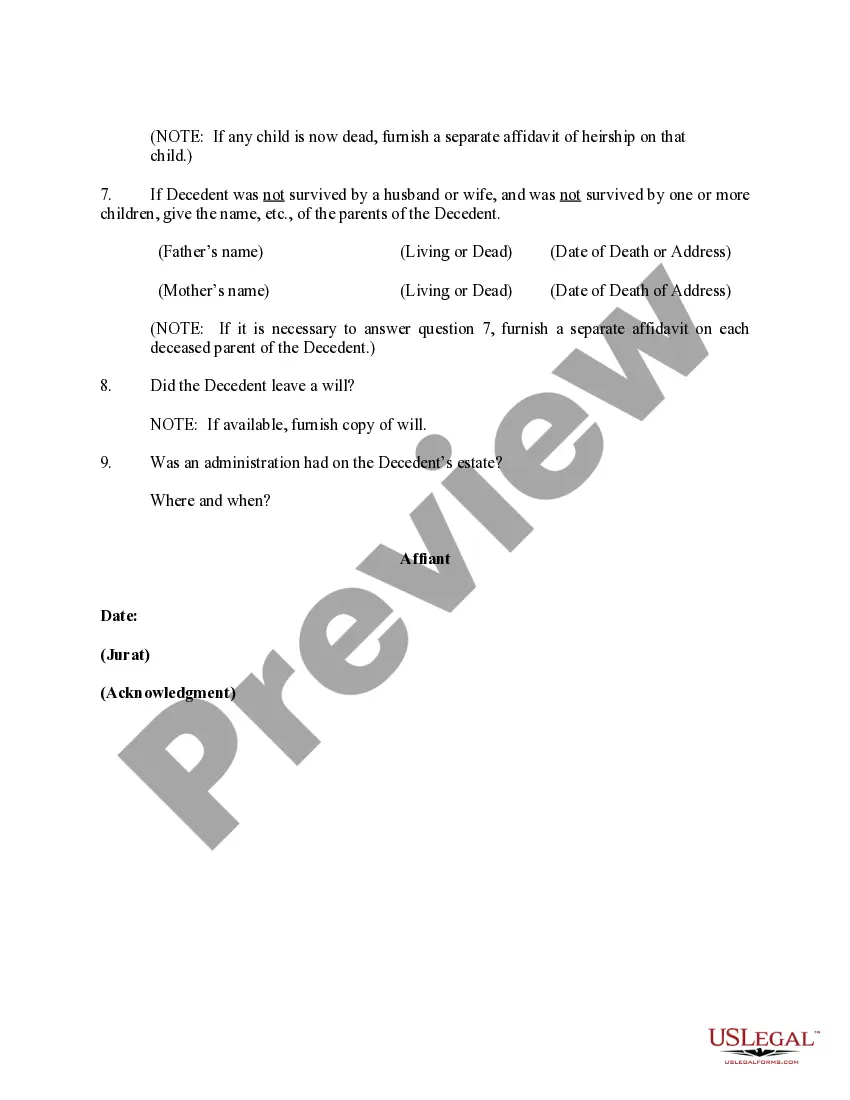

Houston, Texas Affidavit of Warship for the Owner of the Property: A Comprehensive Guide When it comes to real estate ownership in Houston, Texas, understanding the legal procedures and documentation is crucial. In the event of a property owner's passing, an Affidavit of Warship serves as an essential legal document to establish rightful heirs and facilitate the transfer of ownership. What is an Affidavit of Warship? An Affidavit of Warship is a legal document used to establish the rightful heirs and their respective shares in a deceased person's real property. In Houston, Texas, this affidavit plays a crucial role in determining property ownership, especially when the deceased did not leave behind a valid will. By signing this affidavit, the affine (the person creating the affidavit) provides sworn statements, under penalty of perjury, regarding the deceased's family and heirs. The affidavit aims to clarify the intestate inheritance, i.e., the legal heirs when no will is present. Keywords: Houston Texas, Affidavit of Warship, property owner, legal document, real estate ownership, passing, warship, rightful heirs, transfer of ownership. Types of Houston Texas Affidavit of Warship: 1. Standard Affidavit of Warship: This is the most common type used in Houston, Texas. It requires a detailed account of the deceased's family history, including information about their spouse, children, and other potential heirs. The affidavit must be notarized to verify its authenticity. 2. Non-Probate Affidavit of Warship: This type of affidavit is utilized when the deceased's estate falls below a certain value, as determined by Texas law. By completing a Non-Probate Affidavit of Warship, property transfer can occur without going through a formal probate process. However, it's important to consult a legal professional to determine eligibility for this option. 3. Small Estate Affidavit of Warship: When the deceased's estate is considered a "small estate" under Texas law, this affidavit can be utilized to transfer ownership smoothly. It is an expedited process that requires a detailed sworn statement from the affine, stating the legal heirs and their respective shares, and must be filed with the county clerk's office. 4. Probated Affidavit of Warship: This type of affidavit is used when the probate court has already appointed an executor or administrator to handle the deceased's estate. It serves to clarify and validate the heirs' identities and their portions of the property. This document is crucial during the probate process, ensuring a smooth transfer of ownership. Keywords: Standard Affidavit of Warship, Non-Probate Affidavit, Small Estate Affidavit, Probated Affidavit of Warship, family history, notarized, probate process, small estate, formal probate, legal professional, expedited process, county clerk's office, probated, executor, administrator, probate court. In conclusion, the Houston, Texas Affidavit of Warship for the Owner of the Property is a vital legal document used to determine rightful heirs and facilitate the transfer of ownership. Whether it's a standard affidavit, non-probate, small estate, or probated affidavit, each type has its specific requirements to ensure a smooth and legally valid process. Understanding these affidavits is crucial for property owners, their families, and those involved in the inheritance process in Houston, Texas. Keywords: Houston, Texas, Affidavit of Warship, property owner, legal document, real estate ownership, passing, warship, rightful heirs, transfer of ownership, standard affidavit, non-probate affidavit, small estate affidavit, probated affidavit, family history, notarized, probate process, small estate, expedited process, legal professional, county clerk's office, probated, executor, administrator, probate court.

Houston Texas Affidavit of Heirship for the Owner of the Property

Description

How to fill out Houston Texas Affidavit Of Heirship For The Owner Of The Property?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Houston Affidavit of Heirship for the Owner of the Property suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Houston Affidavit of Heirship for the Owner of the Property, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Houston Affidavit of Heirship for the Owner of the Property:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Houston Affidavit of Heirship for the Owner of the Property.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Affidavit of Heirship for Texas Property. Using a properly recorded Affidavit of Heirship, the Texas property records and the property tax records are updated to transfer the property from the deceased's name to the names of the heirs at law without probate.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

The Heirship Affidavit need only be signed Page 2 and sworn by the disinterested parties. All signatures must be in the presence of a Notary Public. Clerk of the county of decedent's residence, along with an Order for the Judge to sign approving it as conforming with the requirements of TPC §137.

It does not transfer title to real property. However, Texas Estates Code 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs.

Ask each individual to complete an affidavit of heirship. They must state they knew the decedent and for how long. They must list all members of the decedent's family, including you, and attest you're related. File the affidavits with the county clerk in the county where the decedent's property is located.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the ?AFFIANT?.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county. The first page usually costs more than the other pages.

Interesting Questions

More info

How does the affidavit of warship process work? You and your heirs sign and file a Writ of Appointment of Wills or Trusts (Form G) with our office. The document is signed by you, the Deceased, and by any other heirs entitled to inherit the property named in the document. The deceased is the “owner” of each real estate and will make a “joint distribution” of all property from his or her estate to other heirs. The document will give these other heirs the ability to sign a “disclaimer” form, which takes some property out of your name and allows you to use it for your heirs. Your heirs can use the Wills, Trusts or other documents you complete and file in our office for the purpose of transferring or selling your property or avoiding probate. When must I complete an affidavit of warship in Texas? All property transfers involving real estate must be completed using an Affidavit of Warship. This process is mandatory for a number of reasons.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.