Collin Texas Affidavit of Warship for the Owner of the Property is a legal document used in Collin County, Texas to establish the rightful heir(s) of an individual who has passed away without leaving a valid will. This affidavit is crucial in determining the distribution of the deceased person's assets and property. Keywords: Collin Texas, Affidavit of Warship, owner of the property, legal document, Collin County, Texas, rightful heir, distribution, deceased person, assets, property. There are two main types of Collin Texas Affidavit of Warship for the Owner of the Property: 1. Non-Informal Affidavit of Warship: This type of affidavit is used in situations where the deceased person did not leave a will and there is no ongoing probate administration. It requires signatories who are disinterested individuals, meaning they have no personal interest in the estate, to swear under oath about the deceased person's family background, marriages, and any known heirs. The affidavit is then recorded in the public records of Collin County to establish the heirs' rights to the property. 2. Informal Affidavit of Warship: This affidavit is used when there is an ongoing probate administration, but no executor or administrator has been appointed. It is similar to the non-informal affidavit of warship but may require additional documentation and approval from the court. This affidavit helps identify the heirs and their respective shares in the estate. In both types of affidavits, it is crucial to provide accurate and detailed information about the deceased person's family history, including marriages, children, siblings, and any known potential heirs. This information will help establish the rightful heirs and the distribution of the property as per Texas intestate succession laws. The Collin Texas Affidavit of Warship for the Owner of the Property is an important legal tool that ensures the proper transfer of the deceased person's assets and property to the rightful heirs. It simplifies the process and helps avoid disputes or confusion regarding the distribution of the estate. It is always advisable to seek legal guidance and assistance when preparing and recording an affidavit of warship to ensure compliance with all relevant laws and regulations in Collin County, Texas.

Collin Texas Affidavit of Heirship for the Owner of the Property

Description

How to fill out Collin Texas Affidavit Of Heirship For The Owner Of The Property?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Collin Affidavit of Heirship for the Owner of the Property, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Collin Affidavit of Heirship for the Owner of the Property from the My Forms tab.

For new users, it's necessary to make some more steps to get the Collin Affidavit of Heirship for the Owner of the Property:

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

(b) Except as provided by Subsection (c), in a proceeding to declare heirship, testimony regarding a decedent's heirs and family history must be taken from two disinterested and credible witnesses in open court, by deposition in accordance with Section 51.203, or in accordance with the Texas Rules of Civil Procedure.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

If the deceased doesn't leave a will (intestate proceeding), the estate will have no free portion and will be divided equally among the surviving spouse and legitimate children. If there are illegitimate children, they are entitled to the equivalent of ½ the share of the legitimate children.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are.

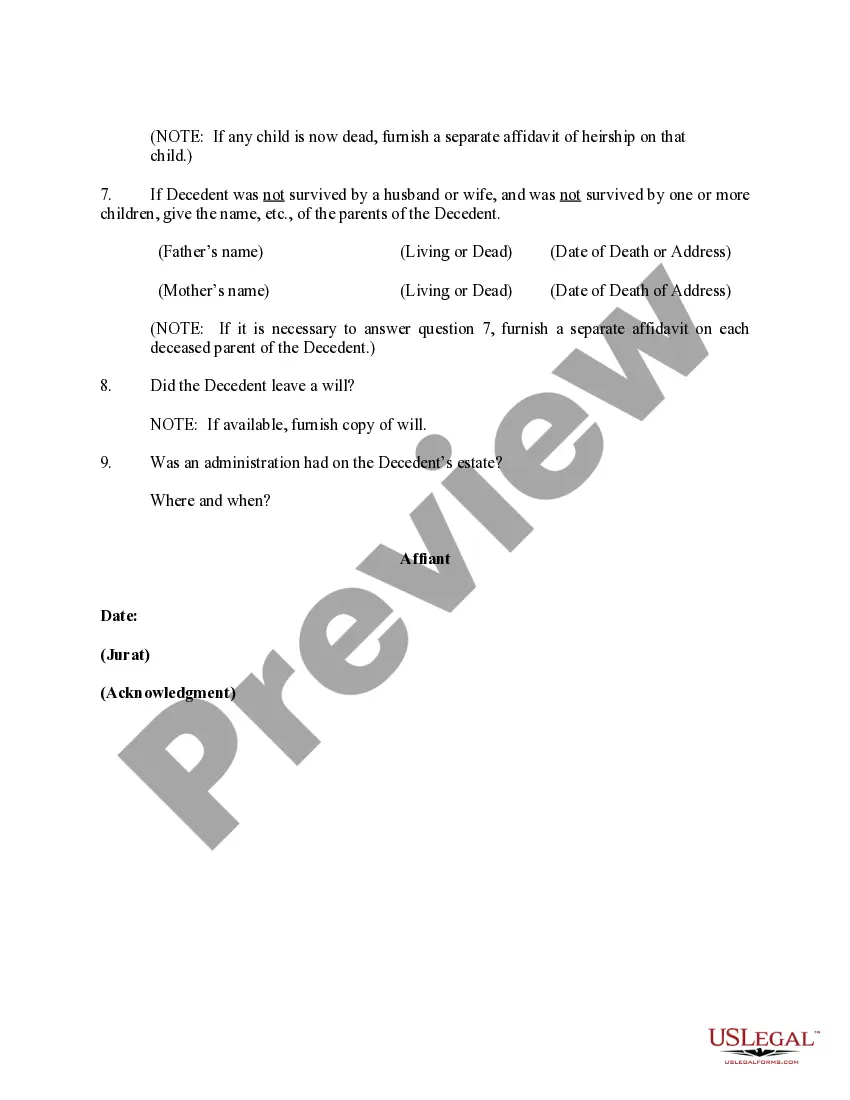

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.