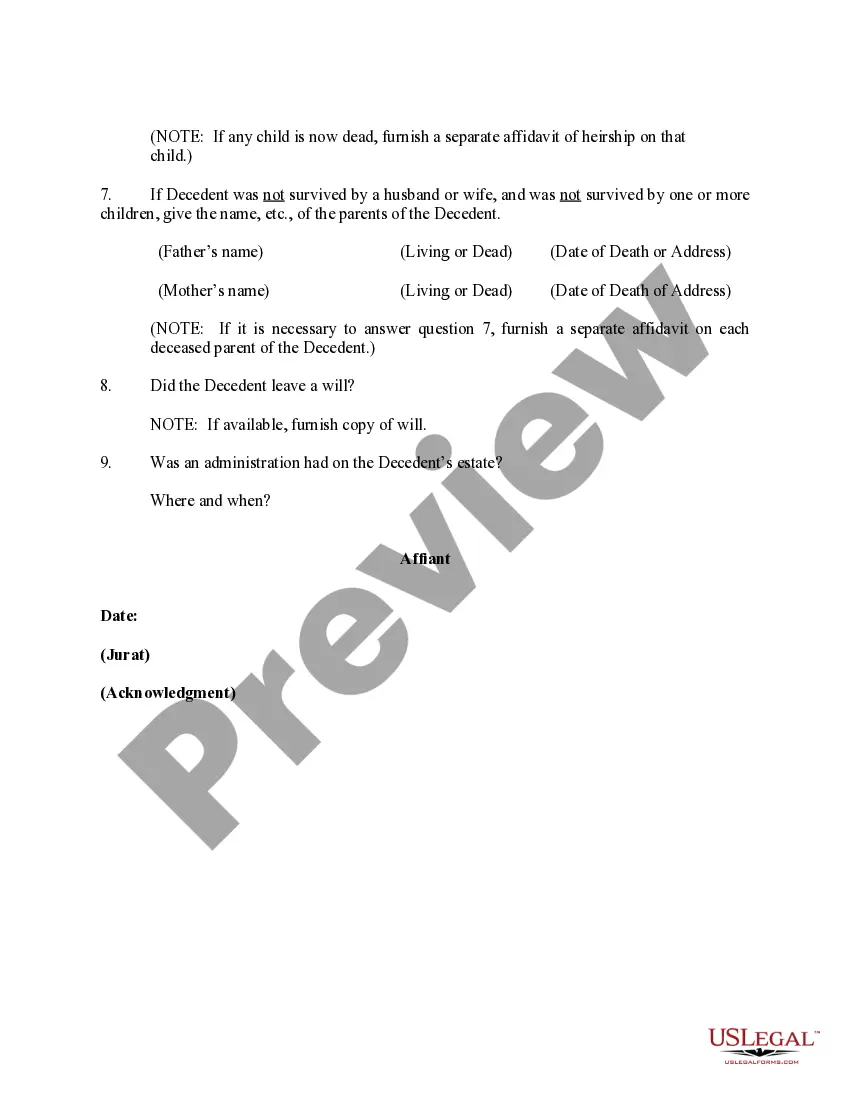

The Cuyahoga Ohio Affidavit of Warship — Descent is a legal document that plays a crucial role in the probate process. It serves to establish the rightful heirs of a deceased individual's estate when there is no valid will or the will does not name beneficiaries explicitly. This affidavit allows the transfer of assets to the legal heirs based on the laws of intestate succession. Keywords: Cuyahoga Ohio, Affidavit of Warship, Descent, probate process, rightful heirs, estate, valid will, beneficiaries, intestate succession. There are primarily two types of Cuyahoga Ohio Affidavit of Warship — Descent: 1. Regular Affidavit of Warship: This is the standard form of the affidavit used when there is no will or when the will does not name beneficiaries. Through this affidavit, the legal heirs establish their claim to the deceased individual's estate by providing their personal information, relationship to the deceased, and any other necessary details. This document is ratified in front of a notary public and is considered legally binding. 2. Small Estate Affidavit of Warship: This type of affidavit is employed when the value of the deceased person's estate is relatively small. In Cuyahoga Ohio, the threshold for a small estate is typically set at $35,000. This affidavit allows for a simplified probate process, avoiding the need for a formal administration. It allows the heirs to claim the assets without going through the full probate process, saving time and costs. Overall, the Cuyahoga Ohio Affidavit of Warship — Descent is a vital legal instrument used to identify and establish the rightful heirs of a deceased individual's estate. It ensures the efficient and rightful distribution of assets in cases where there is no valid will or explicit beneficiaries named.

Cuyahoga Ohio Affidavit of Heirship - Descent

Description

How to fill out Cuyahoga Ohio Affidavit Of Heirship - Descent?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Cuyahoga Affidavit of Heirship - Descent.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Cuyahoga Affidavit of Heirship - Descent will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Cuyahoga Affidavit of Heirship - Descent:

- Make sure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Cuyahoga Affidavit of Heirship - Descent on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Ohio has a unique statute referred to as the designated heir statute. This statute allows a person of sound mind to give a designated person the status of a child born in lawful wedlock.

Unlike other states, like Colorado, which require a will to be submitted to probate within days of the death, or Pennsylvania, which has a criminal statute for failing to submit a will for probate, Ohio has neither a strict time limit nor a criminal penalty for failing to probate a will.

In Ohio, successors may file an affidavit of heirship to claim a decedent's property and administer it outside of probate court. The affidavit process is governed by statute Ohio Rev. Code Ann. § 2113.03. Successors may claim personal property like bank accounts, trusts, and vehicles valued up to $35,000.

2117.02: If you are the executor or administrator of an estate, this spells out the procedures and requirements necessary if you want to make a claim against the estate in probate court. Claims must be filed within 3 months of the decedent's death.

According to Ohio's intestate laws, property is distributed as follows: If there is a surviving spouse, the entire estate will go to him or her. If there is no spouse, but there are children, the estate will be divided equally among them. If there is no spouse and no children, the deceased's parents will inherit.

(a) any person interested in having the estate of the deceased administered may apply for the grant to himself of letters of administration; or. (b) any heir of the deceased may apply for the issue of certificates of heir-ship to each of the heirs entitled to succeed to the estate of the deceased.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

The executor has three months from their assignation to prepare and file a complete list of the estate's assets. Note that, under Ohio probate law, creditors have six months to file any claims.

Filing an heirship affidavit allows for a title transfer without having to deal with probate. When a property owner dies intestate with a house titled in their name, an Affidavit of Heirship will allow the house's title to pass to the decedent's heirs.

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.