The Travis Texas Affidavit of Warship for the Owner of the Property is a legal document that serves to establish the rightful heirs of a property owner who has passed away without leaving a will. This affidavit is particularly relevant in Travis County, Texas, and plays a crucial role in the transfer of ownership and title of the deceased person's property. The main purpose of a Travis Texas Affidavit of Warship is to provide evidence of whom the legal heirs of the deceased property owner are. The affidavit serves as a sworn statement by individuals who have personal knowledge of the family and heirs of the deceased. These individuals, known as affronts, declare under oath the names, relationships, and relevant information about all the heirs entitled to inherit the property. By filing a Travis Texas Affidavit of Warship, the ownership of the property can be transferred to the rightful heirs without the need for a lengthy probate process. It allows for a more straightforward and efficient transfer of ownership, saving time and expenses for the parties involved. It's important to note that different types of Travis Texas Affidavit of Warship for the Owner of the Property can be distinguished based on the specific circumstances of the property and the deceased. Some potential variations include: 1. Intestate Affidavit of Warship: This type of affidavit is used when the deceased passed away without leaving a valid will or testament. 2. Small Estate Affidavit of Warship: If the value of the deceased person's estate falls below a certain threshold, generally around $75,000 in Travis County, a small estate affidavit can be utilized to simplify the probate process. 3. Warship Affidavit for Joint Tenancy: In cases where the deceased owned the property jointly with another person, the affidavit may focus on establishing the heirs' ownership rights based on the joint tenancy arrangement. 4. Affidavit of Warship with Independent Administration: This form of affidavit is typically employed when the court authorizes independent administration of the estate. This allows for more flexibility in managing the affairs of the estate without the need for constant court supervision. Generating a Travis Texas Affidavit of Warship requires careful consideration of the relevant legal requirements and proper documentation. It is often recommended seeking professional guidance from an attorney or legal expert to ensure accuracy and compliance with the specific rules and regulations of Travis County, Texas.

Travis Texas Affidavit of Heirship for the Owner of the Property

Description

How to fill out Travis Texas Affidavit Of Heirship For The Owner Of The Property?

Drafting documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Travis Affidavit of Heirship for the Owner of the Property without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Travis Affidavit of Heirship for the Owner of the Property by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Travis Affidavit of Heirship for the Owner of the Property:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

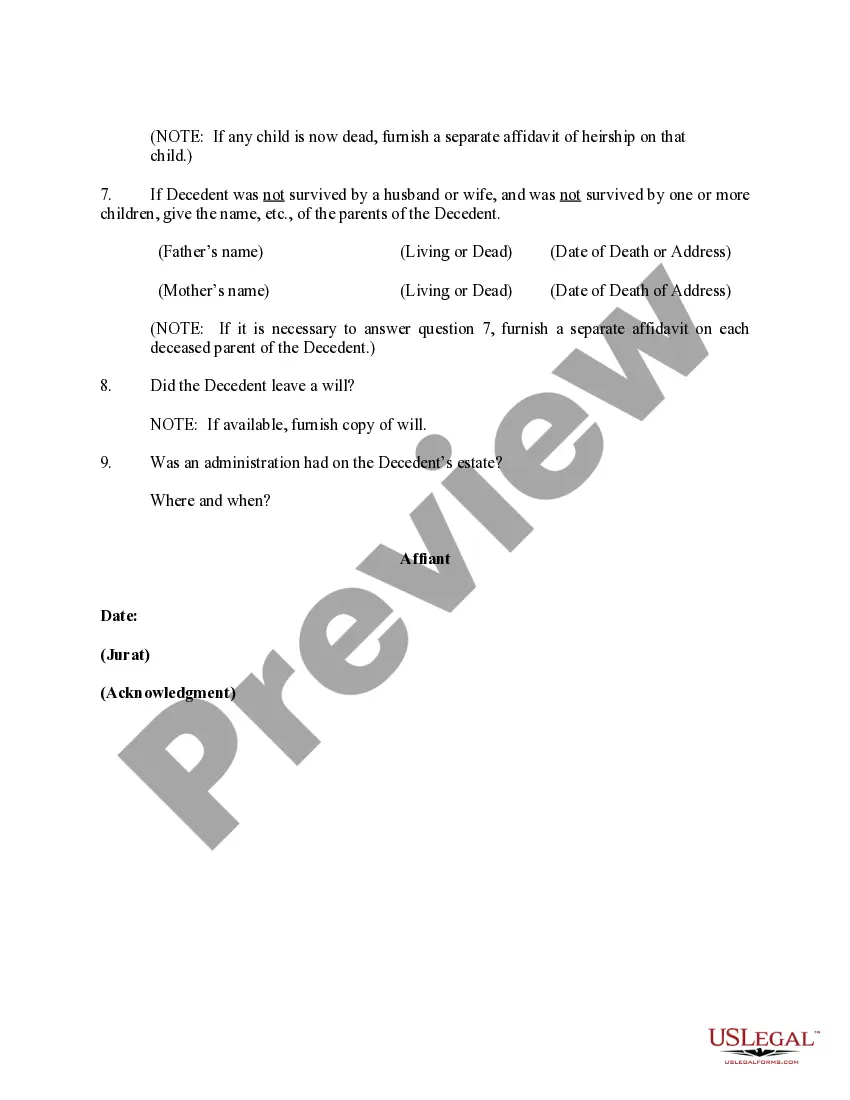

A loved one or heir of the decedent must file an affidavit of heirship with the county clerk of the counties in which the decedent owned property or resided at the time of death. The Affidavit of Heirship form you file must contain: The decedent's date of death. The names and addresses of all witnesses.

The Heirship Affidavit need only be signed Page 2 and sworn by the disinterested parties. All signatures must be in the presence of a Notary Public. Clerk of the county of decedent's residence, along with an Order for the Judge to sign approving it as conforming with the requirements of TPC §137.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

There are several methods of settling an estate of someone who dies without a valid will in Texas: Small Estate Affidavit.Affidavit of Heirship.Determination of Heirship.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

A spouse and parents: spouse inherits all community property, all separate personal property, and ½ of separate real estate; parents inherit everything else. One parent and siblings, but no spouse: parent inherits ½ of property; siblings equally share ½ of remaining property.

If a you are single and die without a will in Texas, your property will be distributed as follows: Your estate will pass equally to your parents if both are living. If one parent has died, and you don't have any siblings, then your estate will pass to your surviving parent.

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.