the probate registry and HM Revenue and

To probate a will in Ohio, take the following steps: Step 1: Find and File the Decedent's Will.Step 2: Order Decedent's Death Certificate.Step 3: Petition for Probate.Step 4: The Probate Is Opened and Letters of Authority Are Issued.Step 5: Administration, Creditors, and Inventory of the Estate.

Ohio has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

If someone dies without leaving a will, then the person responsible for dealing with their property and possessions is called the administrator of the estate. Inheritance laws determine which relatives can apply to be the administrator, starting with the spouse or civil partner of the person who died.

2117.02: If you are the executor or administrator of an estate, this spells out the procedures and requirements necessary if you want to make a claim against the estate in probate court. Claims must be filed within 3 months of the decedent's death.

In order to be appointed administrator, an application must be filed with the Probate Court which contains the name and address of the surviving spouse and next of kin, if known by the applicant, as well as a general statement as to what property is in the estate and its probable value as well as a statement of the

Basic Ohio Probate Forms Version 8 - YouTube YouTube Start of suggested clip End of suggested clip Form thirteen point seven at the same time I may as well send the two children to the required formsMoreForm thirteen point seven at the same time I may as well send the two children to the required forms you can see how quickly that is I just clicked to another person in the worksheet.

When appointing an administrator of the estate, Ohio law requires that the court ordinarily appoint the surviving spouse of the decedent, of if none, or if the spouse declines, the court will appoint one of the next of kin of the decedent. The administrator must be an Ohio resident.

The executor has three months from their assignation to prepare and file a complete list of the estate's assets. Note that, under Ohio probate law, creditors have six months to file any claims.

Unlike other states, like Colorado, which require a will to be submitted to probate within days of the death, or Pennsylvania, which has a criminal statute for failing to submit a will for probate, Ohio has neither a strict time limit nor a criminal penalty for failing to probate a will.